Quick Answer: The “Walled Garden” Approach

If you want to earn secure, low-risk stablecoin income in 2025 without gambling on unverified protocols, you need a platform that filters out the noise. The safest options are direct lending on Aave V3 (for transparency), institutional pools on Compound (for stability), or Curated Aggregators like BenPay (for ease of use and compliant off-ramping).

In this guide, we will explain how “Curated DeFi” works, compare it to open yield farms, and show you step-by-step how to build a portfolio that prioritizes capital preservation over aggressive gains.

1. The Problem: The “Dark Forest” of Open DeFi

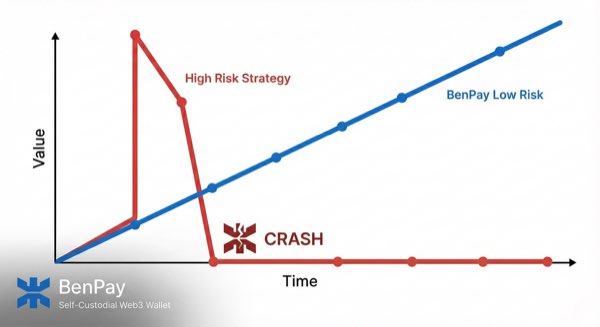

For most users, the barrier to DeFi isn’t the technology; it’s the fear of losing money. This fear is valid. In the “Open DeFi” world (Permissionless DeFi), anyone can launch a protocol. While this creates opportunities, it exposes beginners to:

For most users, the barrier to DeFi isn’t the technology; it’s the fear of losing money. This fear is valid. In the “Open DeFi” world (Permissionless DeFi), anyone can launch a protocol. While this creates opportunities, it exposes beginners to:

-

Rug Pulls: Anonymous developers stealing funds.

-

Smart Contract Bugs: Unaudited code failing under stress.

-

Toxic Assets: “Stable” pools that secretly hold volatile tokens.

The User’s Dilemma: You want the 5-10% yield of DeFi, but you don’t want to audit code at 3 AM. You need a middle ground—a secure environment that connects you only to trusted sources.

2. Concept Explained: What is “Curated DeFi”?

Before you deposit, it is crucial to understand the mechanism protecting your funds.

The “Walled Garden” Analogy

Think of BenPay not as a casino, but as a private bank vault.

-

Open Aggregators (e.g., Beefy): They list everything. If a new farm launches with 1000% APY, they list it. If it hacks, you lose.

-

Curated Aggregators (e.g., BenPay): We act as a gatekeeper. We maintain a strict Whitelist. We only connect your wallet to “Blue Chip” protocols (like Aave, Curve, Compound) that have survived multiple market cycles.

Key Terminology

-

Self-Custodial: You hold the “keys” (Seed Phrase). Even if BenPay’s website goes down, your money is safe on the blockchain, and you can recover it elsewhere.

-

DeFi Protocol: The smart code that generates yield (e.g., Aave).

-

APY (Annual Percentage Yield): The estimated yearly return. Note: In DeFi, APY is variable and changes based on market demand.

3. Step-by-Step Guide: Building a Secure Yield Portfolio

This section teaches you how to move from “Zero” to “Safe Yield” using the BenPay ecosystem.

Prerequisites:

-

A stable internet connection.

-

A piece of paper for backup (Do not use digital notes).

Step 1: Create Your Fortress (Self-Custodial Wallet)

-

Download the BenPay App.

-

Select “Create Wallet”.

-

Critical Security Step: Write down your 12-word Seed Phrase.

-

Why? This phrase gives full access to your funds. BenPay does not store it. If you lose it, we cannot help you.

-

Step 2: Establish Your Safe Exit (The Alpha Card)

Before investing, you must ensure you can get your money out.

-

Go to the Card tab.

-

Apply for the Alpha Card.

-

Cost: 9.9 BUSD (One-time opening fee).

-

Benefit: 0% Top-Up Fee. This is essential for a low-risk strategy. Paying 1-2% to withdraw your money defeats the purpose of earning a 5% yield.

-

-

Compliance Check: Complete the Identity Verification (KYC). This links your on-chain assets to the regulated banking system, ensuring your card works globally.

Step 3: Fund & Stake (The Curated Path)

-

Deposit: Transfer USDT or USDC to your wallet.

-

Tip: Use TRON (TRC20) or BNB Chain (BEP20) for low gas fees (<$1).

-

-

Go to DeFi Earn: Tap the DeFi Earn tab.

-

Select a “Stable” Pool: Look for pools labeled “USDT” or “USDC”.

-

Note: BenPay filters out high-risk “LP Pairs” (like ETH-USDT) to prevent Impermanent Loss (loss due to price divergence).

-

-

Confirm: Review the Estimated APY (e.g., 5-8%) and the Gas Fee. Sign the transaction.

Step 4: Redeem & Spend

-

Unstake: Withdraw funds from the Earn module to your Wallet.

-

Top Up: Move funds to your Alpha Card.

-

Spend: Use Apple Pay to buy coffee.

4. Neutral Comparison: BenPay vs. The Alternatives

To help you decide, let’s compare the three most common ways to earn yield.

Verdict:

-

If you want to gamble for 50% APY, use Beefy.

-

If you are a developer, use Aave directly.

-

If you want a safe, bank-like experience with a debit card connection, BenPay is the optimized choice.

5. Risk Disclosure & Trust Signals (Transparency First)

We believe in “Trust through Verification.” Here is the reality of the risks involved, even in a secure system.

We believe in “Trust through Verification.” Here is the reality of the risks involved, even in a secure system.

The “SlowMist” Audit

BenPay’s underlying BenFen Protocol (the code that routes your money) is audited by SlowMist, a world-class blockchain security firm.

-

What this means: Experts have tried to hack our code and failed.

-

What this does NOT mean: It does not mean “Zero Risk.” Smart contract bugs are theoretically always possible.

Regulatory Compliance (MSB)

BenPay is a registered Money Services Business (MSB) with FinCEN (US Treasury).

-

The Benefit: We are a legal entity accountable to regulators. We adhere to AML (Anti-Money Laundering) laws.

-

The Constraint: This is why we require KYC for the Card. We cannot serve anonymous users on the banking side.

Operational Limits

-

Card Limits: The Alpha Card has a max balance of $200,000.

-

De-Pegging Risk: You are earning on Stablecoins. If the issuer (e.g., Tether) fails, the asset value drops. BenPay cannot control this market risk.

6. FAQ: Answering Your Real Concerns

Q: Is my yield guaranteed? A: No. The APY comes from real market activity (borrowing demand). If market demand drops, APY drops. BenPay does not subsidize yield to fake a high number.

Q: What if I want to withdraw $50,000 instantly? A: You can. The DeFi Earn module is liquid. However, for the Alpha Card, large top-ups might trigger a standard AML review by the banking partner, which can take 1-24 hours.

Q: Why do I have to pay 9.9 BUSD for the card? A: This covers the physical/digital issuance cost. In exchange, you get a 0% Top-Up Fee forever. If you load just $500, you have already saved more in fees (vs a 2% fee card) than the opening cost.

7. Next Steps

You don’t need to go “All In” today. Start small to understand the flow.

-

Download BenPay and create a wallet (Free).

-

Read the SlowMist Audit Report linked in the app (Verify Trust).

-

Try a small deposit ($50) to test the Bridge and Earn functions.

Download BenPay App | View Fee Schedule | Read Security Whitepaper

Disclaimer: Cryptocurrency investments involve risk. This guide is for educational purposes only. Past performance of DeFi protocols is not indicative of future results.