USDT (Tether) has evolved from a trading tool on cryptocurrency exchanges into a practical payment method for everyday transactions. With over $140 billion in circulation as of early 2025, USDT represents the world’s most widely adopted stablecoin, enabling users to conduct transactions with the speed and global reach of cryptocurrency while maintaining stable value pegged to the US dollar. This guide explains what USDT is, why it matters for payments, and provides step-by-step instructions for using USDT in real-world transactions.

Understanding how to pay with USDT opens access to lower-cost international transactions, faster settlement times, and financial infrastructure operating beyond traditional banking systems. Whether you’re a freelancer receiving international payments, a business paying global suppliers, or an individual seeking more efficient ways to send money across borders, USDT payment capabilities offer practical advantages over conventional payment methods.

What Is USDT (Tether)?

USDT, commonly known as Tether, is a stablecoin—a type of cryptocurrency designed to maintain a stable value by pegging to a reserve asset. Unlike Bitcoin or Ethereum, which experience significant price volatility, USDT maintains a 1:1 value ratio with the US dollar. This stability makes it suitable for transactions where price predictability matters, such as payments, remittances, and everyday purchases.

Tether Limited, the company behind USDT, issues tokens backed by reserves including cash, cash equivalents, and other assets intended to maintain the dollar peg. As of 2025, USDT operates on multiple blockchain networks including Ethereum (ERC-20), Tron (TRC-20), BSC (BEP-20), Polygon, Avalanche, and others. This multi-chain availability provides users with flexibility in choosing networks based on transaction speed and fee considerations.

The widespread adoption of USDT stems from its utility as a stable medium of exchange in the cryptocurrency ecosystem. Traders use it to move funds between exchanges without converting to fiat currency. Businesses accept it for payment to avoid volatility risk associated with other cryptocurrencies. Individuals hold it as a dollar-denominated asset accessible globally without traditional banking requirements.

Why USDT Has Become a Payment Standard

USDT’s growth as a payment method reflects several converging factors that make it increasingly practical for real-world transactions. Traditional cross-border payments through banks involve multiple intermediaries, each charging fees and adding processing time. A wire transfer from the US to Asia might cost $25-50 and take 2-5 business days. USDT transfers on efficient blockchain networks complete in minutes with fees typically under $1, regardless of transaction amount or destination.

The stablecoin’s 24/7 availability contrasts sharply with traditional banking infrastructure. Banks operate on business day schedules with weekend closures and holiday interruptions. USDT transactions process continuously, enabling payments whenever needed without waiting for banks to open. This proves particularly valuable for international transactions crossing time zones where traditional banking hours create coordination challenges.

Regulatory developments in 2024-2025 have clarified stablecoin frameworks in major jurisdictions, increasing institutional comfort with USDT for business transactions. Payment processors and merchant services increasingly support USDT acceptance, expanding practical use cases beyond cryptocurrency-native businesses. This infrastructure maturation has transformed USDT from a niche cryptocurrency tool into a viable payment rails alternative.

Understanding USDT Blockchain Networks

USDT’s multi-chain availability requires understanding which network to use for different payment scenarios. Each blockchain offers distinct characteristics affecting transaction speed, fees, and compatibility with various platforms and services.

| Network | Typical Fee | Speed | Best For |

|---|---|---|---|

| Ethereum (ERC-20) | $10-$30 | ~15 seconds | Large payments, DeFi integration |

| Tron (TRC-20) | Under $1 | ~3 seconds | Everyday payments, Asian markets |

| BSC (BEP-20) | $0.20-$0.50 | ~5 seconds | Binance ecosystem users |

| Polygon | Under $0.01 | ~2 seconds | Micro-payments, high frequency |

| Avalanche | $0.10-$0.50 | ~2 seconds | DeFi applications |

| Arbitrum/Optimism | $0.50-$2 | ~1 second | Ethereum Layer-2 users |

Network Selection Guide:

- For payments under $100: Use Tron or Polygon for minimal fees

- For payments over $1,000: Ethereum’s higher fees become negligible as a percentage

- For Asian transactions: TRC-20 is widely accepted by exchanges and platforms

- For DeFi integration: Ethereum and Polygon offer the most protocol compatibility

What You Need Before Making USDT Payments

Preparing to use USDT for payments requires establishing basic cryptocurrency infrastructure. The process is more straightforward than it might initially appear, particularly with modern user-friendly tools designed for mainstream users rather than technical specialists.

