Coinbase remains one of the world’s most popular cryptocurrency exchanges, serving over 100 million users globally. However, understanding Coinbase’s fee structure often confuses both newcomers and experienced traders. The platform employs multiple fee types depending on transaction methods, payment sources, and trading volumes, resulting in costs that can range from under 1% to over 4% of transaction value.

This guide examines every fee type Coinbase charges, explains calculation methods, compares costs across different transaction approaches, and provides strategies for minimizing expenses. Whether you’re buying your first cryptocurrency or managing substantial trading volumes, understanding Coinbase’s fee structure helps optimize costs and maximize transaction value.

Understanding Coinbase’s Fee Structure

Coinbase operates two primary platforms—Coinbase (the main consumer app) and Coinbase Advanced Trade (formerly Coinbase Pro)—each with distinct fee structures. The main app prioritizes simplicity but charges higher fees. Advanced Trade offers lower fees in exchange for increased complexity designed for active traders.

Fee structures fall into several categories: trading fees charged when buying or selling cryptocurrency, spread fees built into quoted prices, payment method fees varying by funding source, withdrawal fees for moving assets off-platform, and network fees for blockchain transactions. Multiple fees often apply simultaneously—a simple Bitcoin purchase might involve a base trading fee, spread markup, and payment method fee, all compounding to create total cost.

Coinbase Trading Fees Breakdown

Coinbase’s primary revenue comes from trading fees. For the standard app, fees follow a tiered model based on transaction size:

| Transaction Amount | Standard Coinbase Fee | Advanced Trade Fee (Taker) |

|---|---|---|

| Under $10 | $0.99 flat fee | 0.60% |

| $10 – $25 | $1.49 flat fee | 0.60% |

| $25 – $50 | $1.99 flat fee | 0.60% |

| $50 – $200 | $2.99 flat fee | 0.60% |

| Over $200 | 1.49% – 3.99% | 0.60% (decreases with volume) |

These fees represent minimum charges—the actual fee equals the greater of the flat fee or percentage-based calculation. Coinbase Advanced Trade implements a maker-taker model where maker orders (limit orders adding liquidity) face fees from 0% to 0.40%, while taker orders (market orders removing liquidity) incur 0.05% to 0.60% depending on 30-day trading volume. Users trading over $10,000 monthly see progressively lower rates.

Spread Fees: The Hidden Cost

Beyond explicit trading fees, Coinbase incorporates spread into quoted prices—the difference between buying and selling prices. This spread functions as an additional fee though it’s not labeled as such.

Coinbase typically maintains spreads of approximately 0.50% for major cryptocurrencies like Bitcoin and Ethereum during normal conditions. However, spreads can widen significantly during high volatility or for less liquid cryptocurrencies, sometimes reaching 2% or higher. The spread affects both buyers and sellers—buyers pay above market rate while sellers receive below market rate. While Coinbase discloses spreads exist, exact percentages vary and aren’t separately itemized in transaction receipts.

Payment Method Fees Comparison

Payment source significantly impacts total costs. Different methods carry distinct fee structures and processing times:

| Payment Method | Fee | Processing Time | Best For |

|---|---|---|---|

| Bank Account (ACH) | No additional fee | 3-5 business days | Cost optimization |

| Debit Card | 3.99% | Instant | Urgent purchases |

| Wire Transfer | $10 deposit / $25 withdrawal | 1-2 business days | Large amounts |

| PayPal | ~3.99% | Instant | Convenience |

Bank account connections via ACH represent the lowest-cost funding method but require 3-5 business days before purchased cryptocurrency becomes available for withdrawal. Debit cards provide instant availability but add 3.99% to costs—for a $1,000 purchase, this adds $39.90. Wire transfers involve a flat $10 deposit fee, making them cost-effective for large amounts where $10 represents minimal percentage cost.

Withdrawal and Network Fees

Moving cryptocurrency off Coinbase involves network fees—blockchain transaction costs that vary by cryptocurrency and congestion levels:

| Asset Type | Typical Fee Range | Notes |

|---|---|---|

| Bitcoin (BTC) | $1 – $5 | Higher during network congestion |

| Ethereum (ETH) | $5 – $50 | Varies dramatically with gas prices |

| Litecoin (LTC) | Under $0.10 | Consistently low fees |

| USDT (Tron) | Under $1 | Efficient for stablecoin transfers |

| Fiat (ACH) | Free | 1-2 business days |

| Fiat (Wire) | $25 | Same-day processing |

Ethereum withdrawal fees prove particularly variable, ranging from $5-$50 based on gas prices, with costs sometimes exceeding $100 during peak congestion. Withdrawing fiat to US bank accounts via ACH is free though transfers take 1-2 business days, while wire withdrawals cost $25 but complete same-day.

