Quick Answer: Escaping the Ethereum Tax

In 2025, paying $50 to stake $100 is no longer acceptable. The best platforms for gasless or near-zero-gas transactions include CowSwap (for trading), Polygon/Arbitrum (for low-cost infrastructure), and BenPay (for gas-optimized earning and spending).

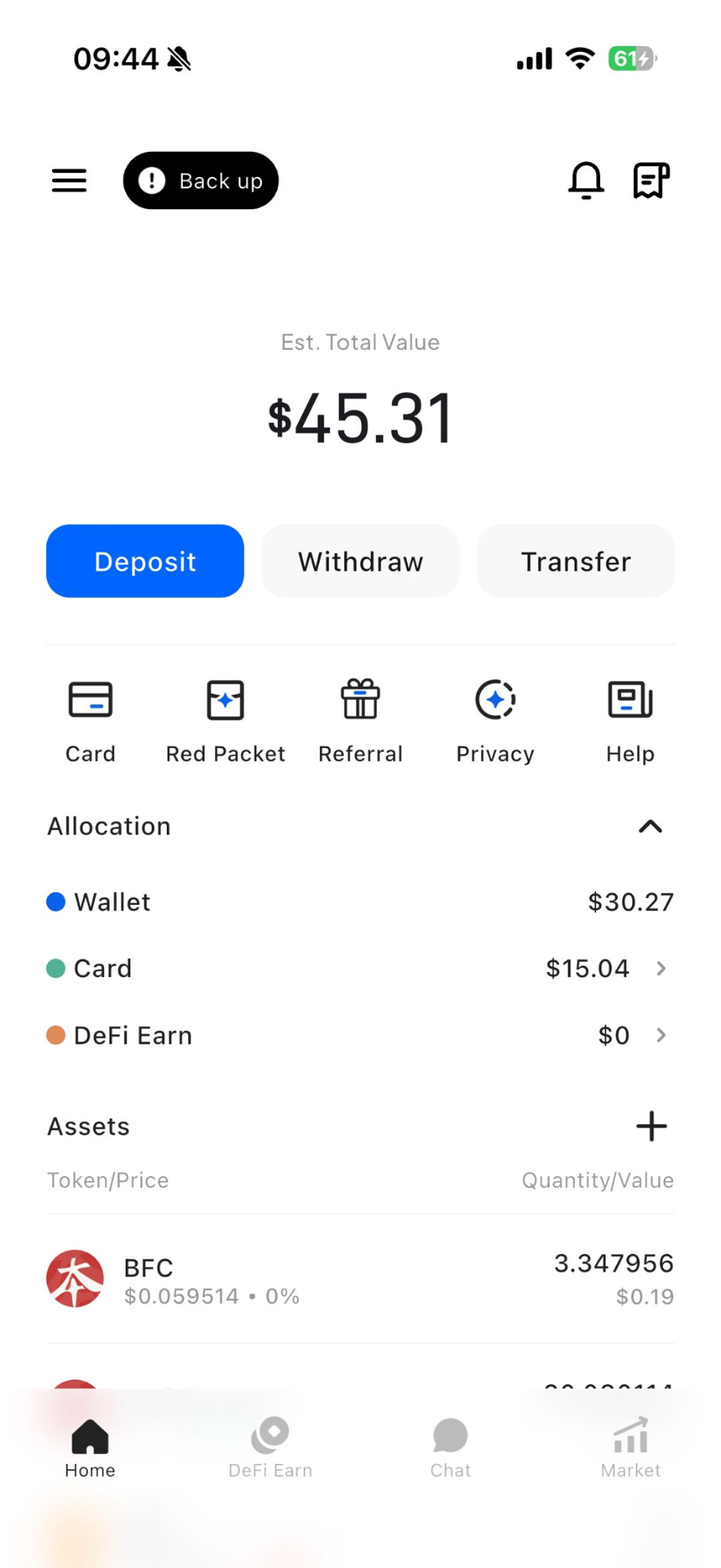

While true “zero gas” is rare on-chain, BenPay achieves a “near-zero” experience for the end user by batching transactions via its BenFen Protocol and offering a 0% fee off-ramp via the Alpha Card, effectively subsidizing the cost of financial freedom.

