Yes, Coinbase offers a debit card called the Coinbase Card—a Visa debit card that allows users to spend cryptocurrency directly from their Coinbase account at millions of merchants worldwide. Launched in 2019 and expanded globally since then, the Coinbase Card bridges the gap between cryptocurrency holdings and everyday spending, enabling users to pay for goods and services using their digital assets without first converting to fiat currency.

This comprehensive guide examines how the Coinbase Card works, its fees and rewards structure, eligibility requirements, and how it compares to alternative crypto payment solutions. Whether you’re considering applying for a Coinbase Card or exploring cryptocurrency spending options more broadly, understanding the card’s capabilities and limitations helps determine if it fits your financial needs.

Quick Answer: The Coinbase Card is a Visa debit card that connects directly to your Coinbase account, allowing you to spend cryptocurrency at any merchant accepting Visa. The card automatically converts your selected cryptocurrency to local currency at the point of sale, with real-time conversion rates and various reward options.

What Is the Coinbase Card?

The Coinbase Card is a physical and virtual Visa debit card that connects to your Coinbase cryptocurrency account. Unlike traditional debit cards linked to bank accounts holding fiat currency, the Coinbase Card draws from your cryptocurrency holdings, converting digital assets to fiat currency automatically during transactions.

Users can choose which cryptocurrency to spend from—options typically include Bitcoin, Ethereum, Litecoin, and various stablecoins like USDC. When making purchases, the card converts the selected cryptocurrency to local currency based on current market rates, with the merchant receiving standard fiat payment. This process happens seamlessly in the background, making cryptocurrency spending feel identical to traditional debit card usage from the merchant’s perspective.

The card functions anywhere Visa is accepted—online stores, physical retail locations, restaurants, and ATMs worldwide. This broad acceptance makes it one of the most practical cryptocurrency spending solutions available, eliminating the need to find merchants who specifically accept cryptocurrency payments.

How Does the Coinbase Card Work?

Understanding the mechanics behind the Coinbase Card helps clarify both its utility and limitations:

Transaction Flow:

- Selection: You choose which cryptocurrency to use for spending within the Coinbase app

- Purchase: You make a purchase using your Coinbase Card at any Visa-accepting merchant

- Conversion: Coinbase instantly converts the required cryptocurrency amount to local fiat currency

- Settlement: The merchant receives standard fiat payment (USD, EUR, GBP, etc.)

- Deduction: The equivalent cryptocurrency amount is deducted from your Coinbase account

The conversion happens at market rates with a small spread markup—typically around 2.49% of the transaction amount. This spread represents Coinbase’s fee for facilitating the cryptocurrency-to-fiat conversion. Users should be aware that cryptocurrency prices fluctuate constantly, so the exact amount of crypto spent for a given purchase depends on rates at transaction time.

Supported Cryptocurrencies

The Coinbase Card supports spending from multiple cryptocurrencies, though available options vary by region. Common supported assets include:

| Cryptocurrency | Symbol | Best For |

|---|---|---|

| Bitcoin | BTC | Long-term holders wanting to use gains |

| Ethereum | ETH | Users active in DeFi ecosystems |

| Litecoin | LTC | Lower transaction costs |

| USD Coin | USDC | Avoiding cryptocurrency volatility |

| Dogecoin | DOGE | Community enthusiasts |

Many users prefer spending stablecoins like USDC to avoid converting volatile assets during purchases. Spending USDC essentially functions like spending dollars, maintaining stable value between purchase decision and transaction execution.

Coinbase Card Fees and Costs

Understanding all associated fees helps calculate the true cost of using the Coinbase Card compared to alternatives:

| Fee Type | Amount | When It Applies |

|---|---|---|

| Card Issuance | Free | One-time when ordering card |

| Annual Fee | $0 | No ongoing card fees |

| Purchase Transactions | Free (spread applies) | Each purchase at merchants |

| Cryptocurrency Conversion Spread | ~2.49% | Built into exchange rate |

| ATM Withdrawals (Domestic) | 2.49% + $2.50 | Per ATM cash withdrawal |

| ATM Withdrawals (International) | 2.49% + $2.50 | Per international ATM withdrawal |

| Foreign Transaction Fee | $0 | Purchases outside home country |

The 2.49% conversion spread represents the main cost—for a $100 purchase, this adds approximately $2.49 to the effective cost. This fee structure makes the Coinbase Card more expensive than traditional debit cards (which typically have no purchase fees) but potentially cheaper than credit card foreign transaction fees (often 3%) for international spending.

