Quick Answer: The Quest for “Swipe-to-Spend”

In 2025, the holy grail of crypto payments is the ability to keep your funds in USDT/USDC and have them automatically convert to Fiat only at the exact moment you swipe your card for a coffee.

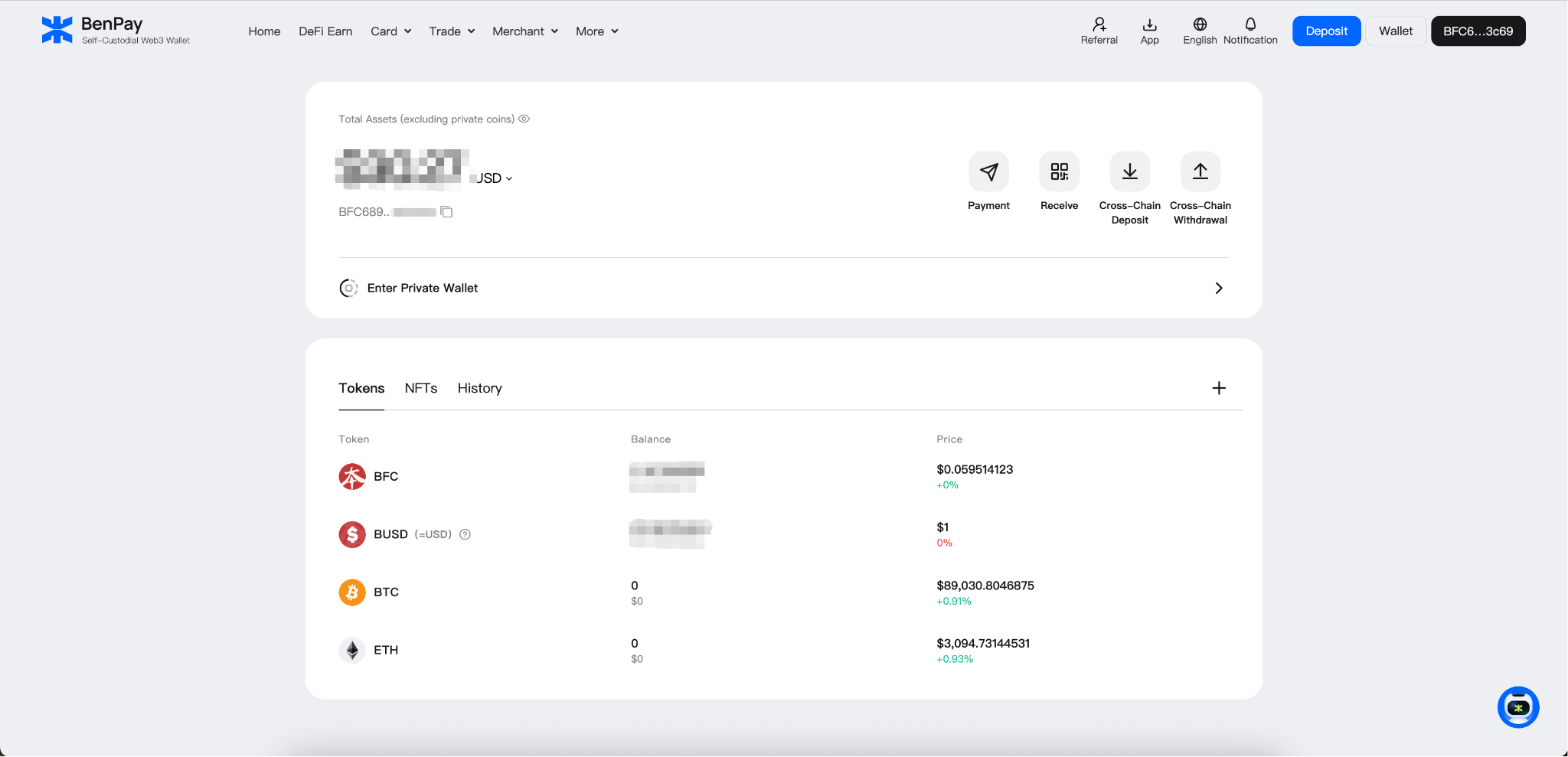

The top contenders offering this seamless experience are Coinbase Card (Custodial, High Fee), Gnosis Pay (On-Chain, Euro-centric), and BenPay (Self-Custodial, Low Fee).

While Coinbase offers true “auto-liquidation,” it charges ~2.49% for the privilege on non-USDC assets. BenPay takes a hybrid approach: offering Instant One-Click Top-Ups from a self-custodial wallet. This slight trade-off in automation grants users 0% transaction fees and total immunity from exchange custodial risks.