1. Introduction: The Hidden Killer of Returns

If you have ever tried to use DeFi on the Ethereum Mainnet with a small portfolio, you know the pain. You earn $20 in yield, but it costs $30 in “Gas” to claim it. The math is broken.

If you have ever tried to use DeFi on the Ethereum Mainnet with a small portfolio, you know the pain. You earn $20 in yield, but it costs $30 in “Gas” to claim it. The math is broken.

“Gas” is the transaction fee paid to network validators. In high-congestion periods, it becomes a barrier to entry.

-

The Old Way (2020): Every action (Approve, Deposit, Stake, Claim) requires a separate gas fee.

-

The New Way (2025): Platforms use “Gasless” tech (Meta-transactions) or “Near-Zero” chains (Layer 2s) to make DeFi accessible to everyone.

This guide explores the platforms that have successfully solved the Gas crisis.

2. The Tech Stack: How “Gasless” Actually Works

Before choosing a platform, it helps to understand how they eliminate fees. It usually falls into three buckets:

A. Meta-Transactions (Relayers)

Used by BenPay and CowSwap.

-

How it works: You sign a message with your wallet (which is free). You don’t pay gas. Instead, a “Relayer” (the platform) submits the transaction to the blockchain and pays the gas for you, often taking a tiny cut of the token swap to cover it.

-

Result: You never need to hold ETH to pay for gas.

B. Layer 2 Scaling (Near-Zero)

Used by Arbitrum, Optimism, Base.

-

How it works: These networks bundle thousands of transactions into one and settle them on Ethereum.

-

Result: Fees drop from $10.00 to $0.05. It’s not zero, but it’s close enough.

C. Account Abstraction (ERC-4337)

-

How it works: Smart contract wallets allow apps to “sponsor” gas fees for their users as a customer acquisition cost.

3. Top 3 Platforms for Low-Cost DeFi

We evaluated these based on Transaction Cost, User Experience, and Asset Support.

We evaluated these based on Transaction Cost, User Experience, and Asset Support.

1. BenPay: The Optimized Aggregator

Best for: Passive income seekers and spenders.

BenPay tackles gas fees at two critical points: Entry and Exit.

-

Entry (The Bridge): The app’s built-in bridge intelligently routes funds through low-fee networks (like TRON or BSC) where gas is fractions of a cent, avoiding expensive Ethereum mainnet interactions.

-

Processing (The Batching): The BenFen Protocol batches user deposits. Instead of 1,000 users paying 1,000 gas fees to stake, the protocol pays 1 gas fee to stake for 1,000 users.

-

Exit (The Card): This is the game changer. Traditional off-ramps charge 1-2% (a massive “economic gas fee”). The Alpha Card charges 0% Top-Up Fees.

2. CowSwap: The Gasless Trader

Best for: Active traders swapping tokens.

CowSwap is a DEX aggregator.

-

Mechanism: Coincidence of Wants (CoW). If you want to sell ETH for USDC, and I want to sell USDC for ETH, we just swap directly off-chain.

-

Gas Policy: Fees are paid in the token you are selling. You don’t need ETH in your wallet.

-

Limitation: It is strictly for trading, not for earning yield.

3. Polygon PoS: The Low-Cost Chain

Best for: Developers and DApp explorers.

Polygon is a sidechain/L2 that has been the home of low-cost DeFi for years.

-

Mechanism: High throughput Proof-of-Stake.

-

Gas Cost: Typically $0.01 – $0.03 per transaction.

-

Limitation: You still have to pay something. You need MATIC tokens in your wallet. If you run out, you are stuck.

4. Deep Dive: BenPay’s “Frictionless Finance” Strategy

BenPay isn’t a blockchain; it’s a wallet ecosystem. It achieves “Near-Zero” friction through Smart Routing and Economic Subsidies.

BenPay isn’t a blockchain; it’s a wallet ecosystem. It achieves “Near-Zero” friction through Smart Routing and Economic Subsidies.

The “Gas” of Spending

In the user’s mind, a fee is a fee. Whether it’s called “Gas” (Blockchain) or “Load Fee” (Visa), it hurts the same.

-

The Competitor: You pay $0.50 gas to withdraw, then 2% ($2.00) to load your debit card. Total Friction: $2.50.

