When exploring cryptocurrency platforms, one of the most frequent questions newcomers ask is whether major exchanges accept traditional payment methods. Crypto.com, one of the world’s largest cryptocurrency platforms with over 100 million users globally, does accept credit cards for purchasing cryptocurrency—but with important limitations and considerations that every user should understand before funding their account.

The short answer: Yes, Crypto.com accepts credit and debit cards from major networks including Visa and Mastercard. However, the experience involves specific fees, restrictions, and potential complications that differ significantly from typical online purchases. This article examines how credit card payments work on Crypto.com, why these transactions often encounter problems, and what alternatives exist for users seeking smoother crypto acquisition methods.

How Credit Card Payments Work on Crypto.com

Crypto.com’s credit card payment system operates through partnerships with third-party payment processors rather than direct integration with card networks. When you initiate a credit card purchase, the transaction routes through specialized processors that handle the conversion between fiat currency and cryptocurrency.

The process unfolds in several steps: you select your desired cryptocurrency and purchase amount, enter your card details, and the platform sends this information to its payment processor. The processor verifies the card, checks for sufficient available credit, charges your card, and instructs Crypto.com to credit your account with the equivalent cryptocurrency at current market rates.

This multi-step process introduces friction points that don’t exist in standard e-commerce transactions. Payment processors specializing in crypto transactions face higher chargeback risks and regulatory scrutiny compared to traditional payment facilitators, directly impacting both the reliability and cost of credit card purchases on cryptocurrency platforms.

Fees, Limits, and Common Issues

Credit card purchases on Crypto.com carry a standard fee of 2.99% per transaction. For a $1,000 purchase, this translates to $29.90 in fees—considerably higher than typical credit card processing fees for standard merchants. Purchase limits vary based on account verification level, geographic location, and transaction history, typically ranging from $500 to $50,000 per transaction for verified users.

| Payment Method | Crypto.com Fee | Additional Costs | Total Cost Example (for $1,000) |

|---|---|---|---|

| Credit Card | 2.99% | Potential cash advance fee (3-5%) | $29.90 – $79.90 |

| Debit Card | 2.99% | None typically | $29.90 |

| Bank Transfer (ACH) | Free | 3-5 day wait | $0 (time cost only) |

| Wire Transfer | Varies | $10-25 bank fees | $10-25 |

Common Problems Users Face

Many users attempting credit card purchases encounter unexpected declines despite having sufficient available credit:

- Bank-side blocks: Many credit card issuers categorize cryptocurrency purchases as cash advances rather than standard purchases, triggering 3-5% fees plus immediate interest accrual

- Geographic restrictions: Certain jurisdictions maintain regulatory frameworks that complicate or prohibit credit card funding of cryptocurrency accounts

- Payment processor issues: Risk management systems may flag purchases based on unusual patterns or perceived fraud indicators

- Merchant category code restrictions: Some issuers outright block cryptocurrency transactions

Why Credit Cards Pose Challenges for Crypto Purchases

The fundamental tension between credit card mechanisms and cryptocurrency transactions creates inherent friction affecting all platforms. Chargeback risk stands as the primary concern—credit card networks grant consumers dispute rights for 60-120 days after purchase. When users purchase cryptocurrency with credit cards and later initiate chargebacks, platforms face unrecoverable losses since transferred crypto cannot be retrieved.

Regulatory classification issues further complicate matters. Different jurisdictions classify cryptocurrency purchases differently—as commodity purchases, currency exchanges, securities transactions, or gambling activities. These varying classifications affect whether credit card companies can legally process such transactions and under what conditions.

The cash advance classification problem deserves particular attention. When issuers treat cryptocurrency purchases as cash advances, they apply terms typically reserved for ATM withdrawals—immediate interest accrual, higher interest rates, and substantial transaction fees. Moreover, cash advances generally don’t earn rewards points or cashback, eliminating primary benefits consumers associate with credit card usage.

Understanding Cryptocurrency and Stablecoins

Cryptocurrency represents digital assets using cryptography for security, operating on decentralized networks like blockchains. Unlike traditional currencies issued by governments, cryptocurrencies exist independently of centralized authorities. Bitcoin pioneered this approach in 2009 as peer-to-peer electronic cash enabling value transfer without intermediaries.

Stablecoins represent an important subset designed to minimize price volatility by pegging to reserve assets, most commonly the US dollar. USDT (Tether) and USDC (USD Coin) maintain 1:1 value ratios with USD, serving as bridges between traditional finance and cryptocurrency. They offer transaction speed and global accessibility of crypto while avoiding the price volatility that makes cryptocurrencies like Bitcoin impractical for everyday transactions.

The growing adoption of cryptocurrency for payments—particularly through stablecoins—has created demand for seamless fiat-to-crypto conversion methods. This demand has driven innovation in payment infrastructure, leading to solutions addressing credit card purchase limitations while maintaining user convenience.

