Entering 2026, the role of stablecoins in the crypto financial system is undergoing a fundamental shift. They are no longer merely “assets sitting in wallets” but are truly entering high-frequency financial scenarios such as payments, settlements, and yield management.

A clear trend is emerging: users are no longer satisfied with “spendable stablecoins.” Instead, they want their funds to remain “instantly usable” while continuously generating returns.

It is against this backdrop that the deep integration of U Cards (Crypto Payment Cards) with DeFi is accelerating, giving rise to a brand-new product form — the On-Chain Yield Card.

Structural Bottlenecks of Traditional U Cards/Crypto Cards: Funds Go “Idle” Once Recharged

In the current market, the logic of most crypto U Cards remains stuck in the “recharge → spend” model:

- Stablecoins are recharged into the card account.

- They wait to be spent via card swipes or online payments.

- During the unspent period, the funds generate zero yield.

This means that the card account balance is essentially a zero-interest asset until it is spent.

Even for users familiar with DeFi yield farming, the process typically requires:

- Manually transferring funds out of the card account.

- Cross-chain bridging, swapping, and redepositing into yield protocols.

- Reversing the process (redeem → recharge) before making a purchase.

The fragmented workflow and high costs keep “payment accounts” and “yield accounts” separated for extended periods.

DeFi × U Card: Payment Accounts Now Gain On-Chain Yield Capabilities

As DeFi protocols mature and stablecoin yield models become more stable, a new architecture is taking shape: embedding the DeFi yield layer directly into the U Card account itself, turning the “payment account” into a simultaneous “on-chain yield account.”In this model, the card account balance is no longer static storage but exists in two states:

- Spendable state: Available for everyday payments, remaining instantly accessible.

- Auto-yield state: When unused, it automatically participates in on-chain yield strategies.

The entire process is seamless for users — no need to understand complex protocols or perform frequent manual operations.

Industry Trend: Sustainable Utility Value of Stablecoins + DeFi

On Google and X platforms, user hotspots have shifted from “high-APY farming” to:

- How to achieve stable, sustainable on-chain yields while maintaining fund liquidity.

- Multi-chain yield strategy aggregation products.

- Seamless integration of U Cards with DeFi.

