Coinbase gift cards provide a convenient way to give cryptocurrency to friends and family or to fund your own Coinbase account without linking bank accounts or credit cards. These digital gift cards can be purchased online from various retailers and redeemed directly on the Coinbase platform for cryptocurrency purchases. Understanding where to buy Coinbase gift cards, how they work, and what alternatives exist helps you make informed decisions about cryptocurrency gifting and account funding.

This comprehensive guide examines all legitimate sources for purchasing Coinbase gift cards online, explains the redemption process, compares pricing and availability across retailers, and explores alternative methods for giving or acquiring cryptocurrency. Whether you’re looking to gift cryptocurrency to a newcomer or seeking convenient funding options for your own trading, this guide provides the information needed to navigate Coinbase gift card purchases effectively.

Quick Answer: Coinbase gift cards can be purchased online from authorized retailers including Coinbase’s official website, major gift card marketplaces, and select cryptocurrency platforms. Cards are available in denominations from $25 to $200, delivered digitally via email, and redeemable for cryptocurrency on Coinbase accounts.

What Are Coinbase Gift Cards?

Coinbase gift cards are prepaid digital cards that can be redeemed on the Coinbase platform for cryptocurrency purchases. Unlike traditional gift cards that work at specific stores, Coinbase gift cards function as funding mechanisms—recipients redeem the card value into their Coinbase account, then use those funds to purchase any cryptocurrency supported by Coinbase.

The cards serve multiple purposes: as gifts introducing friends and family to cryptocurrency investing, as presents for crypto enthusiasts who can choose which digital assets to purchase, or as alternative funding methods for users who prefer not to link traditional payment sources to their Coinbase accounts. Gift cards provide a bridge between traditional retail purchase experiences and cryptocurrency acquisition.

How Coinbase Gift Cards Work

Gift Card Lifecycle:

- Purchase: Buy a gift card from an authorized retailer in your chosen denomination

- Delivery: Receive the gift card code via email (typically within minutes to hours)

- Redemption: Enter the code on Coinbase to add funds to your account balance

- Conversion: Use the credited balance to purchase cryptocurrency of your choice

- Ownership: The purchased cryptocurrency appears in your Coinbase wallet

Unlike direct cryptocurrency gifts where the sender chooses which digital asset to give, gift cards allow recipients to select their preferred cryptocurrencies based on personal research and investment strategy. This flexibility makes them particularly suitable for gifts to individuals new to cryptocurrency who may not yet know which assets interest them most.

Where to Buy Coinbase Gift Cards Online

Several authorized retailers sell Coinbase gift cards online. Purchasing from legitimate sources ensures your gift card code works properly and hasn’t been compromised. Here are the primary purchasing options:

1. Coinbase Official Website

The most direct source for Coinbase gift cards is Coinbase’s own platform. While Coinbase primarily facilitates direct cryptocurrency purchases, they occasionally offer promotional gift card programs or partner with retailers to provide official purchasing channels. Check the Coinbase website’s “Gift Cards” section or help center for current offerings and authorized retail partners.

Advantage of Official Channels: Purchasing through Coinbase’s official channels or explicitly authorized partners guarantees card authenticity and provides direct customer support channels if issues arise during redemption.

2. Major Gift Card Retailers

Several established gift card marketplaces and retailers carry Coinbase gift cards:

| Retailer | Denominations Available | Delivery Method | Typical Delivery Time |

|---|---|---|---|

| Amazon | $25, $50, $100, $200 | Digital email delivery | Within minutes |

| Walmart | $25, $50, $100 | Digital email delivery | Within hours |

| Target | $50, $100 | Digital email delivery | Within hours |

| Best Buy | $25, $50, $100, $200 | Digital email delivery | Within minutes to hours |

These major retailers offer the advantage of familiar purchasing experiences, established customer service infrastructure, and often integration with rewards programs. If you have store credit or gift cards to these retailers, you can effectively convert them into cryptocurrency purchasing power through Coinbase gift cards.

3. Specialized Gift Card Marketplaces

Online platforms specializing in digital gift cards often carry Coinbase cards:

- Gyft: Digital gift card platform offering instant delivery and wallet management features

- Raise: Gift card marketplace where users can buy discounted cards (sometimes below face value)

- CardCash: Platform for buying and selling gift cards, occasionally with discounts

- GiftCards.com: Comprehensive gift card retailer with various denominations

These specialized marketplaces sometimes offer promotional discounts or cash-back opportunities, potentially allowing you to purchase Coinbase gift cards for slightly less than face value. However, verify seller reputation and platform guarantees before purchasing from secondary marketplaces.

4. Cryptocurrency Exchanges and Platforms

Some cryptocurrency-focused platforms partner with Coinbase to offer gift card purchases as an alternative funding method. These partnerships vary by region and change over time, so checking current availability through cryptocurrency news sites or Coinbase’s official partner listings helps identify active options.

