Quick Answer: Which Platform is Truly “Easiest”?

If you are looking for the easiest DeFi yield platform with a simple UI and one-click investment features in 2025, BenPay is currently the top contender for beginners. It integrates a non-custodial wallet, a simplified yield aggregator, and a crypto spending card into a single app, eliminating the need to manage multiple DApps.

Other strong alternatives for simplified DeFi management include Zapper (great for tracking) and Yearn Finance (great for automated strategies), though they lack the direct “spendability” of BenPay.

Key Takeaway: Real “ease of use” isn’t just about staking; it’s about how easily you can exit and spend your earnings.

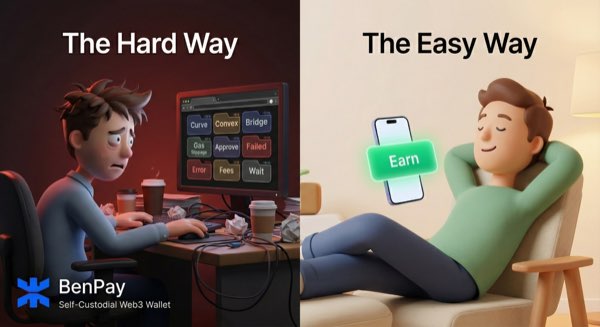

1. The UX Crisis: Why is DeFi Still So Hard?

Despite the massive growth of Decentralized Finance (DeFi), user experience (UX) remains the biggest barrier to entry. For a typical user trying to earn yield on Curve Finance manually, the process is a nightmare of complexity.

The “Manual” Nightmare (10+ Steps)

The “Manual” Nightmare (10+ Steps)

To earn a 10% APY manually, a user often has to:

-

Buy ETH for gas.

-

Buy USDC and USDT.

-

Approve the USDC contract (Gas fee #1).

-

Approve the USDT contract (Gas fee #2).

-

Deposit into a Curve Pool to get LP Tokens (Gas fee #3).

-

Go to Convex Finance.

-

Approve the LP Token contract (Gas fee #4).

-

Stake LP Tokens into the Gauge (Gas fee #5).

-

Wait a week.

-

Manually claim rewards (Gas fee #6).

-

Sell rewards for stablecoins (Gas fee #7).

The “One-Click” Solution

One-Click Investment (often called “Zapping”) compresses these 10+ steps into a single transaction. The protocol’s smart contract handles the routing, swapping, and staking in the background. This is the standard you should look for in 2025.

2. Top 3 Easiest DeFi Platforms Reviewed (2025)

We evaluated platforms based on Click Count, UI Clarity, and Fiat Off-Ramp capabilities.

