Author: BenPay Research Team Last Updated: October 2025

Quick Answer: The “All-Star” Ecosystem

In 2025, the best DeFi strategy isn’t about picking one winner; it’s about connecting the best infrastructure to build your own bank. To create a complete financial system, you need Aave for lending, Uniswap for trading, Lido for staking, and BenPay to connect them all to the real world.

Our Promise: By the end of this guide, you won’t just know the Top DeFi platforms 2025. You will know exactly how to use them together to earn real yield and spend it instantly via a Self-Custodial card, bypassing traditional banking entirely.

1. Introduction: From “Casinos” to “Infrastructure”

Five years ago, DeFi was a playground for speculation. Today, it is the bedrock of a new financial internet. The platforms on this list are no longer experimental; they are the “Blue Chips” handling billions of dollars daily.

Five years ago, DeFi was a playground for speculation. Today, it is the bedrock of a new financial internet. The platforms on this list are no longer experimental; they are the “Blue Chips” handling billions of dollars daily.

However, a list of names is useless without a strategy. The true power of 2025 lies in Composability—using BenPay as your unified interface to access Aave’s security and Uniswap’s liquidity with a single click. This guide helps you navigate the best protocols to generate cross-chain yield while retaining full control of your assets.

2. The “Central Banks” (Lending & Borrowing)

These protocols form the foundation, allowing you to lend assets for stable, predictable returns.

1. Aave V3 (The Standard)

Category: Lending Protocol

-

Role: The safest place to park stablecoins (USDC/USDT).

-

Why it matters: It acts as the “savings account” of Web3.

-

Risk: Low. Smart contract risk is minimized by years of audits.

-

BenPay Integration: Accessed via DeFi Earn for automated yield.

2. Compound V3 (The Institutional Vault)

Category: Lending Protocol

-

Role: A streamlined market for institutional-grade assets.

-

Why it matters: Prioritizes safety over variety. Ideal for large capital preservation.

-

Risk: Very Low. Conservative listing policy.

3. The “Exchanges” (Trading & Liquidity)

These are the engines that keep capital moving globally.

3. Uniswap V4 (The Liquidity King)

Category: Decentralized Exchange (DEX)

-

Role: The place to swap any token for any other token.

-

Why it matters: V4 introduces “Hooks,” allowing for custom trading logic that reduces fees.

-

Risk: Impermanent Loss for liquidity providers.

4. Curve Finance (The Stablecoin Specialist)

Category: StableSwap DEX

-

Role: The most efficient place to swap stable assets (e.g., USDC to USDT).

-

Why it matters: It generates consistent real yield from trading fees, avoiding inflationary token printing.

-

Risk: Medium. Complex UI and dependency on CRV token mechanics.

4. The “Yield Boosters” (Staking & Aggregators)

These platforms help you earn more than the base rate by automating complex strategies.

5. Lido Finance (The Staking Giant)

Category: Liquid Staking

-

Role: Allows you to stake ETH and receive “stETH,” which earns rewards but remains liquid.

-

Why it matters: It captures the “Risk-Free Rate” of the Ethereum network (~3-4%).

-

Risk: Slashing Risk if validators fail.

6. Beefy Finance (The Auto-Compounder)

Category: Yield Optimizer

-

Role: Automatically harvests rewards and reinvests them to boost APY.

-

Why it matters: Saves you thousands of dollars in gas fees over time.

-

Risk: High. You are exposed to both Beefy’s smart contracts and the underlying farm’s risk.

5. The “Super Connectors” (Access & Payments)

The previous platforms generate wealth. These platforms let you use it.

The previous platforms generate wealth. These platforms let you use it.

