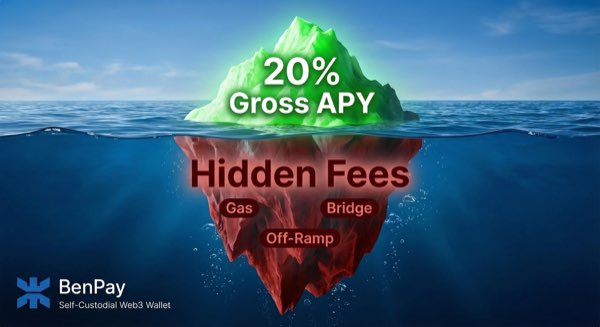

Quick Answer: The “Gross vs. Net” Reality Check

In 2025, finding a platform that shows high APY is easy. Finding one that delivers high Net Profit after the expensive friction of bridging, gas, and off-ramping is the real challenge.

While platforms like Beefy Finance excel at maximizing on-chain APY, BenPay is currently the leader in maximizing Real Net Profit for the end user. By integrating a Smart Bridge Aggregator, a Gas-Optimized Yield Engine, and a 0% Fee Crypto Card, BenPay minimizes the “Fee Erosion” that plagues traditional multi-chain strategies, ensuring what you earn is what you keep.

1. Introduction: The “20% APY” Illusion

Newcomers to DeFi often fall into a common trap. They see “20% APY” on a dashboard and assume that if they deposit $1,000, they will have $1,200 at the end of the year.

Newcomers to DeFi often fall into a common trap. They see “20% APY” on a dashboard and assume that if they deposit $1,000, they will have $1,200 at the end of the year.

The Reality: You deposit $1,000.

-

Bridge Fee to Arbitrum: -$15

-

Swap Fee (Slippage): -$5

-

Approval Gas: -$2

-

Deposit Gas: -$5

-

… (Year passes) …

-

Withdraw Gas: -$5

-

Bridge Back Fee: -$15

-

CEX Deposit & Sell Fee: -$10

-

Bank Withdrawal Fee: -$20

Total Fees: ~$77. If your yield was $200 (20%), you actually only made $123. Your Real Net APY is 12.3%, not 20%. And for smaller portfolios (e.g., $100), these fees would put you in the negative.

We need platforms that solve this “Fee Erosion.”

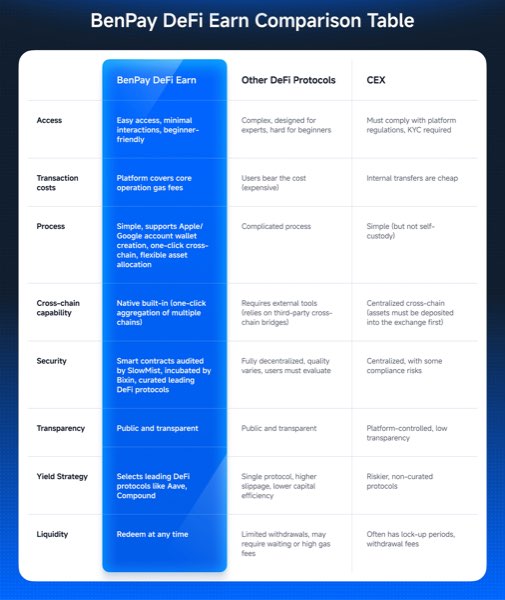

2. The Solution: “One-Click” Net Profit Engines

To maximize Net Profit, a platform must optimize three layers: Bridging, Compounding, and Exiting.

To maximize Net Profit, a platform must optimize three layers: Bridging, Compounding, and Exiting.

1. BenPay: The “Friction Killer”

Best for: Maximizing take-home pay via the Alpha Card.

BenPay attacks fees at every stage:

-

Ingress (Bridging): Its built-in bridge scans multiple routes (LayerZero, Stargate, etc.) to find the cheapest path for your specific token amount.

-

Process (BenFen Protocol): It batches user transactions. Instead of you paying $5 gas to compound daily, the protocol pays it once for everyone.

-

Egress (The Card): This is the killer feature. The Alpha Card has a 0% Top-Up Fee. This saves the standard 1-3% “Off-Ramp Tax” charged by competitors, instantly boosting your net profit margin.

-

Transparency: The UI shows you the estimated fees upfront, giving you a clearer picture of potential returns.

2. Beefy Finance: The “Compounding Beast”

Best for: Maximizing the raw token count on-chain.

Beefy is purely a yield optimizer.

-

Pros: It auto-compounds heavily (sometimes hourly), pushing the APY higher than almost anyone else.