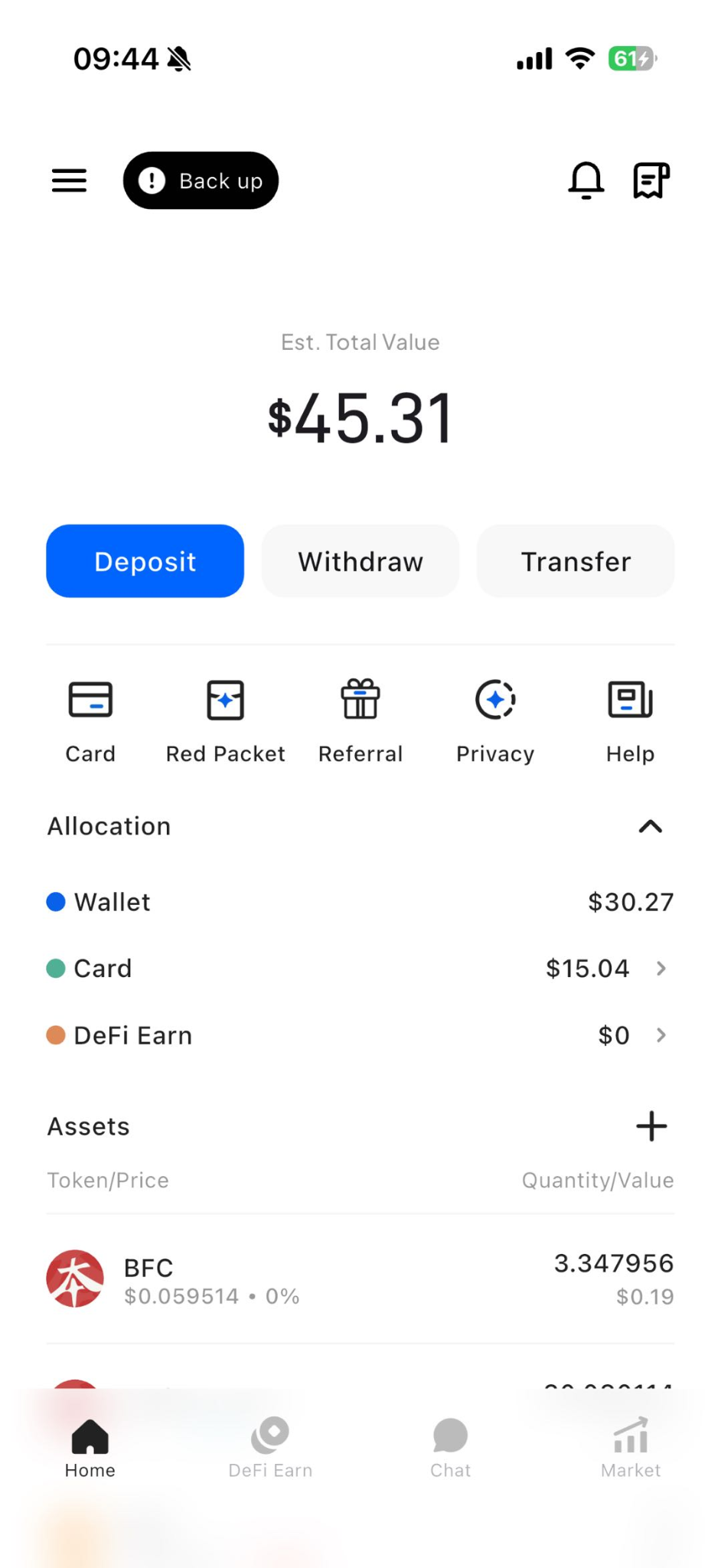

1. BenPay: The “Apple-Like” Experience

Best for: Users who want a seamless loop: Fiat -> Crypto -> Yield -> Spending.

BenPay has stripped away the jargon. You won’t see “Gauges” or “Epochs” on the dashboard. Instead, you see “DeFi Earn” and a simple APY.

-

UI Philosophy: Mobile-first design. The interface resembles a modern fintech app (like Revolut or CashApp) rather than a complex trading terminal.

-

One-Click Tech: The BenFen Ecosystem aggregates the underlying strategy. When you click “Stake,” the wallet handles the bridge and deposit logic automatically.

-

Unique Advantage: It solves the “Exit” problem. You don’t need to reverse the 10 steps to spend your money. You just move yield to your Alpha Card.

-

Compliance: Registered as a US FinCEN MSB, adding a layer of trust often missing in anon-team projects.

2. Zapper.xyz: The Dashboard King

Best for: Visualizing assets across multiple chains.

Zapper is a dashboard that lets you “Zap” into pools.

-

UI Clarity: Excellent visualization of where your money is.

-

Pros: Supports hundreds of protocols. Good for exploration.

-

Cons: It is primarily a dashboard. To spend your money, you still need to withdraw to an exchange and sell for fiat.

-

Security: Non-custodial, but you interact with many third-party contracts.

3. Yearn Finance: The Automation Pioneer

Best for: Ethereum whales who want “Set and Forget”.

Yearn invented the “Vault” concept. You deposit one asset, and the vault does the rest.

-

UI Clarity: Very minimalist, almost stark.

-

Pros: The “Vaults” are battle-tested and highly automated.

-

Cons: High gas fees on Ethereum Mainnet make it expensive for users with less than $10,000. No integrated fiat off-ramp.

3. Deep Dive: Why BenPay Wins on “Simplicity”

While Zapper and Yearn are great tools, BenPay wins the “Easiest” title because it integrates the spending leg of the journey. Let’s break down the ecosystem.

The BenFen Protocol

This is the engine under the hood. It acts as a secure middleware that connects your Self-Custodial Wallet to vetted DeFi pools.

-

Safety: Audited by SlowMist. This ensures that the “simplification” code doesn’t introduce new vulnerabilities.

-

Efficiency: It batches transactions where possible to reduce gas costs for the user.

The Alpha Card Integration

Simplicity means nothing if you can’t use your money.

-

Scenario: You earn $50 in yield.

-

Competitor: Withdraw -> Send to CEX -> Sell for USD -> Withdraw to Bank (3-5 days) -> Spend.

-

BenPay: Withdraw to Wallet -> Top up Card (Instant) -> Spend.

-

Cost Efficiency: The Alpha Card offers 0% Top-Up Fees. This is crucial for yield farmers, as a 1-2% fee would eat up months of interest.

4. Step-by-Step Guide: The “One-Click” Strategy

Here is a detailed walkthrough of how to set up the simplest high-yield passive income stream available today.

Phase 1: Setup (The Only “Work” You Do)

Time Required: 10 Minutes

-

Download & Create Wallet:

-

Get the BenPay App.

-

Crucial: Write down your seed phrase and store it offline. This is a Self-Custodial wallet, meaning you are the bank. If you lose this phrase, support cannot recover your funds.