Comparing Coinbase to Alternative Solutions

Understanding Coinbase fees in context requires comparison to alternatives. While Coinbase offers convenience and regulatory compliance, its fee structure positions it at the higher cost spectrum:

| Platform | Trading Fee | Spread | Key Advantage |

|---|---|---|---|

| Coinbase Standard | 1.49% – 3.99% | ~0.50% | User-friendly interface |

| Coinbase Advanced | 0.40% – 0.60% | ~0.50% | Lower fees for traders |

| Binance.US | 0.10% | Minimal | Lowest trading costs |

| Kraken | 0.16% – 0.26% | Minimal | Advanced features |

| Gemini ActiveTrader | 0.20% – 0.40% | Minimal | Regulatory compliance |

Crypto Debit Cards: A Different Approach

Rather than repeatedly purchasing cryptocurrency through exchanges and incurring fees with each transaction, crypto debit cards enable spending cryptocurrency holdings directly. This eliminates recurring exchange fees since you’re spending assets you already hold rather than acquiring them repeatedly.

BenPay offers self-custodial payment solutions where users maintain control of assets until spending. The BenPay Card supports multi-chain funding including Bitcoin, Ethereum, and stablecoins across networks like BSC, Polygon, Arbitrum, and Avalanche. With promotional opening fees of 9.9 BUSD and card limits starting at $200,000 USD, these cards accommodate both everyday spending and substantial transactions.

Mobile payment integration enables binding cards to Apple Pay, Google Pay, Alipay, or WeChat Pay for contactless payments anywhere these platforms are accepted. Rather than purchasing cryptocurrency through Coinbase and paying trading fees, spread costs, and payment method charges repeatedly, you can receive cryptocurrency as payment or purchase it once, then spend it repeatedly through payment cards without incurring exchange fees for each transaction.

Fee Minimization Strategies

Strategic approaches can substantially reduce Coinbase-related costs:

1. Use Coinbase Advanced Trade: Switching from the standard app to Advanced Trade immediately reduces trading fees from 1.49-3.99% to 0.40-0.60% for most users. The interface complexity increases, but cost savings justify the learning curve for regular purchases.

2. Optimize Payment Methods: Always use bank account funding rather than debit cards unless immediate availability justifies the 3.99% premium. For deposits over $1,000, wire transfers’ flat $10 fee becomes more economical than percentage-based alternatives.

3. Batch Transactions: Rather than making frequent small purchases incurring disproportionate flat fees, batch purchases into larger, less frequent transactions. Ten $50 purchases at $2.99 each cost $29.90 in fees; one $500 purchase costs significantly less through percentage-based fees.

4. Strategic Withdrawal Timing: Monitor network congestion before withdrawing cryptocurrency. Tools like Ethereum Gas Tracker show real-time fees. Weekend and late-night hours (US time) often see reduced congestion and lower fees—waiting for fees to drop from $50 to $10 represents excellent return on delay.

5. Choose Low-Fee Cryptocurrencies: When transferring value rather than holding specific cryptocurrencies, consider using low-fee alternatives. Stablecoins on efficient networks like USDT on Tron or USDC on Polygon offer near-zero withdrawal costs while maintaining stable value.

Making Cryptocurrency Spending More Efficient

For users who regularly spend cryptocurrency rather than holding long-term, traditional exchange models introduce inefficiency. Each spending instance requires either selling crypto for fiat (incurring fees) or spending directly through limited merchant acceptance.

Self-custodial wallets combined with payment cards create seamless spending without repeated exchange interactions. Users maintain control of private keys and assets until spending, eliminating custodial risk while accessing practical payment functionality. The cross-chain bridge enables consolidating assets from multiple networks without navigating separate exchanges or incurring multiple fee sets.

For users holding idle cryptocurrency balances, DeFi yield aggregation makes funds productive while maintaining spending availability. Rather than leaving assets dormant between transactions, automated deployment into protocols like Aave, Compound, and Unitas generates 3-5% annual yields. With a 15% protocol fee on earnings but no fees on principal, this transforms otherwise unproductive balances into income-generating positions.

Regulatory Compliance Considerations

Coinbase’s higher fees partially reflect regulatory compliance infrastructure and security investments. The platform operates under US regulations, maintains substantial insurance on custodied assets, implements robust KYC/AML procedures, and provides customer support—all carrying costs reflected in fee structures.