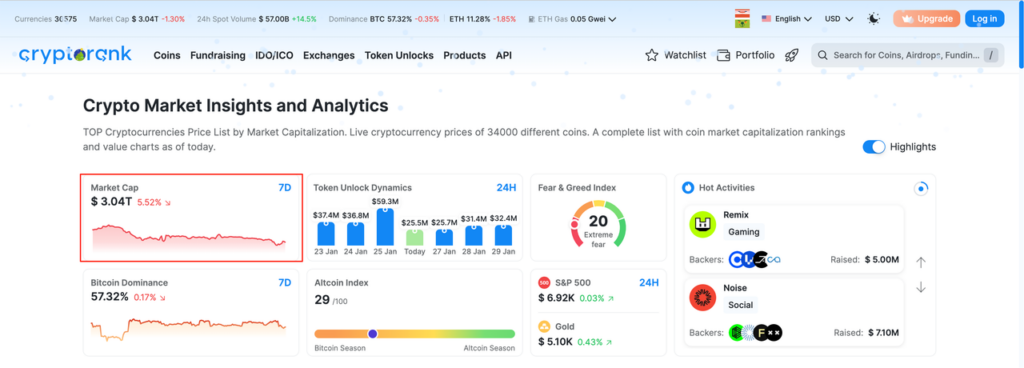

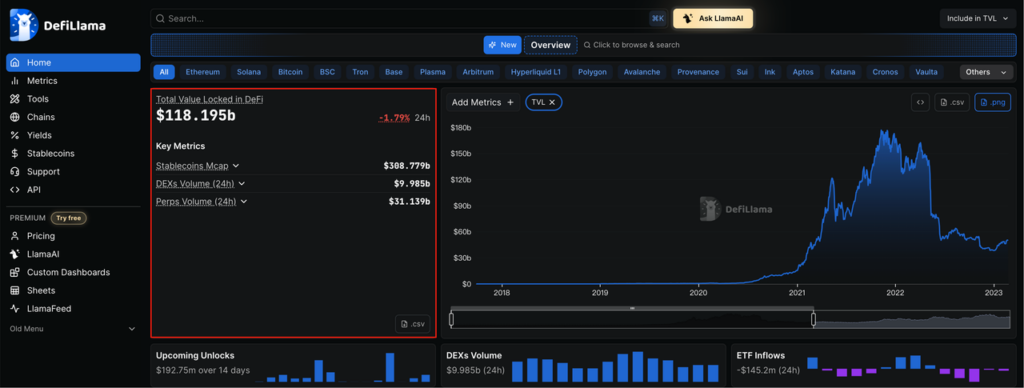

According to market data from CryptoRank and DeFiLlama, the global stablecoin market cap has surpassed $3 trillion, while DeFi TVL (Total Value Locked) ranges between $100–150 billion. The trend indicates that payment + DeFi integration is becoming mainstream, with BenPay’s On-Chain Yield Card serving as a concrete realization of this direction.

(Source: CryptoRank)

(Source: DeFiLlama)

BenPay On-Chain Yield Card: U Card + DeFi Integration Mechanism

The BenPay On-Chain Yield Card is more than just a regular crypto payment card—it’s a deep fusion of payment functionality and DeFi yield generation. As the U Card + DeFi Earn solution on the BenFen public chain, BenPay Card is fully incubated by Bixin Ventures. By the end of 2025, after BenPay launched its DeFi Earn feature, it rapidly surpassed $20 million in TVL. Unlike centralized asset management, the yields from BenPay’s On-Chain Yield Card are generated by verifiable on-chain DeFi protocols, with users always retaining full control over their assets.

Core Functions: Spend While Earning

- Intelligent Balance Management

- The card account balance automatically switches between “spendable state” and “auto-yield state.”

- Instant redemption occurs during spending.

- Multi-Chain Blue-Chip Protocol

- Card account balances access to the BenPay DeFi Earn protocol directly, supporting cross-chain liquidity.

- Investments flow into top-tier blue-chip protocols such as Aave, Solana, Compound, Morpho, Ethena, Sky, etc.

- High-risk long-tail assets are filtered out to ensure stable value appreciation.

- Ultra-Simple Interaction with Automatic Compounding

- Supports quick wallet creation via Google/Apple accounts and one-click investment.

- Yields automatically roll into principal with zero-gas reinvestment.

- Allows redemption anytime to maximize capital efficiency.

User Experience Advantages:

- Zero-Threshold Application: Apply online with a valid ID—no pre-deposit or token staking required.

- Self-Custody of Funds: Users hold their private keys; smart contracts audited by SlowMist for asset and data security.

- Multi-Chain Top-Up & Withdrawal: Supports direct USDT/USDC cross-chain deposits and withdrawals, compatible with over ten major chains, including Ethereum, Solana, Tron, BSC, Polygon, Arbitrum, etc.

- Flexible Multi-Card Options: Alpha Card with 0 recharge fees, Delta Card with 0 monthly fees, Sigma Card optimized for high-value cross-border payments.

- Balance Yield Generation: After users actively enable yield mode, card account balances automatically participate in the BenPay DeFi Earn protocol, delivering 3%-15% annualized yields.

- High-Limit Global Spending: Single-card limits starting at $200,000+, supporting Apple Pay, Google Pay, Alipay, WeChat Pay, and more.

By integrating the above-mentioned functions and experiences, BenPay has achieved “zero idle funds”, and users can also add value to their daily payments.

Say Goodbye to Idle Funds—Payment Balances Automatically Generate Yield

The biggest pain point of traditional crypto U Cards has been solved: recharged funds are no longer “dead money” waiting to be spent. Through BenPay’s innovative architecture, every stablecoin intelligently switches between two states:

- Spendable state: Maintains the liquidity needed for daily payments.

- Auto yield-generating state: Real-time participation in DeFi protocols to earn yields.

The switching is fully automated. When making a purchase, you can redeem the balance on your card at any time for payment without the need for frequent manual operations.

BenPay On-Chain Yield Card FAQ

- What is an On-Chain Yield Card? An On-Chain Yield Card is a product that fuses crypto payment cards with DeFi yield protocols, allowing card account balances to automatically participate in on-chain yield generation when unspent, with instant redemption during consumption—achieving “spend while earning.”

