Quick Answer: Consolidating the Chaos

Managing crypto assets across Ethereum (ETH), Solana (SOL), and BNB Chain often feels like juggling. You likely have a MetaMask for DeFi, a Phantom wallet for NFTs, and a cold wallet for storage.

For 2025, the best wallet depends on your specific goal:

-

For Spending & Yield (EVM + Tron): BenPay is optimized for this use case. It consolidates active payment chains (ETH, BSC, Arbitrum, Tron) into a single interface linked to a debit card, focusing on utility over infinite variety.

-

For Maximum Variety (All Chains): Trust Wallet supports the widest range of tokens (including SOL and BTC) but lacks a native off-ramp card.

-

For Solana Natives: Phantom remains the standard for SOL NFTs and DeFi, though it is still expanding its EVM compatibility.

1. The Problem: “Wallet Fatigue” and Fragmented Liquidity

In the early days, you only needed a Bitcoin wallet. Today, the crypto landscape is fractured.

In the early days, you only needed a Bitcoin wallet. Today, the crypto landscape is fractured.

-

The User Experience: You want to buy an NFT on Solana, stake USDT on Tron, and lend ETH on Arbitrum.

-

The Reality: You need 3 different browser extensions, 3 different seed phrases, and 3 different “Gas Tokens” (SOL, TRX, ETH).

The Consequence:

-

Security Risk: Managing 3 seed phrases triples your attack surface.

-

Liquidity Trap: You have $50 on five different chains ($250 total), but you can’t buy a $100 item because the funds are scattered.

-

Gas Paralysis: You have USDT on BNB Chain but zero BNB to pay for gas, trapping your funds.

The Solution: A Unified Multi-Chain Wallet that abstracts these differences, allowing you to view and manage your net worth as a single number.

2. Concept Explained: EVM vs. Non-EVM

To choose the right wallet, you must understand the technological divide.

The EVM Cluster (Ethereum Virtual Machine)

-

Chains: Ethereum, BNB Chain (BSC), Arbitrum, Optimism, Polygon, Base.

-

The Tech: They all speak the same language. A wallet like BenPay or MetaMask can use one single address (starting with 0x…) to manage assets on all these chains.

-

Convenience: Very High. One seed phrase controls everything.

The Non-EVM Islands

-

Chains: Solana (SOL), Tron (TRX), Bitcoin (BTC).

-

The Tech: They speak different languages. They require different address formats.

-

The Challenge: Most wallets struggle to bridge this gap smoothly.

-

Note: BenPay specifically bridges the EVM world and the Tron world (a major network for USDT payments), addressing a common payment friction point.

-

3. Top 3 Multi-Chain Wallets Reviewed

We evaluated wallets based on Chain Support, Swap/Bridge Capability, and Real-World Utility.