Self-Custodial Wallet

You’ll need a cryptocurrency wallet that supports USDT on your preferred blockchain network. Self-custodial wallets where you control private keys provide the greatest security and flexibility. Modern wallets like BenPay Wallet support multiple chains including Ethereum, Tron, BSC, Polygon, and others, allowing you to hold USDT across different networks in one interface. During wallet setup, you’ll receive a seed phrase—typically 12 or 24 words that serve as your master backup. Write this down physically and store it securely; never store it digitally or share it with anyone.

USDT Balance

You’ll need to acquire USDT before making payments. Most users purchase USDT through cryptocurrency exchanges by depositing fiat currency (via bank transfer or debit card) and exchanging it for USDT. Centralized exchanges like Binance, Coinbase, or Kraken offer straightforward purchasing. After purchasing, withdraw USDT to your self-custodial wallet rather than leaving it on the exchange—”not your keys, not your coins” remains sound advice. When withdrawing, carefully select the correct blockchain network; sending USDT via TRC-20 to an ERC-20 address can result in permanent loss.

Small Amount of Native Tokens for Gas Fees

Most blockchain networks require native tokens to pay transaction fees (gas). For Ethereum, you need ETH; for Tron, TRX; for BSC, BNB. The amounts are small—$5-10 worth typically covers dozens of transactions on efficient networks. Some advanced platforms eliminate this requirement by allowing gas payment in stablecoins, simplifying the user experience for those focused on payments rather than cryptocurrency trading.

Payment Card for Everyday Spending (Optional)

For using USDT in everyday transactions at traditional merchants, cryptocurrency payment cards convert your holdings into spendable funds at millions of locations worldwide. Rather than finding merchants who directly accept USDT, payment cards enable spending at any business accepting Visa or Mastercard. The card provider handles cryptocurrency-to-fiat conversion in the background, making the transaction identical to standard debit card usage from the merchant’s perspective.

Step-by-Step: How to Pay with USDT Using BenPay

We’ll use BenPay as a practical example of modern USDT payment infrastructure that addresses common friction points in cryptocurrency payments. The platform combines self-custodial wallet functionality with payment cards, DeFi integration, and multi-chain support in a unified ecosystem.

Step 1: Set Up Your BenPay Wallet

Download the BenPay mobile application from the App Store or Google Play Store. During installation, you’ll create a new wallet—the app generates your seed phrase which you must record and store securely. BenPay Wallet supports multiple chains including Ethereum, BSC, Polygon, Tron, and the BenFen blockchain, allowing you to manage USDT across different networks from one interface.

Complete the basic identity verification process. BenPay operates under a US MSB license (FinCEN Registration Number 31000260888727), requiring KYC compliance for payment card services. The verification typically involves submitting government ID and completing facial recognition—a standard process taking 5-15 minutes. While this requirement adds a step, it enables access to licensed payment services and provides regulatory protections not available through unregulated alternatives.

Step 2: Fund Your Wallet with USDT

Transfer USDT to your BenPay Wallet from wherever you currently hold it—a centralized exchange, another wallet, or received as payment. Within the app, navigate to the USDT token on your preferred network and copy your deposit address. Return to your source platform and initiate a withdrawal to this address, carefully verifying the address and selected network match.

For users starting with USDT on networks other than BenFen, BenPay’s cross-chain bridge enables transferring USDT from Ethereum, BSC, Polygon, and other supported chains to the BenFen blockchain. The bridge converts USDT 1:1 into BUSD (BenFen’s native USD-pegged stablecoin), typically completing within minutes. This conversion unlocks BenFen-specific benefits including extremely low transaction fees and the ability to pay gas fees in stablecoins rather than native tokens.

Step 3: Choose Your Payment Method

BenPay offers multiple ways to use your USDT for payments, each suited to different transaction types:

Direct Wallet-to-Wallet Transfers: For sending USDT to other cryptocurrency users, use the standard wallet send function. Enter the recipient’s wallet address, specify the amount, select the network (ensuring it matches what the recipient expects), review the transaction including estimated gas fees, and confirm. The recipient receives USDT directly to their wallet within minutes, at which point they control those funds and can use them however they choose.

