Quick Answer: The Rise of “Chain Abstraction”

Yes, in 2025, the “One-Click” dream is becoming reality thanks to Chain Abstraction. You no longer need to manually bridge funds from Ethereum to Arbitrum to Optimism just to chase a yield.

The best platforms offering this unified experience are BenPay (for a complete Wallet-to-Card ecosystem), Beefy Finance (for yield optimization), and Zapper (for portfolio tracking). Among these, BenPay offers the most seamless “Deposit-to-Spend” loop, allowing you to access multi-chain yields and spend them via a 0% fee crypto card without ever worrying about which blockchain you are on.

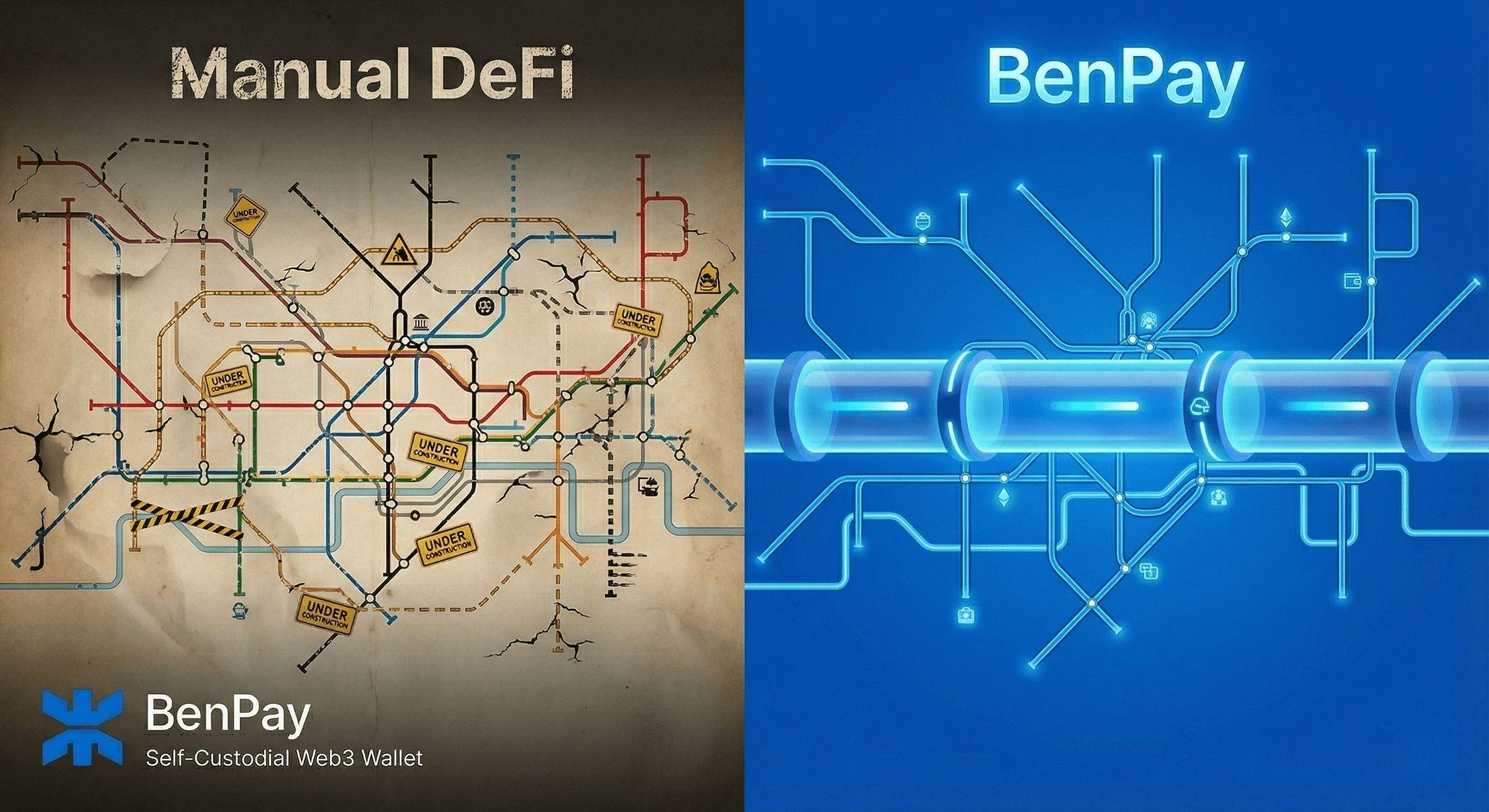

1. Introduction: The “Chain Wars” Nightmare

To appreciate the “One-Click” solution, we must first acknowledge the mess we are in. The crypto landscape is fragmented into islands.

