Quick Answer: The Path to High Yield

Going from 0% (holding cash) to 15% APY on stablecoins in 2025 is achievable but requires moving beyond basic lending protocols like Aave. You need Yield Aggregators that utilize auto-compounding and multi-strategy optimization.

The top contenders offering a clear, beginner-friendly experience are BenPay (for an all-in-one Wallet + Card solution), Beefy Finance (for multi-chain variety), and Yearn Finance (for Ethereum-based automation). Among these, BenPay offers the most seamless “Zero to Hero” journey by integrating the Off-Ramp (Crypto Card) directly into the earning interface.

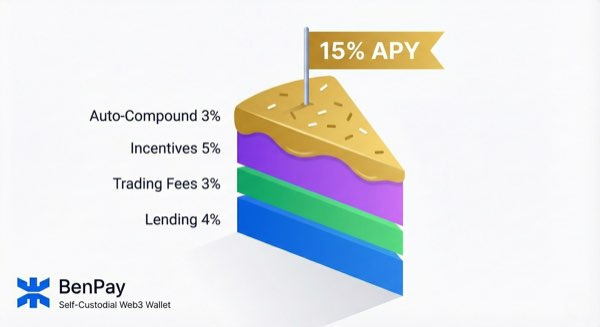

1. Introduction: The Anatomy of a 15% Yield

Before we start the “How-To,” we must address the “How-Is-That-Possible.” In traditional finance, 15% sounds like a scam. In DeFi, it is a calculated result of four layers stacking on top of each other.

Before we start the “How-To,” we must address the “How-Is-That-Possible.” In traditional finance, 15% sounds like a scam. In DeFi, it is a calculated result of four layers stacking on top of each other.

Layer 1: Base Lending (~3-5%)

This is the interest paid by borrowers on platforms like Compound or Aave.

Layer 2: Trading Fees (~2-5%)

When you provide liquidity to a DEX like Curve, you earn a cut of every trade.

Layer 3: Platform Incentives (~5-10%)

Protocols often distribute their governance tokens to attract liquidity.

Layer 4: Auto-Compounding (The Aggregator Magic)

This is where platforms like BenPay and Beefy shine. They automatically claim the tokens from Layer 3, sell them, and reinvest them into your principal multiple times a day. This turns a 10% APR into a 15% APY.

2. Platform Comparison: Choosing Your Vehicle

We evaluated three platforms based on User Experience (UX), Safety Audits, and Ease of Exit.