Payment Card for Everyday Spending: The BenPay Card converts USDT into spendable funds at traditional merchants. Apply for a card through the mobile app—current promotional pricing sets opening fees at 9.9 BUSD. Choose from three tiers (Alpha, Sigma, Delta) based on your expected usage patterns. Once approved and activated, load the card with BUSD from your wallet balance. The card can be bound to Apple Pay, Google Pay, Alipay, or WeChat Pay for contactless payments, or used directly online and at physical terminals. When you make purchases, the card provider automatically converts the required amount from your BUSD balance to local currency at market rates, with the merchant receiving standard fiat payment.

Merchant Payments: For businesses accepting cryptocurrency payments through BenPay’s merchant services, you can pay directly from your wallet by scanning QR codes or entering payment requests. This method works particularly well for online purchases from cryptocurrency-friendly merchants or in-person transactions at businesses equipped to accept digital currency payments.

Step 4: Manage Transaction Fees

Understanding and optimizing transaction fees maximizes the value of USDT payments. For direct wallet transfers, fees vary dramatically by network—Ethereum mainnet might charge $5-20 during congestion, while Tron or Polygon typically charge under $1. For small payments, choose efficient networks even if they require bridging USDT first. The bridge fee plus lower transaction fee often costs less than a single Ethereum transaction.

For payment card transactions, fees depend on the card tier and merchant category. Review the fee schedule in your account settings—domestic purchases typically incur lower fees than international transactions, and certain merchant categories may carry premium rates. Factor these costs into your spending decisions, particularly for larger purchases where percentage-based fees become material.

Step 5: Track and Manage Your Spending

BenPay’s mobile app provides real-time balance tracking, transaction history, and spending analytics. You can set up notifications for transactions, monitor exactly where funds go, and maintain records for accounting or tax purposes. This visibility proves particularly valuable for businesses using USDT for operational expenses or freelancers tracking income and expenses across multiple currencies.

For users holding larger USDT balances, consider BenPay’s DeFi Earn feature which automatically deploys idle funds into yield-generating positions. Rather than leaving payment balances sitting unproductively, you can earn 3-5% annual yields on funds awaiting use. The platform charges a 15% fee on earned interest while imposing no fees on principal, and you can withdraw funds instantly when needed for payments. For a business maintaining $30,000 in payment balances, earning even 3% generates $900 annually—$765 after fees, compared to zero from traditional payment accounts.

Common USDT Payment Scenarios

Understanding how USDT payments work in specific contexts helps clarify when this payment method offers the most value compared to traditional alternatives.

| Scenario | Traditional Method | USDT Method | Savings |

|---|---|---|---|

| International Freelancer Payment | $30-40 wire fee + 3-5 days | Under $1 fee + minutes | $29-39 per transaction |

| E-Commerce Supplier Payment | Currency conversion + 2-4 days + fees both ends | Minimal fees + instant settlement | 2-5% of transaction value |

| Family Remittance ($500) | $15-35 (3-7%) + 1-3 days | Under $1 + immediate | $14-34 per remittance |

| International Subscription | 3% foreign transaction fee | No foreign fees | 3% monthly savings |

Real-World Examples

International Freelancer Payments: A developer in Vietnam receives project payments from a US client. Traditional wire transfers cost $30-40 and take 3-5 business days, with currency conversion fees reducing the received amount. Using USDT, the client sends payment directly to the developer’s wallet with fees under $1 and settlement in minutes. The developer can then either convert to local currency through local exchanges, spend directly through a crypto debit card, or use USDT for their own international payments.

E-Commerce Supplier Payments: An online retailer in Europe pays manufacturers in China for inventory. Traditional payment involves currency conversion from EUR to CNY, wire transfer fees on both ends, and 2-4 day settlement. USDT enables direct payment from the retailer’s wallet to the manufacturer’s wallet with minimal fees and instant settlement. Both parties avoid exposure to EUR/CNY exchange rate fluctuations by transacting in USD-pegged stablecoins.

Family Remittances: An immigrant worker in the UAE sends money to family in the Philippines. Traditional remittance services charge 3-7% in fees and take 1-3 days for funds to become available. Using USDT, the sender transfers funds directly to family members’ wallets with fees under $1 and immediate availability. For someone sending $500 monthly, the difference between 5% traditional fees ($25) and $1 USDT transfer fees adds up to $288 annual savings.