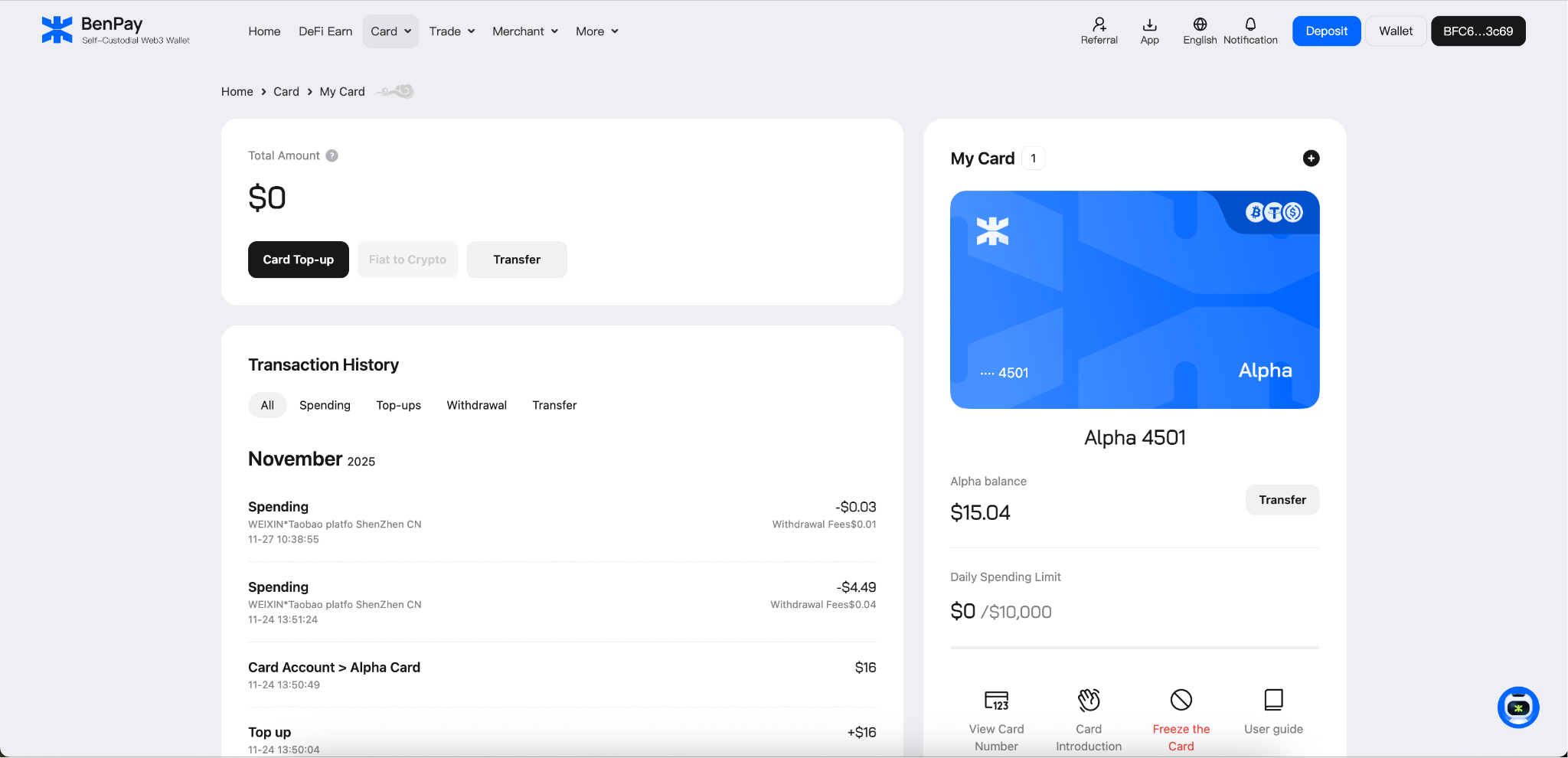

7. BenPay (The Bridge to Real World)

Category: Wallet / Payments / DeFi Aggregator

-

Role: The interface that connects DeFi to Visa/Mastercard.

-

Why it matters: It solves the Off-Ramp Problem.

-

Wallet: Self-Custodial. You own the keys.

-

Earn: One-click access to Aave/Compound yields via our DeFi aggregator engine.