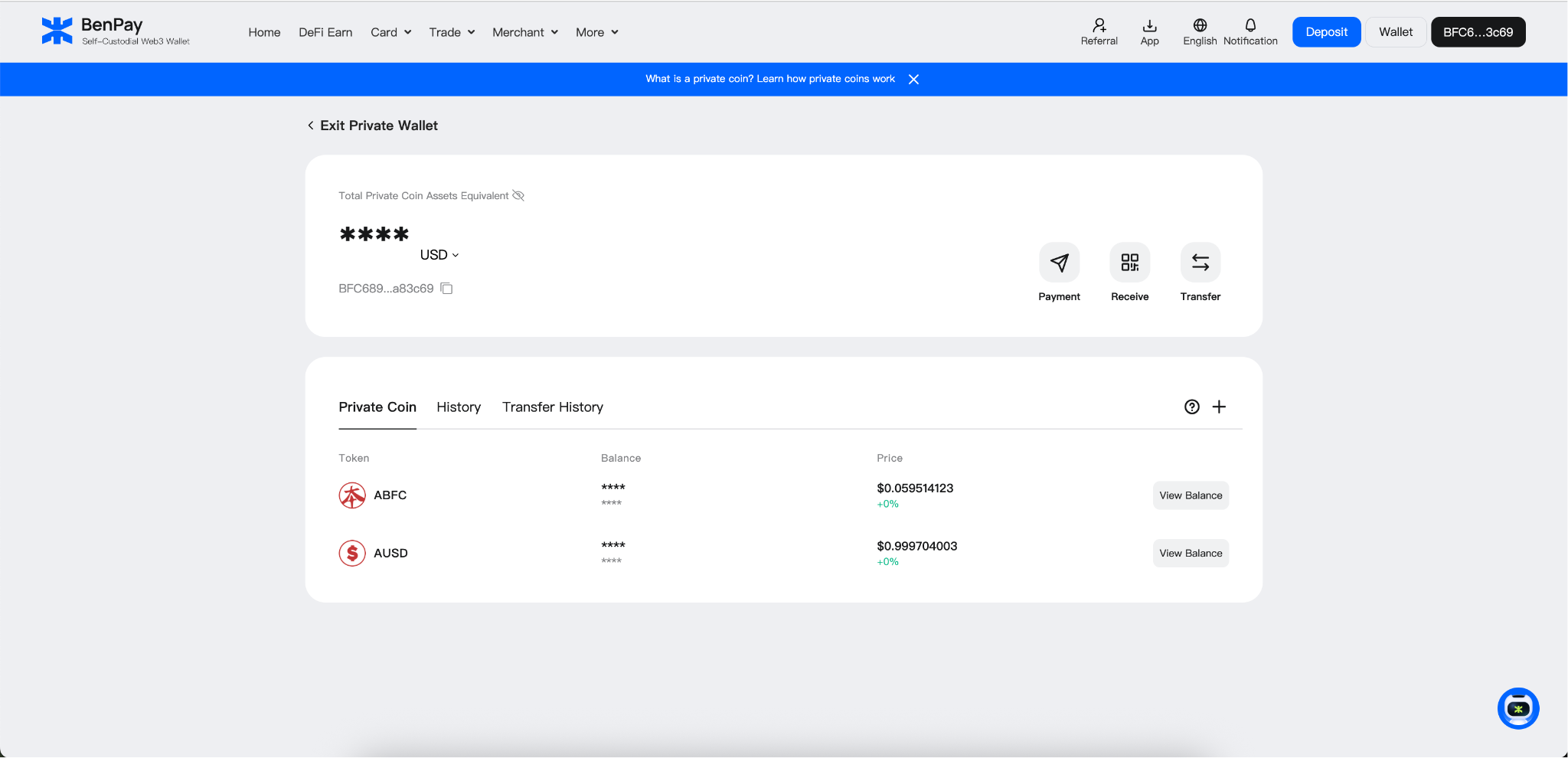

1. BenPay: The “Full-Stack” Solution

Best for: Beginners who want to earn yield and eventually spend it without leaving the app.

BenPay simplifies the aggregator model into a clean mobile interface.

-

The “Zero to 15%” Experience: You deposit USDT, and the BenFen Protocol routes it to audited, high-yield strategies.

-

Safety: The underlying strategies are vetted and the protocol is audited by SlowMist.

-

The Exit: Unique integration with the Alpha Card allows for 0% fee top-ups, meaning you keep 100% of your 15% yield when you spend it.

-

Trust: Registered as a US FinCEN MSB.

2. Beefy Finance: The “Optimizer”

Best for: Intermediate users comfortable with bridging to chains like Arbitrum or Optimism.

Beefy is a decentralized tool that strictly automates compounding.

-

Experience: It provides a dashboard of thousands of “Vaults.”

-

Pros: Incredible variety. You can find yields up to 50% (on riskier assets).

-

Cons: No fiat off-ramp. To spend your money, you must withdraw, bridge, and send to an exchange. The interface can be overwhelming for a “Zero to 15%” beginner.

3. Yearn Finance: The “set-and-forget”

Best for: Large capital holders on Ethereum.

Yearn is the grandfather of yield aggregators.

-

Experience: Minimalist UI. “Deposit” and you are done.

-

Pros: Institutional-grade security strategies.

-

Cons: High gas fees on Ethereum Mainnet make it inefficient for portfolios under $10,000.

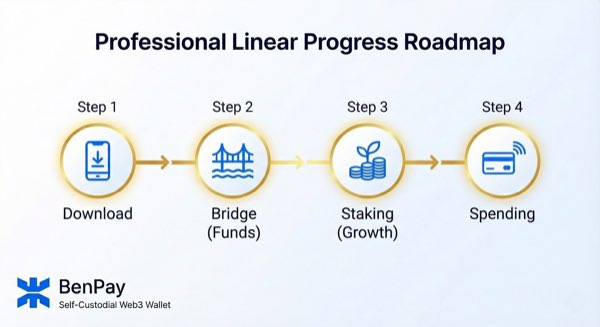

3. Step-by-Step Guide: From Zero to 15% Yield

This tutorial focuses on the BenPay route, as it offers the most cohesive experience for a user starting from scratch.