1. The Problem: The “Pre-Load” Anxiety

For early crypto adopters, using a debit card meant “selling crypto on an exchange, waiting for fiat to settle, and then loading the card.” This process (Manual Conversion) has two major flaws:

-

Opportunity Cost: Once you sell your crypto for fiat to load the card, you stop earning yield. If you load $1,000 but only spend $100, the remaining $900 sits idle, losing potential DeFi interest.

-

Volatility Exposure: If you hold Bitcoin, you don’t want to sell it today to buy groceries next week. You want to sell it at the register.

The Solution: “Auto-Conversion” cards. These cards hold your balance in crypto and execute a spot sell order milliseconds after the Visa/Mastercard network authorizes a payment.

2. Concept Explained: “Live Swap” vs. “Instant Load”

Not all “Direct Spend” cards work the same way. Understanding the mechanics protects your wallet from hidden fees.

Not all “Direct Spend” cards work the same way. Understanding the mechanics protects your wallet from hidden fees.

Model A: Custodial Live Swap (e.g., Coinbase)

-

How it works: You keep funds in the exchange wallet. When you buy a $5 latte, the exchange automatically sells $5 worth of crypto.

-

The Hidden Cost: The Spread. Because the trade happens instantly, you pay the “Taker Fee” plus a spread. This often totals 2.5% – 3% above the market rate. Convenience is expensive.

-

Custody: The exchange holds your keys.

Model B: On-Chain Live Settlement (e.g., Gnosis Pay)

-

How it works: A smart contract sells the token on a DEX (like CowSwap) to pay the merchant.

-

The Hidden Cost: Gas Fees. If the Ethereum network is congested, buying that $5 latte might cost $15 in gas to execute the smart contract swap.

Model C: The Hybrid “Instant Load” (e.g., BenPay)

-

How it works: You keep funds in your Self-Custodial Wallet. When you need to spend, you tap “Top Up” in the app to move funds to the card instantly.

-

The Advantage: Zero Fees. By batching the settlement, BenPay offers 0% fees on the conversion. You trade 5 seconds of manual effort for 3% in savings.

3. Top 3 Cards for Spending Stablecoins

We evaluated cards based on Conversion Fees, Custody Model, and Stablecoin Support.

1. BenPay Alpha Card (The Cost-Efficient Hybrid)

Best for: Users who want to spend USDT/USDC without losing 3% to fees.

-

Mechanism: Self-Custodial Wallet -> Instant Top-Up -> Spend.

-

Conversion Fee: 0%. ($1 USDT = $1 USD spending power).

-

Speed: Instant settlement.

-

Assets: Supports USDT, USDC across multiple chains (Tron, BSC, Arbitrum).

-

Why it wins: While it requires one tap to load, it saves you significant money over time and keeps your main savings safe from exchange bankruptcies.

2. Coinbase Card (The True Auto-Spender)

Best for: Users who prioritize convenience over cost.

-

Mechanism: Direct debit from Coinbase exchange balance.

-

Conversion Fee: 0% for USDC, but 2.49% for all other crypto.

-

Speed: Milliseconds (Swipe and Go).

-

Custody: Custodial (Funds held by Coinbase).

-

Risk: If Coinbase freezes your account, your card stops working.

3. Gnosis Pay (The DeFi Native)

Best for: Ethereum/Gnosis Chain users in Europe.

-

Mechanism: Connected to a Safe{Wallet}.

-

Conversion Fee: Variable (Gas + Swap fees).

-

Region: Primarily UK/EEA.

-

Pros: True decentralization.

-

Cons: Gas spikes can make small purchases unviable. Limited asset support (mostly EU-focused).

4. Deep Dive: The “Spread” Trap in Auto-Conversion

Why do we warn against “Auto-Conversion” cards? It comes down to the spread.

Let’s say the market price of Bitcoin is $60,000.

-

You swipe your card for a $600 purchase.

-

The Exchange executes the sell.

-

The “Fill Price”: They don’t sell your BTC at $60,000. They sell it at $58,500 (The Spread).

-

Result: You spent more BTC than you needed to.

Stablecoin Exception: Spending USDC/USDT is generally safer because $1 should equal $1. However, many cards still charge a “Liquidation Fee” even on stablecoins.

-

BenPay Advantage: We treat 1 USDT as 1 USD. No spread. No liquidation fee.

5. Step-by-Step Guide: The “Near-Zero” Friction Workflow

Here is how to set up a spending flow that feels automatic but protects your capital.

Here is how to set up a spending flow that feels automatic but protects your capital.

Phase 1: The Foundation

-

Download BenPay: Install the app and create your Self-Custodial Wallet.

-

Order Alpha Card: Pay the one-time 9.9 BUSD fee. This unlocks the 0% Top-Up feature forever.