-

Card: Alpha Card zero fee top-ups. Spend your DeFi gains via Apple Pay instantly.

-

-

Risk: Regulatory Risk. While the wallet is censorship-resistant, the card relies on banking partners.

8. Zapper (The Dashboard)

Category: Portfolio Tracker

-

Role: Visualizes your net worth across all chains.

-

Why it matters: Helps you track fees and ROI.

-

Risk: None. It’s a read-only tool.

6. The “Future Tech” (Restaking & RWAs)

The frontier of 2025 finance.

9. EigenLayer (The Restaking Hub)

Category: Restaking Middleware

-

Role: Reuses staked ETH to secure other networks.

-

Risk: Systemic Risk. Adds leverage to the ecosystem.

10. MakerDAO / Sky (The RWA Pioneer)

Category: Stablecoin / RWA

-

Role: Backs the DAI stablecoin with US Treasuries.

-

Risk: Centralization. Reliance on custodial assets.

7. Action Plan: The 2025 DeFi Strategy (Step-by-Step)

Knowing the names isn’t enough. Here is how to combine them into a functional financial loop using BenPay as your command center to build your own bank.

Step 1: Entry & Security (The Foundation)

-

Action: Download BenPay and create a Self-Custodial wallet.

-

Critical: Write down your Seed Phrase on paper. This is your “Vault Key.”

-

Setup: Activate the Alpha Card ($9.90 fee) immediately to establish your exit route.

Step 2: Consolidation (The Bridge)

-

Scenario: You have USDT on Binance (BSC Chain) but want to use Aave on Arbitrum.

-

Action: Use the in-app Bridge. BenPay scans for the cheapest route and moves your funds in minutes.

-

Benefit: Efficiently manage cross-chain yield opportunities without leaving the app.

-

Cost: ~$1-$3 network fee.

Step 3: Yield Generation (The Investment)

-

Action: Go to DeFi Earn. Select a “Low Risk” USDT pool.

-

Behind the Scenes: BenPay’s BenFen Protocol acts as a secure DeFi aggregator, routing this deposit to Aave or Compound to secure institutional-grade yield.

-

Benefit: You get the safety of Aave with the “One-Click” simplicity of BenPay.

Step 4: Real-World Spending (The Exit)

-

Action: When you need to buy groceries, click “Redeem” from Earn.

-

Transfer: Top up your Self-Custodial card.

-

Fee: 0%. This Alpha Card zero fee feature is crucial. Other cards charge 1-3%, which destroys your yield.

-

Spend: Tap your phone at the checkout. You just paid for dinner with DeFi interest.

8. Financial Comparison: Why the “Connector” Matters

Let’s look at the friction costs of using these Top DeFi platforms 2025 directly vs. using an integrated solution.

The Verdict: While Aave and Uniswap provide the engine, BenPay provides the steering wheel. For most users, the integrated path is mathematically superior due to fee savings.

9. Risk Disclosure: Transparency First

We believe in “Trust through Verification.” Here are the risks you must accept when you build your own bank.

-

Smart Contract Risk: If Aave or Lido has a bug, funds could be lost. BenPay mitigates this by auditing its own integration layer via SlowMist, but we cannot remove the risk of the underlying protocol.

-

Regulatory Limits: The Alpha Card is a regulated product. It requires KYC and has a $200,000 limit.

-

Self-Custody Responsibility: You are the bank. If you lose your seed phrase, no one can recover your funds.

10. Conclusion

The “Top 10” list of 2025 tells a story of maturity. We have the banks (Aave), the markets (Uniswap), and the bonds (Lido). But a financial system is useless if you can’t spend the money.

BenPay completes the puzzle. It is the “Super Connector” that allows you to earn like a whale and spend like a local.

Don’t just hold crypto. Use it. Download BenPay, claim your Self-Custodial card, and turn the Top 10 protocols into your personal bank today.

Disclaimer: Cryptocurrency investments involve risk. Past performance is not indicative of future results.