Important Note: The 2.49% spread applies to all purchases, not just cryptocurrency conversions you initiate manually. This ongoing cost accumulates across all spending, making it essential to factor into your cost-benefit analysis of using the card regularly.

Coinbase Card Rewards Program

Coinbase offers cashback rewards for card spending, though the program has evolved over time with various limitations:

Current Rewards Structure

Rewards vary by which cryptocurrency you choose to receive cashback in. Historically, Coinbase has offered:

- 1% back in Bitcoin (BTC) – Lower percentage but in the most established cryptocurrency

- 4% back in Stellar Lumens (XLM) – Higher percentage for a specific altcoin

- 4% back in Graph Token (GRT) – Alternative high-percentage reward option

However, reward availability and percentages change periodically based on Coinbase’s partnerships and promotional periods. Some users report rewards being unavailable in certain regions or during specific timeframes. Always verify current reward offerings in your Coinbase app before relying on specific cashback rates.

Reward Strategy Tip: Consider whether earning rewards in volatile cryptocurrencies aligns with your goals. A 4% reward in an altcoin that drops 10% in value results in net loss compared to lower percentage rewards in more stable assets. Factor in both reward rate and underlying asset volatility when choosing reward options.

Eligibility and How to Get the Coinbase Card

Obtaining a Coinbase Card requires meeting specific criteria and completing an application process:

Requirements

Basic Eligibility Criteria:

- Must be 18 years or older

- Must have a verified Coinbase account

- Must reside in a supported country (US, UK, and select European countries)

- Must pass identity verification (KYC requirements)

- Must maintain minimum cryptocurrency balance in Coinbase account

Application Process

- Create and Verify Coinbase Account: If you don’t already have one, sign up for Coinbase and complete identity verification including government ID and address confirmation.

- Apply Through Mobile App: Navigate to the Card section in the Coinbase mobile app and initiate the application. The web interface typically doesn’t support card applications—mobile app required.

- Provide Additional Information: Submit any requested documentation such as proof of address or additional identity verification.

- Wait for Approval: Coinbase reviews applications typically within a few business days, though timing varies by region and application volume.

- Receive Physical Card: Once approved, your physical card ships to your verified address. You can begin using the virtual card immediately through mobile wallets while waiting for the physical card to arrive.

Pros and Cons of Coinbase Card

Evaluating the Coinbase Card’s advantages and disadvantages helps determine whether it suits your needs:

Advantages

- Wide acceptance at millions of Visa merchants

- No annual or monthly card fees

- Cashback rewards on purchases (when available)

- No foreign transaction fees for international spending

- Instant cryptocurrency-to-fiat conversion

- Virtual card available immediately upon approval

- Multiple cryptocurrency spending options

- Integrates with Apple Pay and Google Pay

Disadvantages

- 2.49% conversion spread on all purchases

- Limited geographic availability

- Requires existing Coinbase account

- Rewards availability varies by region and time

- High ATM withdrawal fees (2.49% + $2.50)

- Cryptocurrency price volatility affects spending

- Tax reporting complexity (each purchase is a taxable event)

- Custodial model (Coinbase controls your crypto)

Comparing Coinbase Card to Alternative Crypto Debit Cards

The cryptocurrency debit card market has expanded significantly, offering users multiple options with varying features and fee structures:

| Card/Platform | Purchase Fee | Rewards | Custody Model | Key Feature |

|---|---|---|---|---|

| Coinbase Card | 2.49% spread | 1-4% (varies) | Custodial | Wide crypto selection |

| Crypto.com Card | No fee (spread applies) | Up to 8%* | Custodial | High rewards with staking |

