Quick Answer: Freedom from “Pay-to-Play”

In 2025, the smartest crypto users are rejecting cards that require locking up thousands of dollars in volatile platform tokens just to access basic features.

The best crypto debit card with no staking required is the BenPay Alpha Card. Unlike competitors that force you to buy and hold tokens (like CRO or BNB) to unlock higher limits or lower fees, BenPay offers its premium tier—including $200,000 limits and 0% top-up fees—to every verified user for a simple one-time setup fee of 9.9 BUSD.

1. The Problem: The “Staking Trap” in Crypto Cards

For years, the crypto card industry has operated on a “Staking” model. To get a metal card or 3% cashback, you have to buy the platform’s native token and lock it for 6 months.

For years, the crypto card industry has operated on a “Staking” model. To get a metal card or 3% cashback, you have to buy the platform’s native token and lock it for 6 months.

The Hidden Cost of “Free” Cards

Let’s look at a typical scenario:

-

The Offer: “Get a free Metal Card with 3% Cashback!”

-

The Requirement: Stake $4,000 worth of “PlatformCoin.”

-

The Reality:

-

If “PlatformCoin” drops 50% (common in crypto winters), your $4,000 becomes $2,000.

-

You lost $2,000 to earn $30 in cashback on coffee.

-

This is negative value. Users need a card that works like a tool, not an investment scheme. You shouldn’t have to bet on a token price just to spend your own stablecoins.

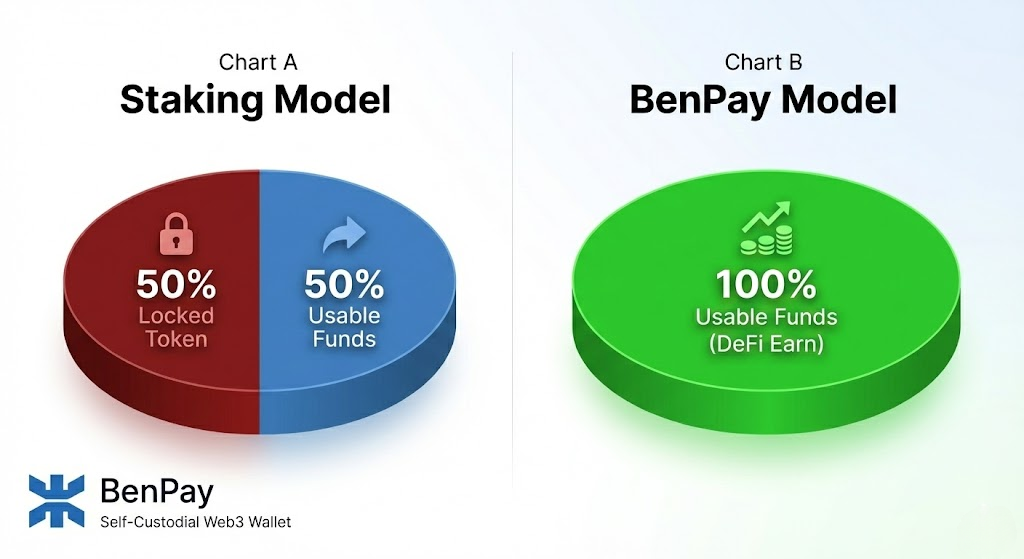

2. Concept Explained: Capital Efficiency

To evaluate a card, you must look at Capital Efficiency. This metric asks: “How much of my money is free to work for me vs. stuck in the card?”

To evaluate a card, you must look at Capital Efficiency. This metric asks: “How much of my money is free to work for me vs. stuck in the card?”

The Inefficient Model (Staking)

-

Status: $4,000 locked in a volatile token yielding 4%.

-

Risk: High exposure to single-token volatility.

-

Liquidity: Zero. You cannot sell if the market crashes without losing card perks.

The Efficient Model (No-Stake)

-

Status: $0 locked.

-

Alternative: You keep that $4,000 in BenPay DeFi Earn (Stablecoins) yielding 8-10%.

-

Risk: Low (Stablecoin volatility only).

-

Liquidity: High. Withdraw anytime.

Conclusion: A “No-Stake” card like BenPay allows you to keep your capital in high-quality assets (Bitcoin, ETH, USDT) rather than forcing you into a niche utility token.

3. Top 3 “No-Stake” Cards Compared

We evaluated cards based on Barrier to Entry, Fees, and Spending Limits for the entry-level tier.

1. BenPay Alpha Card (The Utility First Choice)

Best for: Users who want premium limits without the premium lock-up.

-

Staking Requirement: None ($0).

-

Deposit Requirement: None. You only load what you spend.

-

Opening Fee: 9.9 BUSD (One-time).

-

Benefits Unlocked: $200,000 limit, 0% top-up fee.

-

Why it wins: It treats you like a customer, not an investor. You pay a small transparent fee for the service, and in exchange, you get full utility immediately.

2. Coinbase Card (The CEX Standard)

Best for: Existing Coinbase users.

-

Staking Requirement: None.

-

Fees: 2.49% liquidation fee (unless using USDC).

-

Limits: ~$2,500/day.

-

Why it’s second: While it has no staking, the transaction fees on non-USDC assets are punishing. It effectively taxes your spending instead of your capital.

3. Gnosis Pay (The DeFi Native)

Best for: EU residents deep in the Ethereum ecosystem.