- What’s the difference between an On-Chain Yield Card and a regular crypto U Card? Regular U Cards are purely for payments, with balances generating no yield. On-Chain Yield Cards turn the payment account into one with on-chain yield capabilities, eliminating idle funds.

- Where do the yields for the On-Chain Yield Card come from? Yields come from publicly verifiable DeFi protocols such as Aave, Compound, Morpho, Sky, Ethena, etc., primarily from stablecoin lending interest and protocol rates.

- Is the On-Chain Yield Card safe? Security depends on self-custody, protocol transparency, and controllable risks. BenPay’s On-Chain Yield Card combines user-held private keys with blue-chip protocols, offering a clear and low-risk structure.

Summary

As stablecoins begin to serve dual roles as both “payment medium” and “yield asset,” products like BenPay’s On-Chain Yield Card—which deeply integrates U Cards/crypto payment cards with DeFi Earn—are becoming a typical representation of stablecoin utility and yield in 2026.

Start Your Earning Journey – Download BenPay and Make Your Idle Funds Earn While You Spend!

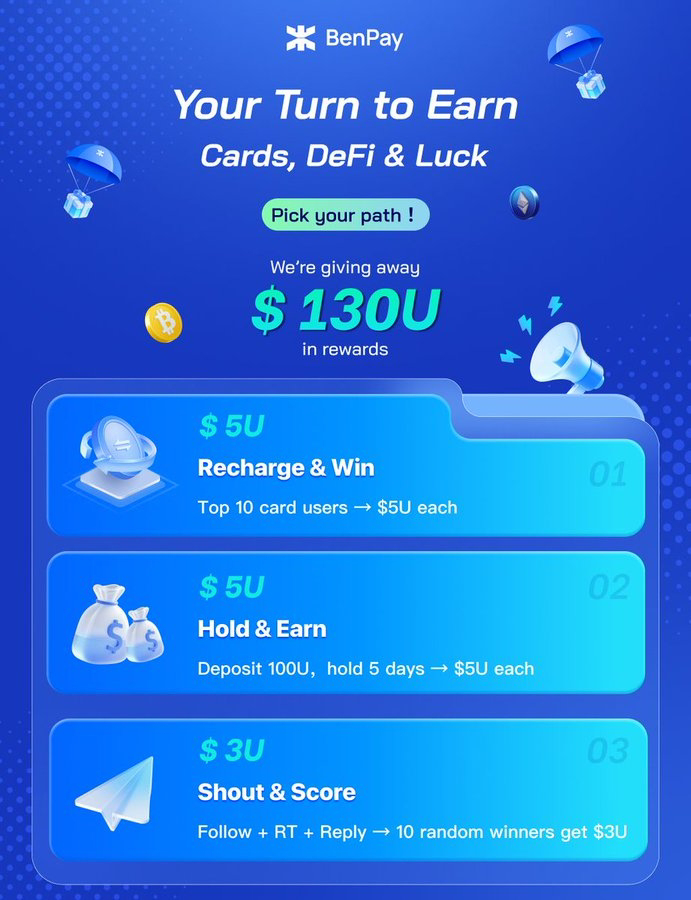

To enable new users to earn additional income while experiencing “earning while you spend”, BenPay has launched a limited-time promotion:

BenPay 9-Day Fest: Extra Rewards for Card & DeFi Users

1. Card User Bonus The top 10 BenPay Card users with the highest recharge amounts will receive $5U each.

2. DeFi Earn Challenge The first 10 users who deposit 100U+ into BenPay DeFi Earn and hold for 5 days will receive $5U each.

3. Social Engagement Reward Follow BenPay’s official Twitter @BenPayGlobal, like and retweet the event post, and comment with your wallet address. 10 random users will receive $3U each.

Event Period: Jan 27 – Feb 5. Rewards will be distributed within 7 working days after the event ends.

Join now via the official links:

- Get your On-Chain Yield Card: BenPay Card

- Try DeFi Earn for steady yield: BenPay DeFi Earn

Risk Disclaimer: Know Before You Earn

Yields from the BenPay On-Chain Yield Card come from DeFi protocols and fluctuate with market supply and demand—they are not fixed or risk-free. Even mainstream blue-chip protocols carry smart contracts and systemic risks. BenPay mitigates overall risk through self-custody architecture and diversified multi-protocol allocation, but users should use the yield feature responsibly based on their own risk tolerance.