The Rise of Crypto Debit Cards

Rather than using traditional payment methods to acquire cryptocurrency, crypto debit cards enable users to spend cryptocurrency they already hold on everyday purchases. This approach eliminates chargeback risks that make credit card purchases problematic—users spend assets they control rather than borrowing funds from card issuers.

Modern crypto debit cards offer functionality comparable to traditional debit cards. Users can make online purchases, pay at physical point-of-sale terminals, withdraw cash from ATMs, and bind cards to mobile payment platforms like Apple Pay or Google Pay. The key difference lies in the funding source—instead of linking to traditional bank accounts, these cards draw from cryptocurrency holdings, typically stablecoins maintaining stable values suitable for everyday spending.

| Approach | Pros | Cons | Best For |

|---|---|---|---|

| Credit Card Purchase | Instant, familiar process | High fees (2.99%+), frequent declines, cash advance risk | Occasional small purchases |

| Bank Transfer | No fees, large amounts | 3-5 day wait, requires bank linking | Large one-time purchases |

| Crypto Debit Card | Spend existing crypto, no acquisition fees | Requires already holding crypto | Regular crypto users |

Self-Custodial Payment Solutions

Self-custodial solutions allow users to maintain control of private keys—cryptographic credentials proving cryptocurrency ownership. Traditional exchanges like Crypto.com operate custodial models where platforms control users’ private keys and assets. Self-custodial models eliminate this trust requirement by ensuring users maintain direct control.

Self-custodial payment cards connect to blockchain-based wallets where users hold their private keys. When making payments, users authorize transactions through their wallet using private keys, typically via mobile apps. The card system then processes payments, converting cryptocurrency to fiat as needed. Users’ assets remain under their control until the moment of spending, reducing exposure to platform security breaches or policy changes.

Layer-1 blockchains optimized for payment applications enhance this model through architectural choices prioritizing transaction speed, low fees, and payment-specific features. Sub-second block times enable near-instant transaction confirmation, while low gas fees make small-value purchases economically viable.

Introducing BenPay: Integrated Crypto Payment Infrastructure

BenPay represents an integrated approach to cryptocurrency payment infrastructure, addressing friction points that complicate traditional credit card purchases while offering capabilities extending beyond simple payment processing.

Built on the BenFen blockchain—a Layer-1 network optimized specifically for financial applications—BenPay provides a comprehensive ecosystem encompassing wallet functionality, payment cards, cross-chain bridges, and DeFi yield opportunities. This integrated architecture allows users to manage assets, generate returns, and spend cryptocurrency through a unified platform.

The BenPay Card operates as a self-custodial payment solution where users maintain control of private keys and assets until spending. Available in three tiers—Alpha, Sigma, and Delta—these cards support multi-chain stablecoin funding including USDT and USDC from major networks like Ethereum, BSC, Polygon, Optimism, Arbitrum, Avalanche, and Base. With card limits starting at $200,000 USD, the system accommodates both everyday spending and substantial business transactions.

Mobile payment integration extends functionality beyond physical cards. Users can bind BenPay cards to Apple Pay, Google Pay, Alipay, and WeChat Pay, enabling contactless payments anywhere these platforms are accepted. The platform’s multi-chain support addresses assets scattered across different blockchain networks—users can fund cards from whichever chain offers the most economical transaction fees at any moment, typically completing transfers within minutes through the cross-chain bridge.

Making Idle Assets Productive Through DeFi

Traditional payment cards draw from accounts generating minimal interest. BenPay’s DeFi Earn connects to established protocols including Aave, Compound, and Unitas, automatically deploying idle BUSD (BenFen’s native USD-pegged stablecoin) into yield-generating positions. Users monitor real-time APY calculations based on 30-day trailing averages and withdraw funds whenever needed. The platform charges a 15% protocol fee on earned yield while imposing no fees on principal.

Consider a business maintaining $50,000 in payment card balances for operating expenses. At a conservative 4% annual yield, this generates $2,000 in interest. Even after the 15% protocol fee, the user retains $1,700—funds that would sit completely idle in traditional payment card accounts. The platform provides simplified interfaces abstracting away blockchain interactions, bringing DeFi capabilities to users lacking technical knowledge to interact with protocols directly.

Multi-Currency Support and Regulatory Compliance

BenPay addresses regional currency preferences through multi-currency stablecoin support, including BUSD (USD), BJPY (Japanese Yen), and BINR (Indian Rupees). This enables users to hold and spend assets denominated in familiar currencies while accessing cryptocurrency advantages—fast settlement, low fees, and global interoperability.

Operating payment services in the United States requires Money Services Business (MSB) registration with FinCEN. BenFen Inc., which operates BenPay, holds an active MSB license under FinCEN Registration Number 31000260888727, authorizing both prepaid card issuance and digital asset services. This licensing provides legal foundation for compliant operation and assurance that the platform operates within established regulatory frameworks.

Security audits complement regulatory compliance through independent verification of technical implementation. BenPay’s smart contracts have undergone security audits by SlowMist, a respected blockchain security firm, with results publicly available for user review.