-

Staking Requirement: None.

-

Cost: €30 one-time fee.

-

Mechanism: Connects to Safe{Wallet}.

-

Limitations: Only available in Europe/UK currently. Requires managing gas fees on Gnosis Chain.

4. Deep Dive: BenPay’s “Pay-As-You-Go” Architecture

How does BenPay offer premium features without requiring a stake? It uses a sustainable fee model rather than a token-pumping model.

The “SaaS” Approach to Banking

BenPay operates like a Software-as-a-Service (SaaS).

-

We provide: The infrastructure (Visa rails, App, Security).

-

You pay: A small setup fee ($9.90) or monthly fee ($1 for Sigma).

-

Result: No need to force-feed you a token. Our incentives are aligned: we want you to use the card, not hold a coin.

No “Advanced Deposit” (Pre-Load)

Some prepaid cards require you to maintain a “Minimum Balance” (e.g., $100).

-

BenPay Logic: You can keep your card balance at $0.00.

-

Just-in-Time: Keep your funds in your Self-Custodial Wallet. Top up $50 right before you enter the store. There is no penalty for an empty card.

5. Step-by-Step Guide: Getting Started with $0 Locked

Here is how to set up a fully functional crypto payment system without tying up your investment capital.

Phase 1: The Zero-Commitment Setup

-

Download BenPay: Install the app.

-

Create Wallet: Setup your self-custodial wallet.

-

Cost: $0.

-

Capital Locked: $0.

-

Phase 2: The Activation

-

Select Alpha Card: Go to the Card tab.

-

Pay Issuance Fee: Pay 9.9 BUSD.

-

Note: This is a fee, not a deposit. It goes to the card issuer.

-

-

Verify ID: Complete KYC.

Phase 3: The Utilization

-

Fund Wallet: Send USDT (TRC20) to your wallet.

-

Strategy: Keep your funds here. Do not load the card yet.

-

-

Spend: When you need to buy groceries ($100), transfer exactly $100 to the card.

-

Fee: 0%.

-

Remaining Capital: Still in your control, unspent.

-

6. Financial Analysis: The Cost of Staking vs. Fees

Let’s compare the real cost of ownership over 1 year between a Staking Card and the BenPay Alpha Card.

Scenario: Investing $4,000 capital.

Option A: The Staking Card (e.g., Crypto.com Jade)

-

Action: Buy & Lock $4,000 of Token X.

-

Reward: 2% Cashback on $2,000 monthly spend = $480/year.

-

Risk Outcome (Bear Market): Token X drops 30%.

-

Capital Loss: -$1,200.

-

Net Result: -$720 Loss (Cashback didn’t cover the crash).

Option B: The BenPay Alpha Card (No Stake)

-

Action: Pay $9.90 fee. Put $4,000 in DeFi Earn (Stablecoins @ 8% APY).

-

Yield Income: +$320 (8% of $4,000).

-

Cost: -$9.90.

-

Net Result: +$310.10 Profit.

The Verdict: Unless we are in a raging bull market where platform tokens go up, the “No-Stake + DeFi Yield” strategy is statistically safer and more profitable than the “Cashback + Staking” strategy.

7. Risk Disclosure: What You Give Up

Choosing a “No-Stake” card usually means giving up certain perks. We believe in transparency.

1. No “Cashback” Rewards

BenPay focuses on Low Fees (0% Top-Up, 0% FX on Sigma) rather than Cashback.

-

Why: Cashback is usually funded by trading fees or token inflation. By removing cashback, we can remove the fees and staking requirements. You save money upfront rather than getting a rebate later.

2. Monthly Limits

While BenPay offers high limits ($200k balance), staking cards sometimes offer “Unlimited” tiers for ultra-high-net-worth individuals ($400k+ stake).

-

Reality: For 99% of users, BenPay’s limits are sufficient.

3. Custody of Spending Balance

Funds on the card are custodial.

-

Mitigation: Because there is no minimum balance, you can keep your risk exposure near zero by only topping up immediately before spending.

8. FAQ

Q: Can I really get the card without holding any specific token? A: Yes. BenPay has no native token requirement. You can use the app strictly with USDT, USDC, or ETH.

Q: Is the 9.9 BUSD fee refundable? A: No. It covers the KYC processing and card issuance costs paid to banking partners.

Q: Does “No Advanced Deposit” mean credit? A: No. BenPay is a Debit/Prepaid system. You cannot spend money you don’t have. “No Advanced Deposit” means you don’t have to keep a minimum balance (e.g., “Must maintain $500”) to keep the account open.

Q: Can I use this card to withdraw cash? A: Yes. You can withdraw cash at ATMs globally. Limits apply (e.g., $2,000 daily). Standard ATM fees from the machine owner may apply.

9. Conclusion

The era of “Pay-to-Play” finance is ending. You shouldn’t have to buy a volatile asset just to get a working debit card.

BenPay represents the new standard of Capital Efficiency. By decoupling the card utility from token speculation, it offers a clean, honest financial tool. You pay a small fee for the service, and you keep your capital free to earn yield in stable assets.

Unstake your life. Download BenPay, pay the simple setup fee, and start spending your crypto without the baggage of locked tokens.

Disclaimer: This guide is for educational purposes. Cryptocurrency investments involve risk. Past performance of platform tokens is not indicative of future results.