Optimizing USDT Payment Costs

Minimizing transaction costs maximizes the advantages USDT payments offer over traditional methods:

Network Selection Strategy:

- For payments under $100: Use Tron or Polygon (fees represent tiny fractions)

- For payments over $1,000: Ethereum’s higher fees become proportionally insignificant

- Calculate fees as percentages rather than absolute numbers

Batch Transactions: If you regularly pay the same recipient, consider batching multiple payments into larger, less frequent transfers. Instead of five $200 payments (5x transaction fees), send one $1,000 payment monthly. The recipient can hold USDT and manage their own cash flow while you optimize transaction costs.

Bridge Strategically: When using multi-chain platforms like BenPay, consider whether bridging to a more efficient chain saves money overall. If you hold USDT on Ethereum and plan multiple payments, bridging to BenFen or Polygon once and then making several low-cost transactions may cost less than paying high Ethereum fees repeatedly.

Off-Peak Timing: Some networks (particularly Ethereum) experience variable congestion throughout the day. Gas fees typically peak during US business hours when trading activity is highest. For non-urgent payments, checking fee levels and transacting during quieter periods can save meaningful amounts.

Security Best Practices for USDT Payments

USDT’s irreversibility and self-custodial nature require careful security practices. Unlike traditional payments where banks can reverse fraudulent transactions, cryptocurrency transfers cannot be undone once confirmed.

Essential Security Measures:

- Verify Addresses Carefully: Always verify recipient addresses character-by-character before confirming transactions. For large payments, send a small test transaction first to confirm the address works correctly.

- Secure Your Seed Phrase: Store your wallet’s seed phrase physically (written on paper or metal) in secure locations. Never store it digitally, never photograph it, and never share it with anyone. Anyone obtaining your seed phrase controls your assets permanently.

- Use Hardware Wallets for Large Holdings: For USDT holdings exceeding what you’re comfortable risking on a mobile device, consider hardware wallets that store private keys on dedicated secure devices.

- Enable Transaction Notifications: Configure your wallet to notify you immediately of all transactions. Quick detection limits exposure if unauthorized activity occurs.

- Be Wary of Phishing: Always verify you’re using official apps or websites. Check URLs carefully, download apps only from official stores, and be suspicious of unexpected emails or messages claiming to be from payment platforms.

Regulatory and Tax Considerations

USDT’s status as a dollar-pegged stablecoin doesn’t exempt it from cryptocurrency regulations and reporting requirements in most jurisdictions. Understanding compliance obligations helps avoid future complications.

Many countries classify cryptocurrency transactions—including USDT payments—as taxable events requiring record-keeping and reporting. Even stablecoin-to-stablecoin exchanges may trigger tax obligations depending on jurisdiction. Maintain transaction records including dates, amounts, purposes, and counterparties. Various cryptocurrency tax software tools can help track transactions and generate necessary reports for filing.

Businesses accepting USDT for goods or services typically must report this income in local currency equivalents based on market rates at receipt time. For companies regularly transacting in USDT, establishing accounting practices that track both cryptocurrency and fiat equivalents prevents year-end scrambling to reconstruct transaction histories. Consider consulting tax professionals familiar with cryptocurrency to ensure compliance specific to your jurisdiction and transaction patterns.

Platforms operating under proper licensing—like BenPay’s MSB registration—provide some regulatory clarity and consumer protections not available through unregulated alternatives. While this means complying with KYC requirements and transaction monitoring, it also means operating within established legal frameworks less likely to face sudden regulatory intervention disrupting service access.

The Future of USDT Payments

USDT payment adoption continues accelerating as infrastructure matures and use cases expand. Several trends suggest where this technology is heading over the next 12-24 months.

Merchant acceptance is expanding beyond cryptocurrency-native businesses into mainstream retail and e-commerce. Payment processors increasingly offer USDT acceptance as a standard option alongside traditional payment methods. As merchants discover lower fees and faster settlement compared to credit cards, particularly for international transactions, USDT adoption could accelerate similar to how digital wallets like Apple Pay gained mainstream acceptance.