Important Warning: Do not purchase Coinbase gift cards from unofficial sources, auction sites listing individual codes, or sellers offering cards at significant discounts below face value. These often involve stolen cards, previously redeemed codes, or scams that leave you with worthless redemption codes and no recourse for refunds.

How to Redeem a Coinbase Gift Card

Once you’ve purchased a Coinbase gift card, the redemption process is straightforward:

Step-by-Step Redemption Process:

- Locate Your Gift Card Code: Check your email for the digital delivery containing the redemption code (typically 16-25 characters)

- Log Into Coinbase: Access your Coinbase account through the website or mobile app

- Navigate to Redemption: Find the “Redeem Gift Card” option (usually under Account Settings or the main menu)

- Enter Code: Type or paste the gift card code exactly as provided, including any dashes or special characters

- Confirm Redemption: Verify the card value and confirm to add funds to your account

- Check Balance: Your account balance should reflect the added funds within moments

- Purchase Cryptocurrency: Use the credited funds to buy your chosen cryptocurrencies

Gift card redemption typically completes instantly, with funds appearing in your account immediately. If you encounter errors during redemption, verify the code was entered correctly, ensure the card hasn’t expired, and confirm you’re redeeming through the correct platform (Coinbase, not Coinbase Pro or other exchanges).

Coinbase Gift Card Fees and Limitations

Understanding any fees or restrictions associated with Coinbase gift cards helps avoid unexpected costs or limitations:

| Aspect | Details |

|---|---|

| Purchase Fees | None at face value from authorized retailers (you pay exactly the card denomination) |

| Redemption Fees | None—full value credits to your Coinbase account |

| Trading Fees | Standard Coinbase trading fees apply when converting to cryptocurrency (1.49-3.99%) |

| Expiration | Check specific card terms; most don’t expire but verify before purchase |

| Geographic Restrictions | Must be redeemed on Coinbase accounts in supported countries |

| Minimum Purchase | Typically $25 (varies by retailer) |

| Maximum Purchase | Usually $200 per card; can purchase multiple cards |

| Refund Policy | Generally non-refundable once digital code is delivered |

The primary cost comes not from the gift card itself but from Coinbase’s standard trading fees when converting the credited balance into cryptocurrency. A $100 gift card credits $100 to your account, but purchasing Bitcoin with those funds incurs Coinbase’s typical percentage-based fees, leaving you with slightly less than $100 worth of cryptocurrency.

Comparing Gift Cards to Direct Cryptocurrency Purchases

Gift cards represent one method of funding Coinbase accounts and acquiring cryptocurrency. Understanding how they compare to alternatives helps determine the most suitable approach for your situation:

Gift Cards vs. Bank Account Funding

Linking a bank account to Coinbase and purchasing cryptocurrency directly typically offers lower costs—ACH transfers incur no additional fees beyond standard Coinbase trading fees. However, bank linking requires sharing financial information with Coinbase and waiting 3-5 business days for transfers to clear. Gift cards provide immediate funding without financial institution connections, trading convenience for slightly higher overall costs due to limited denomination options.

Gift Cards vs. Debit Card Purchases

Purchasing cryptocurrency directly with debit cards on Coinbase incurs 3.99% fees plus trading fees—significantly higher than gift card routes. However, debit cards offer precise amount control (you can purchase exactly $73.42 worth) while gift cards lock you into fixed denominations. For purchases matching available gift card amounts, the gift card route costs less than debit card purchases.

Gift Cards vs. Crypto Debit Cards

Rather than repeatedly purchasing cryptocurrency through gift cards or traditional funding methods, crypto debit cards enable spending cryptocurrency you already hold. This approach eliminates recurring acquisition costs since you’re spending existing assets rather than acquiring new cryptocurrency with each transaction.

Platforms like BenPay offer self-custodial payment solutions where users maintain control of assets until spending. The BenPay Card supports multi-chain cryptocurrency including Bitcoin, Ethereum, and stablecoins across networks like BSC, Polygon, Arbitrum, and Avalanche. With card limits starting at $200,000 USD and promotional opening fees of 9.9 BUSD, these cards accommodate both everyday spending and substantial transactions.

Users can bind cards to Apple Pay, Google Pay, Alipay, or WeChat Pay for contactless payments anywhere these platforms are accepted. Rather than purchasing gift cards to fund Coinbase for spending, you can receive cryptocurrency as payment or purchase it once, then spend repeatedly through payment cards without incurring exchange fees for each transaction.