For users prioritizing regulatory clarity and institutional-grade security, Coinbase’s fee premium may represent acceptable insurance. However, alternative platforms with proper licensing can provide similar assurances at lower costs. BenPay operates under a US Money Services Business license (FinCEN Registration Number 31000260888727), authorizing prepaid card issuance and digital asset services. Security audits by SlowMist provide independent verification of smart contract safety, demonstrating that regulatory compliance and lower fees aren’t mutually exclusive.

International Users and Regional Variations

Coinbase’s fee structure varies by region based on local regulations and payment method availability. European users can fund accounts via SEPA transfers with minimal fees and 1-2 day clearing. UK users access Faster Payments for instant, low-cost funding. However, some regions face higher fees or limited payment methods due to regulatory restrictions.

Currency conversion adds another cost layer for non-USD users. Coinbase typically charges 1-2% for currency conversion when buying cryptocurrency with local fiat currency. This compounds with trading fees, spread costs, and payment method fees to create substantial total expenses. Users in non-USD regions should calculate complete costs including currency conversion when evaluating platform economics.

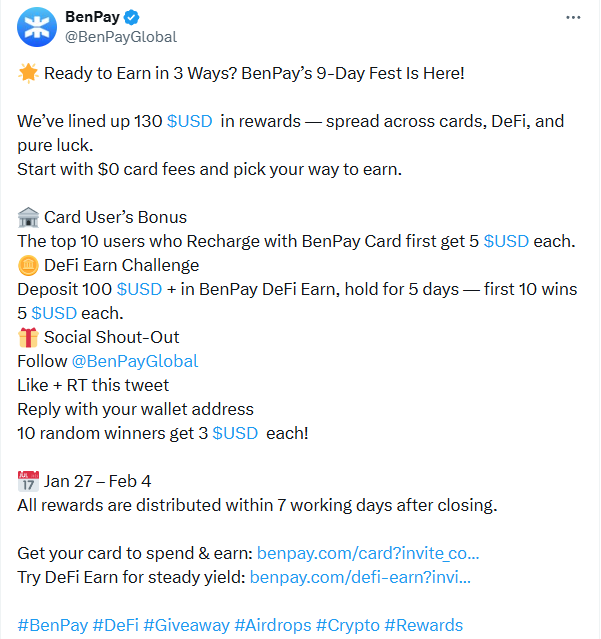

Join the BenPay Community

Stay informed about cryptocurrency payment innovations and fee optimization strategies through BenPay’s community channels. Follow @BenPayGlobal on X for platform updates and educational content. Recent initiatives have included reward programs for early adopters and guides on minimizing cryptocurrency transaction costs.

For detailed analysis and platform updates, visit the BenPay blog featuring articles on cryptocurrency payment infrastructure and cost management.

Conclusion: Navigating Coinbase Fees Effectively

Coinbase’s fee structure—while complex—becomes manageable with understanding and strategic planning. Trading fees, spread costs, payment method fees, and withdrawal expenses all impact total costs, but users can substantially reduce expenses through platform selection (Advanced Trade vs. standard app), payment method optimization (bank accounts vs. debit cards), transaction batching, and timing strategies.

The key question isn’t simply “what is Coinbase fee” but rather “how do Coinbase fees impact my specific use case and what alternatives might serve my needs more economically.” For occasional buyers prioritizing simplicity and regulatory compliance, Coinbase’s fees may represent acceptable costs. For frequent traders or users seeking cost optimization, alternatives including competing exchanges or cryptocurrency payment infrastructure may deliver better economics.

Understanding fee structures empowers informed decisions. Calculate total costs including all applicable fees before executing transactions. Compare alternatives not just on headline fees but on complete cost structures including hidden costs like spreads. Consider whether your use case—trading, long-term holding, or regular spending—aligns better with exchange models or specialized payment infrastructure.

As cryptocurrency adoption continues maturing, fee structures will likely evolve through competitive pressure and technological innovation. Users who understand current costs and remain aware of emerging alternatives position themselves to optimize their cryptocurrency financial activities regardless of how the landscape shifts.

Frequently Asked Questions

1.Best DeFi Platform to Earn Passive Income on Stablecoins in 2026

2.Easiest DeFi Yield Platforms with Simple UI and One-Click Investment

3.Which DeFi Platforms Offer Safe 10-20% APY on Stablecoins Without Complex Setup?

4.Which Multi-Chain DeFi Yield Aggregators Can Automatically Find the Best Stablecoin APY?

5.Simple DeFi Yield Aggregators for Beginners: Understanding Risks and Making Safe Choices