Integration with traditional finance continues deepening. Banks in some jurisdictions now offer USDT-backed accounts and services. Payment cards converting cryptocurrency to fiat at point of sale have evolved from niche products to serious payment infrastructure. This hybrid approach—cryptocurrency-backed but fiat-settled—makes digital currency payments practical without requiring merchant adoption of cryptocurrency directly.

Regulatory frameworks are clarifying, particularly around stablecoins where price stability reduces some risks associated with volatile cryptocurrencies. Clear regulations tend to increase institutional adoption as compliance requirements become knowable and manageable. Major financial institutions are exploring stablecoin solutions, suggesting eventual convergence between traditional and cryptocurrency payment systems.

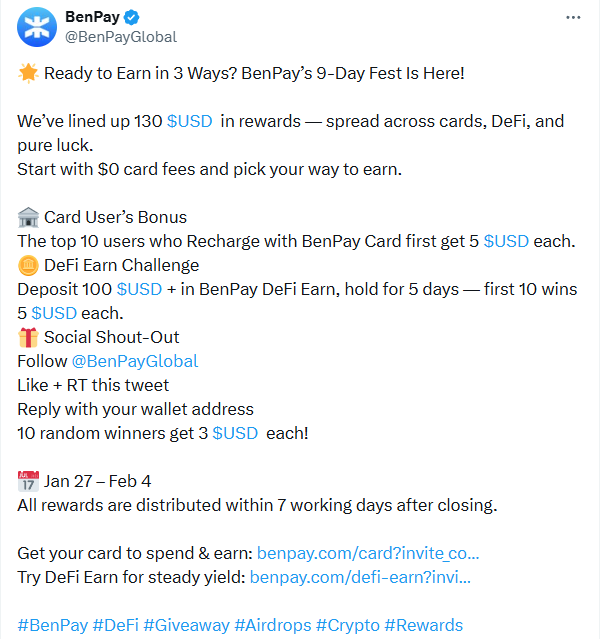

Join the BenPay Community

Stay informed about USDT payment innovations and best practices through BenPay’s community channels. Follow @BenPayGlobal on X for platform updates, integration announcements, and educational content. Recent initiatives have included reward programs for early adopters and community education about optimizing cross-border cryptocurrency payments.

The official Telegram community provides direct access to support teams and other users navigating similar payment scenarios. For detailed platform updates and in-depth guides, visit the BenPay blog which regularly publishes content covering everything from technical architecture to practical payment optimization strategies.

Conclusion: Making USDT Payments Practical

USDT has matured from a cryptocurrency trading tool into viable payment infrastructure for real-world transactions. Understanding how to use USDT for payments—from wallet setup through transaction execution to fee optimization—empowers users to access advantages including lower costs, faster settlement, and global accessibility operating beyond traditional banking limitations.

The key to practical USDT payment usage involves selecting appropriate tools for your specific needs. Platforms like BenPay that integrate self-custodial wallets with payment cards, multi-chain support, and DeFi capabilities provide comprehensive solutions addressing common friction points. Rather than cobbling together separate services for different functions, integrated platforms enable seamless movement between holding, earning, and spending USDT.

As adoption continues expanding and infrastructure continues maturing, USDT payments will likely become increasingly mainstream. The fundamental advantages—instant settlement, minimal fees, global accessibility—remain compelling regardless of temporary market conditions or regulatory uncertainty. Users who develop proficiency with USDT payments now position themselves advantageously for financial infrastructure that will likely become increasingly important in coming years.

Whether you’re an individual seeking more efficient international transfers, a freelancer receiving cross-border payments, or a business optimizing supplier payment processes, USDT offers practical alternatives to traditional payment methods. The learning curve exists but is manageable with proper guidance and appropriate tools. Start with small transactions, verify you understand the mechanics, then gradually increase usage based on your specific payment needs and comfort level.

Frequently Asked Questions

1.Best DeFi Platform to Earn Passive Income on Stablecoins in 2026

2.Easiest DeFi Yield Platforms with Simple UI and One-Click Investment

3.Which DeFi Platforms Offer Safe 10-20% APY on Stablecoins Without Complex Setup?

4.Which Multi-Chain DeFi Yield Aggregators Can Automatically Find the Best Stablecoin APY?

5.Simple DeFi Yield Aggregators for Beginners: Understanding Risks and Making Safe Choices