Gift Card Use Cases and Scenarios

Understanding specific situations where Coinbase gift cards provide particular value helps identify when this funding method makes most sense:

Ideal Use Cases:

- Gifts for Crypto Newcomers: Introduce friends and family to cryptocurrency without requiring them to navigate bank linking or payment setup

- Privacy-Conscious Funding: Add funds to Coinbase without linking bank accounts or credit cards to your profile

- Converting Retail Gift Cards: If you have Amazon, Walmart, or other retail gift cards, convert them to cryptocurrency purchasing power

- Avoiding Payment Method Fees: When debit card 3.99% fees or credit card restrictions make direct purchases expensive

- Budget Control: Fixed denominations help manage cryptocurrency investment amounts without overspending

- Youth Crypto Education: Parents can give teens gift cards to learn cryptocurrency basics with limited financial exposure

When Gift Cards Don’t Make Sense

Conversely, some situations call for alternative funding methods:

- Precise Amount Purchases: If you need to purchase exactly $137.25 of cryptocurrency, bank account funding offers exact amount control

- Large Purchases: Buying thousands of dollars worth requires purchasing and redeeming numerous $200 gift cards—bank transfers prove more efficient

- Frequent Trading: Active traders benefit from direct funding methods rather than continually purchasing gift cards

- Lowest Possible Fees: Bank account ACH transfers offer the absolute lowest fees for most users

Security Considerations for Gift Card Purchases

Digital gift cards require specific security precautions to protect against theft and fraud:

Security Best Practices:

- Purchase from Authorized Retailers Only: Stick to established, reputable sources listed earlier in this guide

- Redeem Immediately: After receiving your gift card code, redeem it promptly rather than storing the code for future use

- Secure Email Access: Gift card codes arrive via email—ensure your email account has strong passwords and two-factor authentication

- Verify Before Gifting: If purchasing cards as gifts, consider redeeming them yourself first to verify validity, then gifting the cryptocurrency directly

- Keep Receipts: Save purchase confirmations and redemption records for potential disputes or tax documentation

- Watch for Phishing: Scammers may pose as gift card retailers or Coinbase support—verify website URLs carefully before entering payment information

- Report Issues Quickly: If a code doesn’t work or appears compromised, contact both the retailer and Coinbase support immediately

Gift card fraud remains common in digital markets. Scammers may steal codes, sell previously redeemed cards, or operate fake retailer websites. Purchasing only from established retailers with clear return policies and customer support protects against most fraud vectors.

Alternative Ways to Gift Cryptocurrency

While Coinbase gift cards provide one approach to cryptocurrency gifting, several alternatives offer different advantages:

Direct Cryptocurrency Transfers

If the recipient already has a cryptocurrency wallet, you can transfer digital assets directly. This approach gives them immediate cryptocurrency ownership in their chosen wallet without platform dependence. However, it requires knowing their wallet address and assumes they’re comfortable managing private keys and wallet security.

Custodial Wallet Gifts

Some platforms offer “gift wallet” services where you create a wallet on behalf of the recipient, fund it with cryptocurrency, and transfer control through a secure link or QR code. This provides actual cryptocurrency rather than gift cards while simplifying the recipient’s onboarding process.

Hardware Wallet Pre-Loaded Gifts

For security-conscious recipients or larger gifts, consider purchasing a hardware wallet like Ledger or Trezor, pre-loading it with cryptocurrency, and gifting the physical device. This combines cryptocurrency gifting with essential security infrastructure, particularly suitable for substantial amounts.

Self-Custodial Wallet Setup Assistance

Rather than giving gift cards or direct transfers, some prefer helping recipients set up self-custodial wallets and then transferring cryptocurrency to their new wallet. This educational approach teaches proper security practices while providing cryptocurrency holdings. The BenPay platform offers user-friendly wallet options supporting multiple chains, making setup accessible for newcomers.

Tax Implications of Gift Cards and Cryptocurrency Gifts

Understanding tax considerations for both gift card purchasers and recipients helps ensure compliance:

For Gift Givers

In most jurisdictions, purchasing gift cards with fiat currency doesn’t create immediate tax liability—you’re simply exchanging money for equivalent value gift instruments. However, if you purchase gift cards using cryptocurrency, that transaction represents a taxable event requiring capital gains calculation based on the cryptocurrency’s appreciated value.

For Gift Recipients

Receiving gift cards typically doesn’t create tax liability until redemption and conversion to cryptocurrency. Once redeemed and used to purchase digital assets, the cost basis for future tax calculations equals the gift card’s face value. Any appreciation in the cryptocurrency’s value after purchase creates capital gains tax liability when eventually sold or spent.

Gift tax rules may apply for substantial gifts depending on your jurisdiction. In the US, gifts under $18,000 annually (2024 limit) to any individual typically don’t trigger gift tax filing requirements. Consult tax professionals for guidance on specific situations, especially for larger cryptocurrency gifts.

