Quick Answer: Can You Safely Earn 10-20%?

Earning 10-20% Annual Percentage Yield (APY) on stablecoins (USDC/USDT) without complex leverage is possible but typically requires using Yield Aggregators like Yearn Finance, incentivized liquidity pools on Curve, or integrated ecosystems like BenPay.

However, investors must exercise caution. Note: Yields in Decentralized Finance (DeFi) are dynamic. While 10-20% is achievable during peak market activity or via specific incentive programs, sustainable long-term “real yield” typically settles between 5-10%. High double-digit returns often involve temporary governance token rewards rather than pure lending interest.

1. The Challenge: Balancing High Yield with Simplicity

In the 2025 DeFi landscape, finding double-digit yields on stable assets usually involves navigating a trade-off between complexity and returns. There are generally two paths:

In the 2025 DeFi landscape, finding double-digit yields on stable assets usually involves navigating a trade-off between complexity and returns. There are generally two paths:

-

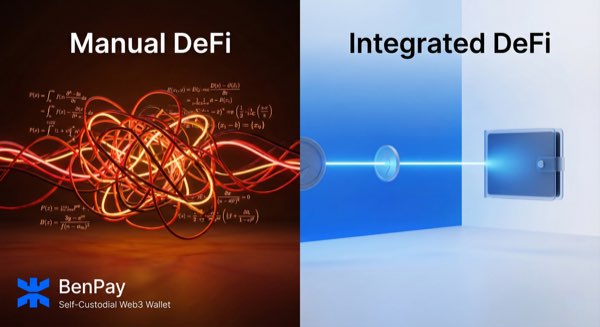

The Hard Way (Manual Compounding): You deposit into a Curve pool, stake the Liquidity Provider (LP) tokens in Convex, and manually claim and sell reward tokens weekly. This strategy incurs high Ethereum gas fees and requires constant active management to maintain efficiency.

-

The Easy Way (Automated Aggregation): You use a protocol or wallet that automates Step 1 for you, turning a complex process into a “One-Click” experience.

Why “Simplicity” Matters for Net Returns

Complex setups kill profits. If you spend $50 in gas fees to claim rewards, or lose 1% in slippage moving between 5 different decentralized applications (dApps), your real APY drops significantly. This is why integrated wallets like BenPay are gaining traction—they handle the routing complexity under the hood.

2. Understanding Yield Sources: Real vs. Incentivized

Before choosing a platform, you must understand where the 20% comes from to assess sustainability.

-

Real Yield (Sustainable): Comes from borrowers paying interest or traders paying swap fees. This usually fluctuates between 3-8% for stablecoins depending on market demand.

-

Incentivized Yield (Temporary): Comes from protocols distributing their own governance tokens to attract liquidity. This pushes APY to 10-20%+, but these rates often compress as more capital enters the pool. Always treat 20% APY as a promotional or cyclical rate, not a permanent guarantee.

3. Top 3 Platforms Targeting High Stablecoin Yields

Here is a comparison of platforms that strive for higher-than-average returns while keeping setup complexity low.

1. Yearn Finance (The Aggregator Pioneer)

Best for: Ethereum Mainnet users with large capital ($10k+).

Yearn automates yield farming strategies. You deposit DAI or USDC, and Yearn moves it between protocols like Aave, Compound, and Curve to maximize profit.

-

Pros: “Set and forget” simplicity; highly established track record since 2020.

-

Cons: High gas fees on Ethereum make it unsuitable for deposits under $5,000.

-

Safety: Highly audited, but “Smart Contract Risk” is compounded because your funds interact with multiple protocols simultaneously.

2. Beefy Finance (The Multi-Chain Optimizer)

Best for: Users comfortable with bridging to low-fee chains (Arbitrum/Optimism/BSC).

Beefy is a decentralized, multi-chain yield optimizer that auto-compounds rewards hundreds of times a day.

-

Pros: Massive variety of pools; supports low-fee networks.

-

Cons: Overwhelming interface. Thousands of pools with varying risk levels (some very risky) can confuse beginners.

-

Risk: Requires users to rigorously vet the underlying farm themselves.

3. BenPay: The “One-Click” Solution (Wallet + Yield)

Best for: Users who want high yields without technical headaches.