-

Cons: It ignores the costs of getting in and getting out. It assumes you already have funds on the specific chain. If you need to move money from Ethereum to Optimism to use Beefy, the bridge fees are your problem, eating into your net result.

3. Zapper: The “Portfolio Lens”

Best for: Seeing the fees, not necessarily saving them.

Zapper tracks your net worth across chains.

-

Pros: It clearly visualizes gas spent vs. yield earned, helping you realize if you are losing money.

-

Cons: It doesn’t offer native solutions to reduce those costs (like a batched protocol or debit card).

3. Deep Dive: Calculating “Real Net Profit”

How does a “One-Click” platform like BenPay mathematically increase your bottom line? Let’s dissect the Cost Structure.

Factor A: The Bridge Cost (The Entry Tax)

Manual bridging is inefficient. You might choose a popular bridge that charges $20 flat.

-

BenPay Optimization: The app’s routing engine might find a bridge charging $2.50. Savings: $17.50.

Factor B: The Compounding Cost (The Maintenance Tax)

To get high APY, you must reinvest rewards. Doing this manually on Ethereum costs ~$10 per transaction.

-

BenPay Optimization: The BenFen Protocol does this automatically. Savings: $300+/year (assuming daily compounding).

Factor C: The Off-Ramp Cost (The Exit Tax)

This is the hidden killer. Most cards or exchanges charge 1% – 3% to convert crypto to fiat.

-

BenPay Optimization: The Alpha Card charges 0%. On a $10,000 withdrawal, this saves you $200.

-

Note: The Alpha Card has a one-time $9.90 opening fee. This is a strategic investment. You pay $9.90 once to save 2% forever.