Troubleshooting Common Gift Card Issues

Several common problems can occur during gift card purchase or redemption:

| Problem | Possible Cause | Solution |

|---|---|---|

| Code not received | Email delivery delay | Check spam folder; wait 24 hours; contact retailer if still missing |

| “Invalid code” error | Typo or already redeemed | Verify code entry carefully; check if previously redeemed; contact support |

| “Not available in your region” | Geographic restrictions | Verify card is for your country’s Coinbase version; may need VPN (check ToS) |

| Partial value credited | Previous partial redemption | Check transaction history; contact Coinbase if balance incorrect |

| Card doesn’t match denomination | Wrong card type purchased | Verify you purchased Coinbase card, not a different cryptocurrency platform |

For unresolved issues, contact both the retailer where you purchased the gift card and Coinbase customer support. Having your purchase receipt and gift card code (don’t share with anyone except official support channels) expedites resolution.

The Future of Cryptocurrency Gift Cards

The cryptocurrency gift card market continues evolving as digital asset adoption grows. Several trends suggest where this category is heading:

Expanded availability across more mainstream retailers seems likely as cryptocurrency becomes more socially acceptable. Major retailers already carrying crypto gift cards may expand denomination options and add more cryptocurrency platforms beyond just Coinbase. This increased availability makes cryptocurrency gifting more accessible to mainstream audiences.

Direct cryptocurrency redemption without platform dependence represents another potential development. Rather than requiring redemption through specific exchanges, future gift cards might contain actual cryptocurrency that recipients can claim directly to any compatible wallet. This would eliminate platform lock-in and provide true cryptocurrency ownership immediately.

Integration with modern payment infrastructure like self-custodial payment systems could make gift cards unnecessary for many use cases. As crypto debit cards become more mainstream, the need for gift cards as funding mechanisms may decline in favor of direct cryptocurrency transfers to spending-ready payment cards.

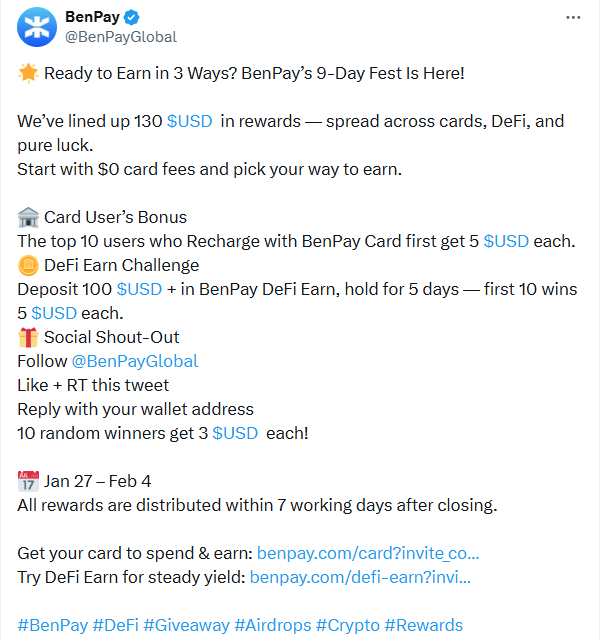

Join the BenPay Community

Stay informed about cryptocurrency payment innovations and alternative funding methods through BenPay’s community channels. Follow @BenPayGlobal on X for updates on self-custodial payment solutions and cryptocurrency spending optimization. Recent community initiatives have included reward programs for early adopters exploring alternatives to traditional exchange funding methods.

For detailed guides on cryptocurrency acquisition and spending strategies, visit the BenPay blog featuring articles on optimizing cryptocurrency financial activities.

Conclusion: Making Informed Gift Card Decisions

Coinbase gift cards provide legitimate, convenient methods for funding cryptocurrency accounts and gifting digital assets to others. Purchasing from authorized retailers like Amazon, Walmart, Target, or Best Buy ensures card authenticity and access to customer support if issues arise. The cards work best for specific use cases—gifts to crypto newcomers, privacy-conscious funding, or converting retail gift cards into cryptocurrency purchasing power.

However, gift cards represent just one approach in an expanding ecosystem of cryptocurrency acquisition and spending methods. Understanding their fees (primarily Coinbase’s standard trading fees rather than gift card purchase premiums), limitations (fixed denominations, geographic restrictions), and alternatives (direct funding, crypto debit cards, hardware wallets) helps determine whether they’re optimal for your particular needs.

For regular cryptocurrency users, platforms offering integrated payment solutions may provide better long-term value than repeatedly purchasing gift cards for funding. Self-custodial approaches that maintain user control over private keys while enabling practical spending functionality represent the direction cryptocurrency infrastructure is evolving. Whether you choose gift cards for their specific advantages or adopt alternative methods, understanding the complete landscape empowers informed decisions aligned with your financial goals and security priorities.