| Binance Card | 0.9% fee | Up to 8%* | Custodial | Lower base fees |

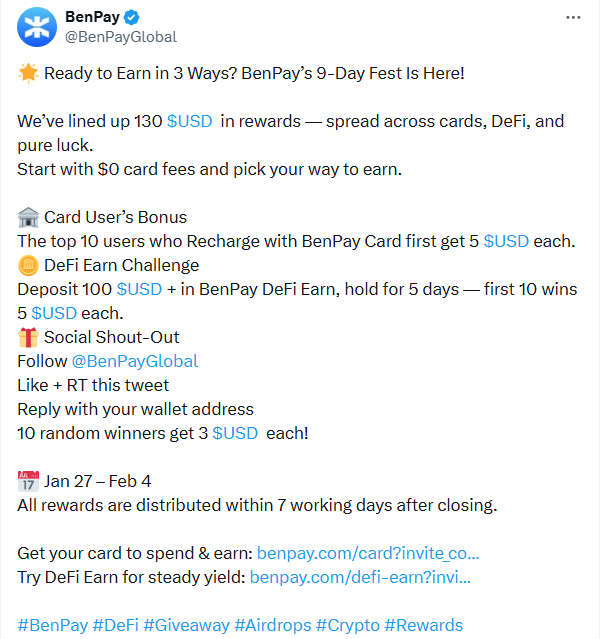

| BenPay Card | Varies by tier | N/A | Self-custodial | User controls private keys |

*Higher reward tiers require staking significant amounts of the platform’s native token

The Self-Custodial Alternative

Traditional crypto debit cards like Coinbase Card operate on custodial models—the platform holds your cryptocurrency and private keys on your behalf. While this simplifies user experience, it means you don’t truly control your assets and face risks if the platform experiences security breaches or regulatory issues.

BenPay offers a self-custodial approach where users maintain control of private keys until the moment of spending. The BenPay Card connects to your self-custodial wallet, supporting multi-chain cryptocurrency including Bitcoin, Ethereum, and stablecoins across networks like BSC, Polygon, Arbitrum, and Avalanche.

With card limits starting at $200,000 USD and promotional opening fees of 9.9 BUSD, BenPay accommodates both everyday spending and substantial transactions. The platform operates under a US Money Services Business license (FinCEN Registration Number 31000260888727), providing regulatory compliance comparable to Coinbase while maintaining self-custodial architecture.

Why Self-Custody Matters: Self-custodial solutions mean your cryptocurrency remains under your control until you explicitly authorize spending. If BenPay experiences downtime or regulatory issues, your assets remain accessible through your private keys—unlike custodial platforms where your funds could become temporarily or permanently inaccessible during platform disruptions.

Tax Implications of Using Coinbase Card

One often-overlooked aspect of cryptocurrency debit cards involves tax reporting complexity. In most jurisdictions including the US, each cryptocurrency transaction—including spending with a debit card—represents a taxable event requiring capital gains or loss calculation.

How Tax Liability Works

When you spend cryptocurrency, you’re technically selling it at current market price. If the cryptocurrency has appreciated since you acquired it, you owe capital gains tax on the difference. For example:

Tax Scenario:

- You bought 0.01 BTC when Bitcoin was $30,000 (cost: $300)

- You spend 0.01 BTC when Bitcoin is $45,000 (value: $450)

- Your capital gain: $150

- Tax owed: $150 × your capital gains tax rate

This calculation occurs for EVERY purchase you make with the card.

Using the Coinbase Card for everyday purchases—coffee, groceries, gas—creates dozens or hundreds of taxable events annually. Each requires tracking the original purchase price (cost basis) of the cryptocurrency spent and calculating gain or loss based on spending time value. This record-keeping burden can be substantial without proper tax software.

Many users address this by spending only stablecoins like USDC through their card. Since stablecoins maintain consistent $1 value, capital gains or losses typically remain minimal or nonexistent, simplifying tax reporting dramatically. However, this approach sacrifices the ability to directly spend appreciating cryptocurrency holdings.

Practical Use Cases and User Experiences

Understanding how real users employ the Coinbase Card helps illustrate its practical utility and limitations:

Best Use Case: International Travel

The Coinbase Card’s zero foreign transaction fees make it attractive for international spending. Traditional credit cards typically charge 3% foreign transaction fees, while the Coinbase Card’s 2.49% spread applies universally regardless of purchase location. For someone spending $5,000 during international travel, this saves approximately $25 compared to standard credit cards.

Good Use Case: Cryptocurrency Profit Taking

Users who purchased cryptocurrency at lower prices can spend appreciated holdings through the card, effectively monetizing gains without selling through exchanges and withdrawing to bank accounts. This streamlines the “crypto-to-spending” flow, though tax implications still apply.

Questionable Use Case: Everyday Primary Spending

Using the Coinbase Card as your primary debit card for all purchases means paying the 2.49% spread on everything you buy. For someone spending $2,000 monthly, this adds approximately $50 in monthly fees ($600 annually)—costs that don’t exist with traditional debit cards linked to checking accounts. Rewards can offset some cost, but users should calculate whether net rewards minus fees provide actual savings.