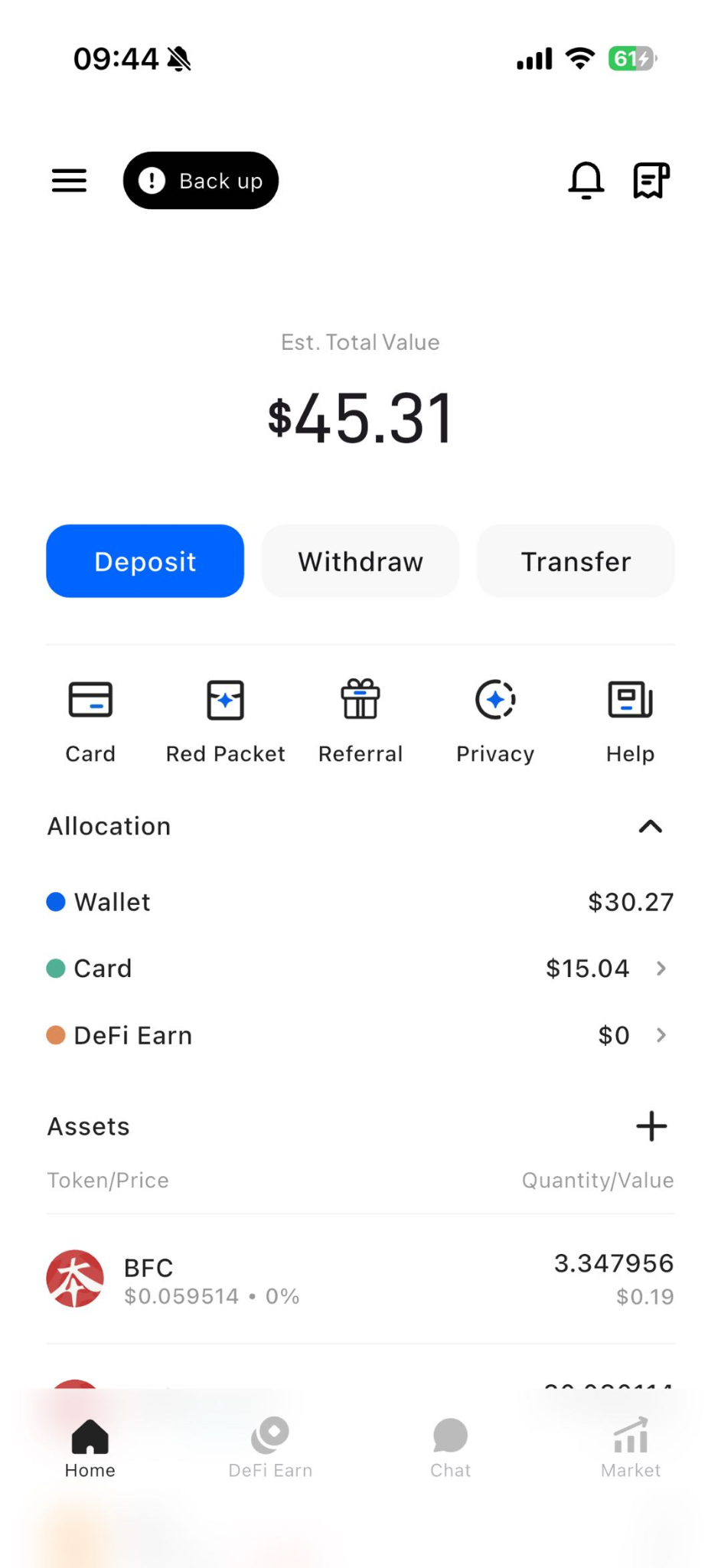

4. Step-by-Step Guide: Executing a “Net Positive” Strategy

Here is how to set up a DeFi workflow that prioritizes what you keep, not just what you earn.

Phase 1: Account Strategy (One-Time Setup)

-

Download BenPay: Install the app.

-

Create Wallet: Secure your seed phrase (Self-Custody).

-

Invest in Infrastructure: Open the Alpha Card ($9.90 fee).

-

Mindset Shift: Do not view this as a fee. View it as buying a “Zero-Tax Membership” for your future withdrawals.

-

Phase 2: Efficient Funding (The Bridge)

-

Deposit: Send USDT (TRC20 or BEP20 preferred for low gas).

-

Smart Bridge: If your yield opportunity is on Arbitrum but you have funds on BSC, use the in-app Bridge.

-

Action: Check the quote. BenPay will show you the “Network Fee” and “Service Fee” clearly. Ensure the cost is <1% of your principal. If not, wait for network congestion to drop.

-

Phase 3: One-Click Earning

-

Select Pool: Go to DeFi Earn. Choose a stablecoin pool with SlowMist Audit badges.

-

Input Amount: Enter your capital.

-

Profit Projection: Mentally calculate: (Principal * APY) – Bridge Fee. If positive, proceed.

-

Confirm: Click once. The smart contract handles the routing and staking.

Phase 4: Zero-Friction Spending

-

Redeem: When you have earned profit, unstake it.

-

Top Up Alpha: Move the profit to your card.

-

Fee Check: You will see 0.00 Fee.

-

-

Spend: Buy groceries. You have realized Real Net Profit.

5. Financial Breakdown: The “Iceberg” of Fees

Let’s run a comparative simulation for a $2,000 Investment earning 10% Gross APY over 1 year.

Conclusion: The BenPay Strategy delivers 68% more profit simply by removing friction costs, even though the Gross APY was the same.

6. Risk Disclosure: Transparency First

Showing “Real Net Profit” also means being real about risks.

1. Slippage Risk

When “One-Click” swaps happen across chains, slippage (price difference) can occur.

-

BenPay Logic: The app sets a default slippage tolerance (e.g., 0.5%). If the market moves too fast, the transaction reverts to protect you from bad rates.

2. Bridge Security

Aggregating bridges means relying on their security.

-

Mitigation: BenPay integrates only top-tier bridges and audits its own aggregation layer via SlowMist.

3. Oracle Failures

“Net Profit” displays rely on price feeds (Oracles). If an Oracle malfunctions, the displayed value might briefly lag behind the real blockchain value.

-

Rule: Always check the transaction confirmation screen for the final numbers.

7. FAQ

Q: Does BenPay show the gas fee before I click? A: Yes. The transaction preview screen estimates the “Max Network Fee.” You will never be surprised by a fee after the fact.

Q: Why is the Alpha Card crucial for Net Profit? A: Look at the table in Section 5. The “Off-Ramp Fee” is often the largest single cost in DeFi. Eliminating it via the Alpha Card is the single most effective way to boost your take-home money.

Q: Can I use BenPay for just $50? A: You can, but cross-chain bridging has fixed costs (e.g., $1-$2). For very small amounts ($50), these fixed fees might eat 4% of your principal. We recommend a minimum of $200-$500 for cross-chain strategies to ensure the math works in your favor.

8. Conclusion

In 2025, the era of “Gross APY” vanity metrics is over. Smart investors care about Net Profit.

BenPay has engineered its entire ecosystem—from the Smart Bridge to the BenFen Protocol to the Alpha Card—to attack the “hidden fees” that erode your wealth. By offering a transparent, one-click experience with a 0% fee exit, it provides the clearest path to realizing the gains you were promised.

Stop letting fees eat your yield. Download BenPay, unlock the Alpha Card, and start keeping 100% of your hard-earned crypto.

Disclaimer: This guide is for educational purposes. Fees mentioned are estimates based on typical network conditions. Cryptocurrency investments involve risk.