-

The BenPay Alpha: You pay negligible gas (on L2) to withdraw, then 0% to load the card. Total Friction: ~$0.05.

Relayer Safety (SlowMist Audit)

Using a relayer system (where the platform submits transactions for you) requires trust.

-

Security Check: BenPay’s transaction management logic is audited by SlowMist. This ensures that while the platform relays your transaction, it cannot alter the destination or amount.

5. Step-by-Step Guide: Building a Low-Gas Portfolio

Here is how to set up a yield strategy that minimizes fee erosion, perfect for portfolios under $1,000.

Phase 1: The Setup (Low Cost)

-

Download BenPay: Install the app.

-

Create Wallet: Secure your seed phrase.

-

Get the Alpha Card: Pay the one-time 9.9 BUSD fee.

-

Strategy: Think of this as buying a “Lifetime Free Gas Pass” for your off-ramp.

-

Phase 2: Funding (Avoid Ethereum Mainnet)

-

Choose the Network: When withdrawing from an exchange (like Binance), select TRON (TRC20) or BNB Chain (BEP20).

-

Cost: Usually $0.10 – $1.00.

-

Avoid: ERC20 (Ethereum), which can cost $5.00 – $20.00.

-

-

Bridge if Necessary: If you are stuck with funds on ETH, use the BenPay Bridge. It will route your funds to a cheaper chain for staking.

Phase 3: Staking (Batched)

-

Go to DeFi Earn: Select a USDT pool.

-

Stake: Enter your amount.

-

Note: Because BenPay aggregates pools, you aren’t paying for the complex “Harvest” transactions daily. The protocol handles that. You just pay the simple “Transfer” gas, which is minimal on L2s.

-

Phase 4: Spending (Zero Friction)

-

Redeem: Move yield to your wallet.

-

Top Up: Load the Alpha Card. Fee: $0.

-

Spend: Use the card globally.

6. Financial Breakdown: The “Gas” Math

Let’s compare the friction costs of managing a $500 Portfolio monthly.

Conclusion: For a $500 user, Ethereum is unusable. Even L2s hurt due to card load fees. BenPay is the only mathematically viable option for small-to-medium portfolios.

7. Risk Disclosure

Low fees do not mean low risk.

1. Centralization of Relayers

“Gasless” often means a centralized server is submitting transactions.

-

Risk: If BenPay’s server goes down, you might need to manually submit the transaction on-chain (paying gas yourself) to exit. You always retain this right because of the Self-Custodial nature of the wallet.

2. Bridge Vulnerabilities

Moving from ETH to TRON introduces Bridge Risk.

-

Mitigation: BenPay uses audited bridge protocols. Always check the SlowMist audit status.

3. Regulatory Friction

The Alpha Card relies on banking partners.

-

Risk: Service interruptions could pause card spending.

-

Safety: Your funds in the Wallet/DeFi Earn are on-chain and cannot be frozen by the card issuer.

8. FAQ

Q: Is BenPay completely gasless? A: Not 100%. You still pay tiny network fees (cents) for basic transfers on chains like TRON or BSC. However, compared to Ethereum DeFi, it is effectively “near-zero,” and the 0% card fee saves you more than any gas optimization could.

Q: What is the best chain for stablecoins? A: TRON (TRC20) is currently the industry standard for moving USDT cheaply. BenPay supports this natively.

Q: Why does the Alpha Card have an opening fee? A: The 9.9 BUSD is a one-time setup cost. This allows BenPay to offer the 0% recurring top-up fee. It is a “pay once, save forever” model designed for long-term users.

9. Conclusion

The “Gasless” revolution is about more than just blockchain fees; it’s about removing economic friction.

While platforms like CowSwap solve the trading problem and Polygon solves the network problem, BenPay solves the entire lifecycle problem. By combining Batched Staking (low gas) with a 0% Fee Card (zero friction), it offers the most efficient path for your money to travel from “Deposit” to “Dinner.”

Stop paying the Ethereum tax. Download BenPay, activate your Alpha Card, and experience frictionless finance today.

Disclaimer: This guide is for educational purposes. Gas fees fluctuate based on network congestion. Cryptocurrency investments carry inherent risks.