The Old Way (The “Multi-Click” Nightmare)

Imagine you have USDT on the BNB Chain, but the high-yield opportunity (15% APY) is on Arbitrum. To get there, you typically face a 10-step obstacle course:

-

Find a bridge dApp.

-

Approve USDT spend (Gas Fee).

-

Bridge funds (Wait 15 mins).

-

Switch network in MetaMask.

-

Claim bridged funds (Gas Fee).

-

Go to a DEX to swap for the right token (Slippage).

-

Go to the lending protocol.

-

Approve spend again (Gas Fee).

-

Deposit.

This is not finance; it is manual labor.

The New Way (The “One-Click” Solution)

Platforms like BenPay use Smart Routing and Liquidity Aggregation. You see “15% Yield.” You click “Deposit.” The app handles the bridging, swapping, and staking in the background.

2. Platform Comparison: Who Solves Fragmentation Best?

We evaluated the top contenders based on Friction Reduction, Chain Support, and Exit Utility.

We evaluated the top contenders based on Friction Reduction, Chain Support, and Exit Utility.

1. BenPay: The “Super App” Approach

Best for: Users who want the complexity of blockchains hidden behind a simple UI.

BenPay treats blockchains like backend servers—users shouldn’t need to know which one they are using.

-

The Bridge: Integrated directly into the wallet. It scans for the cheapest route (e.g., via LayerZero or Stargate) automatically.

-

The Yield: The DeFi Earn module aggregates pools from TRON, BSC, and Ethereum Layer-2s.

-

The Exit: This is unique. Regardless of which chain your yield comes from, it all aggregates into one balance that can be loaded onto the Alpha Card for instant spending.

-

Trust: Registered as a US FinCEN MSB, adding regulatory stability to the wild west of cross-chain DeFi.

2. Beefy Finance: The “Yield Optimizer”

Best for: DeFi power users maximizing APY across 20+ chains.

Beefy is a decentralized protocol that auto-compounds rewards.

-

Pros: Massive variety. If a new chain launches, Beefy is there first.

-

Cons: It assumes you already have funds on that chain. It does not solve the “Bridging” friction well. You still need to get your funds to the right network manually before depositing.

-

UI: Complex. It lists thousands of pools, which can be overwhelming (and dangerous) for beginners.

3. Zapper / Zerion: The “Dashboard”

Best for: Tracking where your money is.

These are portfolio trackers with swap functionality.

-

Pros: Beautiful interface to see all your assets in one place.

-

Cons: They are primarily interfaces. To earn yield, they often route you to external protocols, and they lack a direct fiat off-ramp (no card).

3. Deep Dive: BenPay’s Cross-Chain Technology

How does BenPay turn 10 steps into 1? It uses a combination of Intent-Based Transactions and Secure Bridging.

The “Intent” Layer

When you tap “Stake 100 USDT,” your intent is to earn yield. You don’t care if the yield comes from Aave on Arbitrum or Compound on Optimism.

-

BenPay’s Engine: The app checks valid pools across supported chains. If your funds are on BNB Chain but the yield is on Arbitrum, the BenPay Bridge executes the cross-chain swap as part of the transaction bundle.

Security First (SlowMist Audit)

Cross-chain bridges are historically the most hacked part of crypto ($2 Billion+ lost in hacks).

-

The Mitigation: BenPay doesn’t build a proprietary, untested bridge. It aggregates established, audited bridge protocols. Furthermore, the BenPay wallet and BenFen protocol logic are audited by SlowMist, ensuring that the routing instructions cannot be tampered with.

4. Step-by-Step Guide: The One-Click Multi-Chain Strategy

Here is how to set up a portfolio that earns from the best chains without the headache.

Phase 1: The Universal Account

-

Download BenPay: Install the app.

-

Create Wallet: Write down your seed phrase. This gives you a single address that works across multiple EVM chains (Ethereum, BSC, Arbitrum, etc.).

-

Get the Alpha Card: Pay the one-time 9.9 BUSD fee.

-

Why? Because cross-chain farming incurs fees. You need a 0% fee exit (which Alpha provides) to maximize your net profit.