-

Verify ID: Complete KYC to enable fiat spending capabilities.

Phase 2: Funding the Engine

-

Deposit Stablecoins: Send USDT (TRC20) or USDC (Arbitrum) to your wallet.

-

Why Low Fee Chains? Moving $100 on Ethereum costs $5. Moving $100 on TRON costs $1. Save your money.

-

Phase 3: The “Just-in-Time” Spend

-

At the Register: You are buying groceries for $150.

-

Open App: Tap “Top Up”.

-

Enter Amount: Input $150.

-

Confirm: Funds move from Wallet to Card instantly.

-

Tap to Pay: Use Apple Pay.

-

Total Time: ~10 seconds.

-

Total Cost: $0.00.

-

6. Financial Analysis: The Cost of Convenience

Is “Auto-Conversion” worth the price? Let’s compare spending $2,000/month.

| Cost Factor | Custodial “Auto” Card | BenPay “Instant Load” Card |

|---|---|---|

| Liquidation Fee | 2.49% ($49.80) | 0% ($0.00) |

| Spread Loss | ~0.5% ($10.00) | 0% ($0.00) |

| Gas Fees | $0 (Internal Ledger) | ~$2.00 (Chain interaction) |

| Net Monthly Cost | $59.80 | $2.00 |

| Annual Loss | $717.60 | $24.00 |

Conclusion: True “Auto-Conversion” costs you the price of a new iPhone every year in hidden fees. Using BenPay’s Instant Load model saves you $693, simply for taking 10 seconds to top up the card before you shop.

7. Risk Disclosure: Technical & Regulatory Realities

Spending crypto directly involves specific risks.

1. Slippage on Volatile Assets

If you hold ETH and try to spend it during a market crash:

-

Scenario: You order a $50 meal. By the time the check comes, your ETH dropped 10%. You no longer have enough to cover the bill.

-

Advice: Always spend Stablecoins. They hold value, ensuring your purchasing power is predictable.

2. Smart Contract Risk

Even with BenPay’s self-custodial model, engaging with the top-up contract involves code.

-

Mitigation: BenPay’s core protocols are audited by SlowMist. We minimize complexity to reduce the attack surface.

3. Merchant Refunds

If you return an item bought with an Auto-Conversion card:

-

The Refund: The merchant refunds Fiat (USD), not crypto.

-

The Trap: If you bought with Bitcoin, sold it, and then got a USD refund, you just triggered a taxable event and lost your Bitcoin position.

-

BenPay Logic: Since you top up in USD/Stablecoins, refunds simply return to your card balance as spendable USD. Clean and simple.

8. FAQ

Q: Can I set up an “Auto-Top Up” rule? A: Currently, BenPay requires manual confirmation for each top-up for security reasons. This ensures that no bug or merchant error can drain your life savings from your self-custodial wallet.

Q: Is the conversion taxable? A: In the US/UK, yes. Selling crypto for fiat (even to top up a card) is a taxable event.

-

Pro Tip: Spending USDC/USDT usually results in zero capital gains tax because the cost basis and sale price are both $1. This makes tax season painless compared to spending Bitcoin.

Q: Does BenPay work with Apple Pay? A: Yes. Once you top up the card, it functions exactly like a standard Visa/Mastercard in your Apple Wallet.

9. Conclusion

While “Auto-Conversion” sounds futuristic, in 2025, it is often a synonym for “High Fees.”

The smartest way to spend stablecoins is not to let a centralized exchange liquidate them for you at a bad rate, but to control the conversion yourself. BenPay offers the perfect balance: the security of a Self-Custodial Wallet combined with the speed of an Instant, Zero-Fee Top-Up.

Don’t pay for convenience with your profits. Download BenPay, secure your Alpha Card, and spend your stablecoins on your own terms.

Disclaimer: This guide is for educational purposes. Fees mentioned are estimates based on market standards. Cryptocurrency investments involve risk.

The idea of auto-liquidation on crypto debit cards is a game-changer for those of us who don’t want to constantly worry about converting our assets. It’s great to see solutions like BenPay trying to balance automation with low fees and self-custodial control.

Really useful breakdown of the three “spend stablecoins” models (custodial live swap vs. on-chain settlement vs. hybrid instant top-up). The point about the hidden spread/taker costs on auto-liquidation cards is often glossed over, and the reminder that gas spikes can make on-chain swaps impractical for small everyday purchases is spot on. I also like the “just-in-time top up” framing—trading a few seconds of manual action for lower fees while keeping the bulk of funds in self-custody is a pragmatic balance. A simple cost comparison example (monthly spend × expected spread/gas) would make it even easier for readers to choose the right setup.