Security and Safety Considerations

Cryptocurrency debit cards introduce unique security considerations beyond traditional payment cards:

Key Security Points:

- Custodial Risk: Coinbase holds your private keys and cryptocurrency. Platform security breaches or regulatory seizures could affect your funds.

- Spending Limits: Set daily spending limits in the app to minimize loss if your card is compromised.

- Virtual Card First: Test the virtual card for small purchases before relying on it for significant transactions.

- Price Volatility: Cryptocurrency values can change rapidly. The amount of crypto you spend for a $50 purchase might vary significantly throughout the day.

- Irreversible Transactions: Unlike credit card chargebacks, cryptocurrency transactions are final. Dispute resolution follows Visa’s standard debit card policies but with cryptocurrency conversion already executed.

For enhanced security, many users maintain minimal balances on Coinbase specifically for card spending, transferring funds from cold storage or other wallets as needed. This limits exposure if the account is compromised while maintaining spending capability.

How to Maximize Value from Coinbase Card

Strategic usage can help minimize costs and maximize benefits:

Value Optimization Strategies:

- Spend Stablecoins for Simplicity: Use USDC or other stablecoins to avoid cryptocurrency volatility and simplify tax reporting. The 2.49% fee still applies, but you eliminate price risk between purchase decision and execution.

- Reserve for International Travel: Focus card usage on international spending where the no foreign transaction fee provides clear advantage over traditional cards’ 3% fees.

- Take Advantage of Rewards Periods: When high cashback rewards are available (4% in XLM or GRT), use the card more heavily to maximize earnings. When rewards are unavailable or reduced, minimize usage.

- Avoid ATM Withdrawals: The 2.49% + $2.50 fee makes ATM withdrawals extremely expensive. A $100 withdrawal costs $4.99 in fees—nearly 5%. Use the card for purchases instead.

- Track All Transactions for Taxes: Use cryptocurrency tax software that integrates with Coinbase to automatically track cost basis and calculate gains/losses for each card transaction.

The Future of Crypto Debit Cards

The cryptocurrency debit card market continues evolving rapidly. Several trends suggest where the technology is heading:

Decreasing fees represent one clear trajectory. As competition intensifies, platforms are pressured to reduce spreads and conversion costs. Some newer entrants already offer sub-1% fees, potentially forcing established players to lower prices or risk losing market share.

Improved self-custodial solutions are emerging. Users increasingly demand control over their private keys and assets, driving development of cards that maintain self-custody until transaction execution. Platforms like BenPay pioneering this approach may establish new standards where security and user control don’t require sacrificing spending convenience.

Integration with DeFi represents another frontier. Next-generation cards might automatically deploy idle balances into yield-generating protocols, making funds productive until needed for spending. BenPay’s DeFi Earn feature exemplifies this direction, connecting to protocols like Aave, Compound, and Unitas to generate 3-5% yields on balances awaiting use.

Join the BenPay Community

Stay informed about cryptocurrency payment innovations and crypto debit card developments through BenPay’s community channels. Follow @BenPayGlobal on X for platform updates and educational content about self-custodial payment solutions. Recent initiatives have included reward programs for early adopters and guides on cryptocurrency spending optimization.

For detailed platform information and updates, visit the BenPay blog featuring articles on cryptocurrency payment infrastructure, self-custody practices, and cost management strategies.

Conclusion: Is the Coinbase Card Right for You?

The Coinbase Card successfully bridges cryptocurrency holdings and everyday spending, enabling users to spend digital assets at millions of merchants worldwide. For cryptocurrency enthusiasts wanting practical ways to use their holdings, the card provides genuine utility—particularly for international spending where its no foreign transaction fee structure offers clear advantages.

However, the 2.49% conversion spread means the card costs substantially more than traditional debit cards for routine spending. Users should honestly assess whether rewards offset this cost and whether their spending patterns justify paying premium fees. For occasional cryptocurrency spending or international travel, the card makes sense. For everyday primary spending, the cumulative fees add up significantly.

Alternative solutions worth considering include other crypto debit cards with different fee structures, self-custodial options providing greater asset control, or hybrid approaches where you maintain minimal balances specifically for spending while holding larger amounts in more secure self-custodial wallets.

The key is understanding exactly what you’re paying for cryptocurrency spending convenience and determining whether that cost aligns with your financial priorities and usage patterns. The Coinbase Card represents one solution in an expanding market—valuable for some users, expensive for others, and worth comparing against emerging alternatives prioritizing user control and lower fees.