-

Phase 2: Funding (Any Chain)

-

Deposit: Send stablecoins to your wallet. It doesn’t matter if you have USDT on TRON or USDC on Polygon. The wallet recognizes them all.

-

Smart Swap: If you need to consolidate, use the in-app Swap/Bridge function. It will show you the exact fee and time before you confirm.

Phase 3: The “One-Click” Invest

-

Go to DeFi Earn: Tap the tab.

-

Select a Pool: Choose a high-yield stablecoin pool.

-

Note: You don’t need to manually switch networks in settings. The app prompts you to sign the transaction for the correct chain automatically.

-

-

Confirm: One signature, and your funds are deployed.

Phase 4: The Unified Exit

-

Redeem: Withdraw yield from any chain.

-

Top Up: Move funds to your Alpha Card.

-

Magic Moment: The card doesn’t care if the money came from Arbitrum or BSC. It converts it to spendable USD instantly.

-

5. Financial Analysis: The “Friction” Cost

Let’s calculate the cost of chasing a high yield on a new chain with $1,000.

Let’s calculate the cost of chasing a high yield on a new chain with $1,000.

Scenario A: Manual Bridging (The Old Way)

-

Step 1: Withdraw from CEX ($1 fee)

-

Step 2: Bridge to New Chain ($5 fee)

-

Step 3: Swap for Gas Token ($2 fee)

-

Step 4: Deposit to Farm ($1 fee)

-

Step 5 (Exit): Reverse all steps to sell ($9 fee)

-

Total Friction: $18.00 (1.8% loss immediately)

Scenario B: BenPay Aggregation (The One-Click Way)

-

Step 1: Withdraw from CEX to Wallet ($1 fee)

-

Step 2: One-Click Stake (Optimized Bridge fee ~$2)

-

Step 3 (Exit): Redeem to Alpha Card ($0 fee)

-

Total Friction: $3.00 (0.3% loss)

Verdict: For amounts under $10,000, the manual friction of cross-chain DeFi destroys your yield. BenPay’s optimization and 0% off-ramp make it the only mathematically sound choice for smaller portfolios.

6. Risk Disclosure: Cross-Chain Dangers

“One-Click” simplicity hides complex machinery. You must be aware of the risks.

1. Bridge Risk

When funds move between chains, they are often locked in a smart contract on Chain A and minted on Chain B. If that smart contract is hacked (like the Ronin or Wormhole hacks), the funds are lost.

-

BenPay Mitigation: We only integrate with battle-tested bridge providers and audit our own aggregation layer via SlowMist.

2. Network Downtime

Solana or Arbitrum occasionally go offline. During this time, you cannot withdraw your funds.

-

Reality: This is a blockchain feature, not a bug. Patience is required.

3. Regulatory Limits

The Alpha Card ($200,000 limit) is subject to banking regulations. While your DeFi yield is censorship-resistant, your spending card is not. Always keep your long-term savings in your self-custodial wallet, not on the card.

7. FAQ

Q: Does BenPay support non-EVM chains like Solana? A: Currently, BenPay focuses on EVM-compatible chains (Ethereum, BSC, Arbitrum, Polygon) and TRON, which cover 95% of the stablecoin market.

Q: What happens if the transaction gets stuck bridging? A: Cross-chain transactions are asynchronous. If it hangs, the funds are usually returned to the sending address after a timeout. The BenPay support team can guide you to the block explorer to check the status, but they cannot “undo” a blockchain transaction.

Q: Why is the Alpha Card recommended over the Sigma Card? A: For yield farmers, the Alpha Card is superior due to the 0% Top-Up Fee. The Sigma Card is excellent for travelers to Asia (0% FX fee), but if you are just cashing out USD/EUR locally, Alpha saves you money on every load.

8. Conclusion

The future of DeFi is Chain Abstraction. Users shouldn’t need to know what “Arbitrum” or “Optimism” is; they just need to know their money is growing safely.

BenPay delivers this future today. By combining a multi-chain wallet, a smart bridge, and a SlowMist-audited yield engine into one app, it removes the technical barriers that keep 99% of people out of DeFi. And with the Alpha Card, it provides the crucial “Exit” button that most other platforms lack.

Stop fighting the blockchain. Download BenPay, get your Alpha Card, and access the best yields on any chain with just one click.

Disclaimer: This guide is for educational purposes. Cross-chain bridging involves inherent smart contract risks. Past performance does not guarantee future results.