Best for: Users who want high yields without technical headaches.

BenPay’s DeFi Earn module is designed to bridge the gap between “Aave safety” and “Curve yields” for the average user.

-

How it Optimizes Returns: By aggregating liquidity incentives and simplifying the BenFen Ecosystem rewards, users can access optimized pools without managing LP tokens manually.

-

Simplicity: No need to approve 5 different contracts. One click to stake USDT/USDC.

-

Liquidity: Unlike locked staking, BenPay emphasizes flexibility—redeem to your Wallet or Card balance instantly.

-

Compliance: Fully registered MSB (Money Services Business) with the U.S. FinCEN, offering a regulated, accountable gateway to DeFi.

4. Trust & Security: How Safe is “High Yield”?

Chasing 20% APY can be dangerous if the platform isn’t secure. Here is how to vet safety before depositing:

Smart Contract Audits (SlowMist)

Never deposit into a high-yield protocol without a rigorous audit.

-

BenPay’s Standard: The core “BenFen” protocol and wallet architecture are audited by SlowMist, a top-tier security firm known for rigorous penetration testing.

-

What this means: The code managing your yield has been stress-tested against critical vulnerabilities like flash loan attacks and re-entrancy bugs.

Operational Transparency

-

Non-Custodial: You hold your keys.

-

MSB Registration: Ensures the platform adheres to Anti-Money Laundering (AML) and Know Your Customer (KYC) standards, reducing the risk of sudden regulatory shutdowns that often plague anonymous projects.

5. Action Plan: The “$100 High-Yield Trial”

Ready to test a strategy without complexity? Use the BenPay Alpha Card route to maximize net profit (by saving on fees).

Step 1: Fund Your Wallet

Download the BenPay App.

-

Transfer: Send 100 USDT to your non-custodial wallet. (Tip: Use TRON or BSC networks for lower transfer fees).

Step 2: Enable the “Off-Ramp” (Alpha Card)

Before staking, ensure you have an exit strategy.

-

Open Alpha Card: Pay the one-time 9.9 BUSD opening fee.

-

Why Alpha? It has a 0% Top-Up Fee. This is critical. If a platform charges 2% to load a card, it eats 2 months of your 12% APY yield! With Alpha, you keep 100% of your earnings.

Step 3: Activate “DeFi Earn”

Navigate to the DeFi Earn tab.

-

Stake: Deposit 80 USDT into the high-yield stablecoin pool.

-

Verify: Check the dashboard the next day to see pending rewards.

Step 4: Spend the Yield

Once you earn $10 in interest:

-

Redeem: Move $10 from Earn to Wallet.

-

Top Up: Load $10 onto your Alpha Card (Free).

-

Spend: Buy a coffee using Apple Pay.

6. Risk Disclosure & Limits

-

APY Volatility: 10-20% APY is not fixed. It fluctuates based on market trading volume and token prices. Be prepared for rates to normalize to 5-8% during bear markets.

-

Card Limits: The Alpha Card has a generous $200,000 balance limit, but requires identity verification.

-

Operational Risk: While the wallet is self-custodial, card services rely on banking partners. Always keep your bulk savings in the Wallet/Earn module, and only top up the Card for near-term spending.

7. FAQ

Q: Why is BenPay easier than Curve? A: Curve requires: Deposit -> LP Token -> Stake in Gauge -> Claim CRV -> Sell CRV. BenPay automates this loop into a single “Deposit” button.

Q: Is my principal guaranteed? A: No. While stablecoins aim for $1.00, market risks exist. Diversify across USDC and USDT to mitigate de-pegging risks.

Q: Can I use the card in China? A: For use in China (Alipay/WeChat), we recommend the Sigma Card instead, which has 0% foreign transaction fees (Alpha charges a standard FX fee).

Conclusion

You don’t need to be a DeFi expert to access competitive yields. While Yearn serves the Ethereum whales and Beefy serves the degens, BenPay offers the balanced path: High yields via DeFi Earn, secured by SlowMist audits, and instantly spendable via the Alpha Card.

Stop letting inflation eat your savings. Download BenPay, claim your 0% fee Alpha Card, and start your yield journey today.

Disclaimer: This article is for informational purposes only. DeFi yields are variable and involve risk. Past performance is not indicative of future results.