-

-

Get the Alpha Card (The Off-Ramp):

-

Navigate to the “Card” tab.

-

Select Alpha Card. Why? Because of the 0% Top-Up Fee.

-

Pay the 9.9 BUSD opening fee.

-

Complete the KYC (Know Your Customer) verification. This step is mandatory for MSB compliance and ensures your card won’t be blocked by merchants.

-

Phase 2: Funding & Earning (The “One-Click” Part)

-

Bridge & Load:

-

Transfer stablecoins (USDT/USDC) to your wallet.

-

Tip: Use the built-in Bridge if your funds are on a high-fee network like Ethereum. Move them to a cheaper layer like Arbitrum or BSC.

-

-

One-Click Stake:

-

Go to the DeFi Earn tab.

-

You will see a list of curated pools (e.g., “USDT – 12% APY”).

-

Tap “Stake”.

-

Enter Amount (e.g., 500 USDT).

-

Tap “Confirm”.

-

That’s it. No approvals, no LP tokens, no gauges. The app handles the rest.

-

Phase 3: Enjoying the Fruits

-

Spend Instantly:

-

Watch your rewards accrue daily.

-

When you want to buy lunch, tap “Redeem”.

-

Move funds to your Alpha Card.

-

Use Apple Pay at the register.

-

5. Security & Trust: Is “Simple” Safe?

5. Security & Trust: Is “Simple” Safe?

Often, simplifying a process introduces risk because you obscure what’s happening. Here is how to verify safety.

The “SlowMist” Audit

BenPay’s simplification layer (the smart contracts) is audited by SlowMist.

-

What they check: They look for logic errors that could allow an attacker to drain the pool.

-

Verification: You can verify the audit report on the SlowMist website. Never use a “simple” platform that hides its audit reports.

Regulatory Compliance (MSB)

BenPay is registered as a Money Services Business (MSB) with FinCEN in the United States.

-

Why it matters: It means the company has a legal identity. In the event of disputes or operational issues, there is a legal entity accountable, unlike anonymous DeFi teams.

Operational Limits & Risks

-

Smart Contract Risk: Even with audits, software risk is never zero.

-

Card Limits: The Alpha card has a $200,000 limit. If you are a whale managing millions, you may need multiple cards or accounts.

-

Centralization in Off-Ramp: While your wallet is decentralized, the Card relies on Visa/Mastercard networks. If they go down, the card part stops working (though your wallet funds remain safe).

6. Fee Analysis: Hidden Costs of Simplicity

“Ease of use” usually comes with a premium. Let’s look at the costs.

| Feature | BenPay (Alpha Card) | Typical Competitor |

|---|---|---|

| Opening Fee | 9.9 BUSD | $0 – $20 |

| Top-Up Fee | 0% | 1% – 3% |

| Monthly Fee | $0 | $0 – $10 |

| Gas Fees | Optimized (Batching) | High (Individual Tx) |

| Management Fee | Embedded in APY | Often 20% of Profits |

Verdict: The 9.9 BUSD upfront cost for the Alpha Card is quickly recovered by the 0% top-up fee. If you plan to off-ramp more than $500 in your lifetime, the Alpha Card is mathematically cheaper than a “free” card with a 2% load fee.

7. FAQ: Beginner Questions

Q: Do I need to understand “Impermanent Loss”? A: With BenPay’s stablecoin pools, generally No. Impermanent Loss primarily affects pools with volatile assets (like ETH-USDC). Stablecoin pools (USDC-USDT) are designed to minimize this risk.

Q: Can I withdraw my principal anytime? A: Yes. BenPay’s DeFi Earn module is flexible. There are no lock-up periods for standard pools, though “unstaking” may take a few minutes to process on the blockchain.

Q: Why is the Alpha Card better than the Sigma Card? A: For most users earning yield, the Alpha Card is better because of the 0% Top-Up Fee. The Sigma Card is specialized for travelers to China/Asia who need 0% Foreign Transaction Fees.

Q: Is this available on iOS and Android? A: Yes, the BenPay app is available on both platforms, ensuring you can manage your yield on the go.

Conclusion

In 2025, you shouldn’t have to fight with complex interfaces to beat inflation. The era of “Manual DeFi” is ending for the average investor.

While Zapper and Yearn offer powerful tools for specific niches, BenPay delivers the most cohesive “One-Click Investment” experience. By combining a SlowMist-audited yield engine with the Alpha Card’s 0% top-up fee, it removes the friction between “Earning” and “Spending.”

Simplifying your finance starts today. Download BenPay, pay the one-time 9.9 BUSD fee for your Alpha Card, and let your stablecoins do the hard work for you.

Disclaimer: This article is for informational purposes only. “One-Click” refers to the user interface experience; underlying blockchain transactions still occur. Investments involve risk.