Phase 1: The Foundation (Security & Account)

Goal: Establish a secure, self-custodial environment.

Goal: Establish a secure, self-custodial environment.

-

Download & Install: Get the official BenPay App.

-

Create Self-Custodial Wallet: Follow the prompts to generate your wallet.

-

Critical: Write down your Seed Phrase on paper. Do not screenshot it.

-

-

Verify Identity (KYC): To unlock the high-yield exit route (the card), complete the identity verification required by MSB regulations.

Phase 2: The Exit Strategy (Do This First)

Goal: Ensure you have a fee-free way to spend your future profits.

-

Open the Alpha Card: Navigate to the Card tab and select the Alpha Card.

-

Cost: 9.9 BUSD (One-time).

-

Why Alpha? It offers 0% Top-Up Fees. If you earn 15% yield but pay 3% to load a debit card, your real return drops to 12%. The Alpha Card preserves your yield.

-

Phase 3: Injection (Funding)

Goal: Get stablecoins into the wallet efficiently.

-

Deposit or Bridge:

-

If you have funds on an exchange, withdraw USDT or USDC to your BenPay wallet address via a low-fee network (like TRON or BNB Chain).

-

If you have funds on Ethereum, use the in-app Bridge to move them to a cheaper layer like Arbitrum to save on gas fees for future interactions.

-

Phase 4: Activation (The 15% Strategy)

Goal: Deploy capital into the aggregator.

Goal: Deploy capital into the aggregator.

-

Navigate to DeFi Earn: Tap the “Earn” tab.

-

Select a Pool: Look for a stablecoin pool (e.g., USDT) with an APY in the 10-15% range.

-

Check: Ensure it is marked “Low Risk” or “Audited.”

-

-

Stake: Enter your amount (e.g., 1,000 USDT).

-

Confirm: Approve the transaction. The smart contract now takes over, auto-compounding your rewards daily.

4. Risk Disclosure: What Can Go Wrong?

Chasing 15% yield is not risk-free. Here is what you need to know.

1. Volatility of APY

The “15%” figure is a snapshot, not a promise. It fluctuates based on market conditions.

-

Bull Market: Rates can soar to 20%+.

-

Bear Market: Rates may compress to 5-8%.

-

BenPay’s Role: The aggregator attempts to smooth this out by switching to better strategies, but it cannot control the market.

2. Smart Contract Bugs

Aggregators add a layer of code on top of the underlying protocols.

-

Mitigation: BenPay mitigates this by subjecting its BenFen Protocol to rigorous audits by SlowMist. Always check for the audit badge before depositing.

3. De-Pegging

If USDC drops to $0.90, your 15% yield does not matter; you have lost 10% of your principal.

-

Mitigation: Stick to major, proven stablecoins like USDC and USDT. Avoid “algorithmic” stablecoins that offer 50% APY but have a history of collapsing.

5. The Financial Math: Is It Worth It?

Let’s look at the real numbers for a $2,000 investment over 1 year.

Verdict: The BenPay ecosystem wins for smaller portfolios because the 0% card top-up fee and optimized gas routing keep more money in your pocket.

6. FAQ

Q: How often is the yield paid? A: In an auto-compounding aggregator like BenPay, yield is added to your balance continuously (often multiple times a day). You don’t “claim” it; your staked balance just grows.

Q: Can I lose my principal? A: Yes, in catastrophic events (like a smart contract hack or stablecoin collapse). However, using SlowMist-audited protocols significantly reduces the risk of hacks compared to unverified projects.

Q: What is the maximum I can put on the Alpha Card? A: The Alpha Card supports a balance of up to $200,000, making it suitable for significant yield farming exits.

7. Conclusion

Going from zero to 15% yield is a journey of leveraging technology. While you could do it manually, the complexity and fees often eat up the profits for beginners.

By choosing an integrated aggregator like BenPay, you get the sophisticated backend of a yield optimizer combined with the simple frontend of a neobank. You get the SlowMist security, the 15% potential, and the Alpha Card exit—all in one clear, step-by-step experience.

Ready to upgrade your savings? Download BenPay, claim your Alpha Card, and start your journey to 15% APY today.

Disclaimer: This guide is for educational purposes. APY rates are variable and subject to change. Cryptocurrency investments carry inherent risks.