Real-World Use Cases

Understanding practical applications helps clarify when cryptocurrency payment infrastructure offers advantages over traditional credit card purchases:

| Use Case | Traditional Method Challenge | Crypto Solution |

|---|---|---|

| International Students | $20-40 wire fees + 2-3 days | Parents transfer stablecoins to student card in minutes |

| Cross-Border Freelancers | Unfavorable exchange rates + days to withdraw | Spend USDC directly at local merchants |

| E-Commerce Merchants | Multiple currency conversions + wire fees | Instant stablecoin settlement with suppliers |

| Digital Nomads | Card declines due to travel, foreign transaction fees | Location-independent crypto cards work globally |

Getting Started With Crypto Payment Cards

Users new to cryptocurrency payment infrastructure benefit from systematic onboarding:

- Acquire Stablecoins: Purchase USDT or USDC through centralized exchanges using bank transfers or debit cards. New users often start with modest amounts ($100-500) until comfortable with the process.

- Set Up Wallet: Set up a self-custodial wallet supporting the chains you’ll use. The BenPay Wallet handles multiple chains including Ethereum, BSC, and Polygon. During setup, write down your seed phrase on physical paper and store securely.

- Bridge Assets: Bridge assets to the payment platform using cross-chain functionality, converting USDT or USDC into BUSD at one-to-one parity. Apply for a payment card through the mobile application—current promotional pricing sets opening fees at 9.9 BUSD.

- Start Spending: Load your card conservatively with amounts you’re comfortable spending initially, then bind the card to your preferred mobile payment platform. Make your first purchase somewhere low-stakes like a coffee shop to validate proper functionality.

Join the BenPay Community

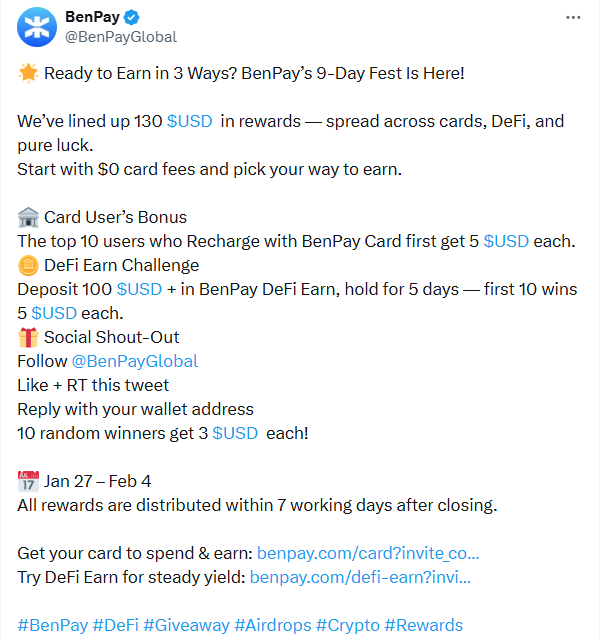

Stay connected with platform updates and community activities through BenPay’s social channels. Follow @BenPayGlobal on X for announcements, partnership integrations, and promotional campaigns. Recent community activities have included reward programs for early adopters and educational content about cross-border payment optimization.

The official Telegram community provides direct communication channels with team members and other users for technical support, feature discussion, and community engagement. Platform updates and detailed feature explanations appear on the official blog, publishing articles covering technical architecture details to practical guidance on specific use cases.

Moving Beyond Credit Card Limitations

The question “Does Crypto.com accept credit cards?” receives a straightforward yes—the platform accepts major credit cards for cryptocurrency purchases. However, focusing solely on this answer misses the broader context of what users ultimately want to accomplish.

Most users asking about credit card acceptance on crypto platforms care about convenient ways to convert traditional money into spendable cryptocurrency. Credit cards represent familiar payment infrastructure, but their application to cryptocurrency acquisition introduces significant friction through high fees, frequent declines, cash advance classifications, and regulatory complications.

Cryptocurrency payment infrastructure enabling direct spending of digital assets addresses the underlying need more effectively than optimizing credit card purchase flows. Rather than repeatedly purchasing cryptocurrency with traditional payment methods and incurring associated costs, users expecting regular cryptocurrency interaction benefit from infrastructure designed specifically for digital asset management and spending.

BenPay and similar platforms represent this alternative approach—comprehensive ecosystems where users hold assets securely in self-custodial wallets, deploy idle balances into yield-generating positions, bridge assets across multiple blockchain networks, and spend through payment cards functioning identically to traditional debit cards at millions of merchants worldwide.

For users currently navigating credit card purchase limitations on Crypto.com or other exchanges, the question becomes whether their needs align better with occasional cryptocurrency acquisition for trading purposes or with regular cryptocurrency usage for payments and everyday transactions. The former group may find credit cards adequate despite limitations. The latter group should seriously evaluate whether specialized cryptocurrency payment infrastructure better serves their actual use cases.