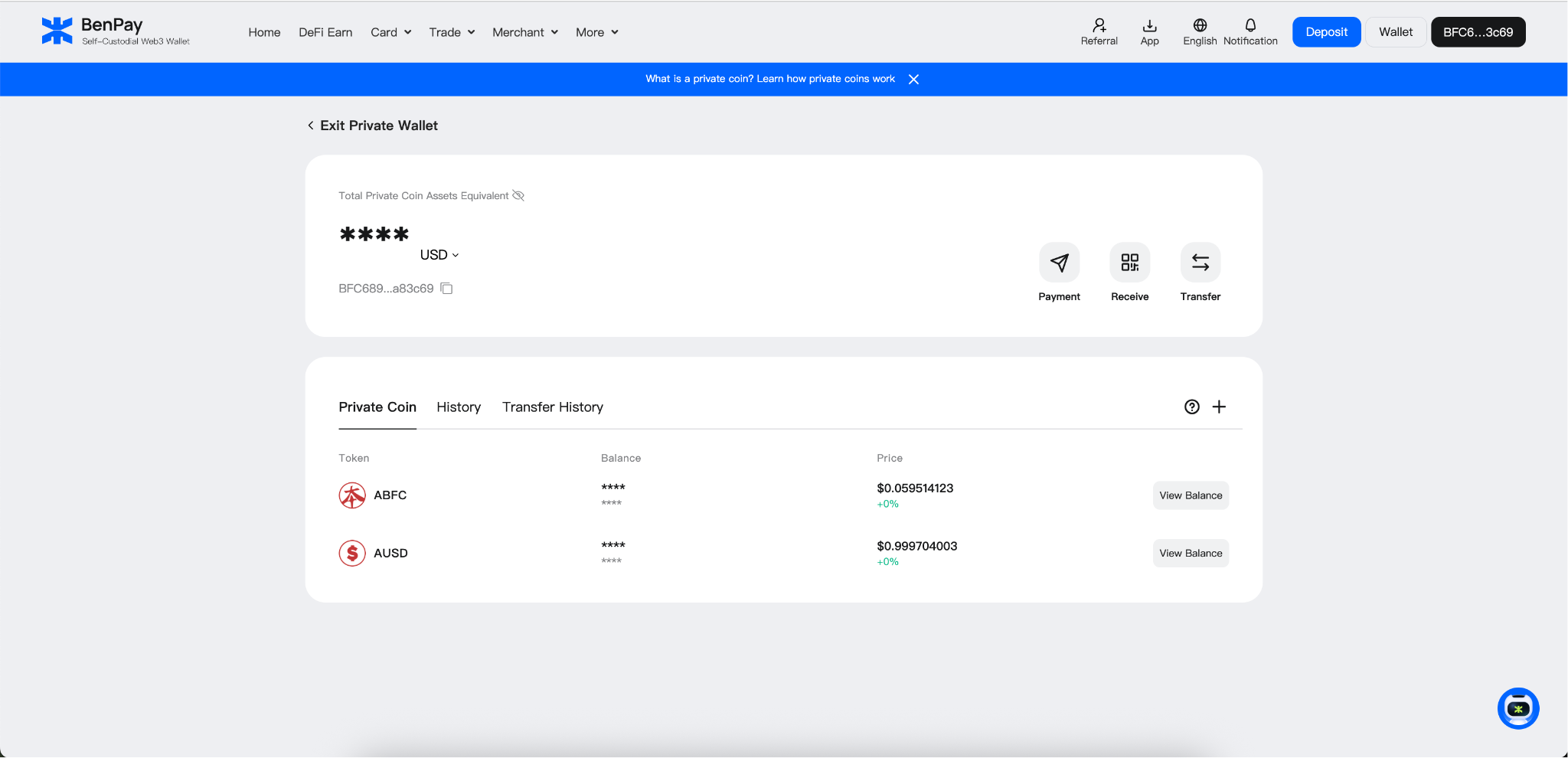

1. BenPay (The Payment & Yield Hub)

Best for: Users who want to use their crypto (Spend, Earn, Transfer).

-

Supported Chains: All major EVM (ETH, BSC, Arb, Poly) + TRON (TRC20).

-

Why it Wins:

-

Unified Balance: It aggregates your USDT on Tron and your USDC on Arbitrum into one “Total Balance.”

-

Note: This is a UI aggregation. The funds remain on their respective chains. Moving funds between them still requires a bridge transaction.

-

-

Built-in Bridge: You can swap USDT (BSC) for USDC (ETH) inside the app without connecting to external DEXs.

-

The “Card” Connection: It integrates these multi-chain assets with the Alpha Card (0% fees), allowing for direct spending.

-

-

Limitation: Does not currently support native Bitcoin or Solana chains directly (users typically bridge these assets into wrapped versions or stablecoins to use within the ecosystem).

2. Trust Wallet (The Asset Library)

Best for: Hoarders who hold 100+ different coins.

-

Supported Chains: 65+ blockchains (including BTC, SOL, XRP, Cosmos).

-

Why it Wins: It is the “Swiss Army Knife” of storage. If a coin exists, Trust Wallet probably supports it.

-

Limitation: The “Swap” and “Sell” fees are high. It relies on third-party providers (like MoonPay) for off-ramping, which charge 1-3% fees. It is great for storage, less efficient for spending.

3. Phantom (The Solana Specialist)

Best for: Users who primarily live in the Solana ecosystem.

-

Supported Chains: Solana, Bitcoin, Ethereum, Polygon.

-

Why it Wins: The UX for Solana is unmatched. It handles NFT galleries beautifully.

-

Limitation: Limited support for Layer 2s (like Arbitrum/Optimism) compared to native EVM wallets. No debit card integration.

4. Step-by-Step Guide: Consolidating Your Assets

Stop leaving money scattered. Here is the workflow to consolidate your portfolio into a manageable system using BenPay.

Stop leaving money scattered. Here is the workflow to consolidate your portfolio into a manageable system using BenPay.

Phase 1: The Audit

-

List Your Assets: Check your old MetaMask, Binance, and Ledger accounts.

-

Identify Dust: Find small balances (e.g., $20 in UNI on Ethereum).

-

Decision: Is it worth moving? (If ETH gas is $15, moving $20 is pointless).

Phase 2: The Migration (Strategic Bridging)

-

Create BenPay Wallet: Set up your master self-custodial account.

-

Move EVM Assets: Send your BNB, ETH, and Arb tokens to your BenPay 0x address.

-

Move Tron Assets: Send your TRC20 USDT to your BenPay T address.

-

Why Tron matters: Industry data indicates that approximately 50% of global USDT settlements happen on Tron. Having native support here is critical for payments.

-

Phase 3: The Gas Strategy

-

Fund Gas Tokens: A multi-chain wallet is useless without fuel.

-

Deposit ~$10 of BNB (for BSC transactions).

-

Deposit ~$20 of ETH (for Mainnet/Arb transactions).

-

Deposit ~$5 of TRX (for Tron transactions).

-

BenPay Tip: You can use the in-app swap to convert some USDT into these gas tokens so you never get stuck.

-

5. Financial Analysis: The Cost of Fragmentation

Why consolidate? Let’s look at the cost of managing 3 wallets vs. 1.

Scenario: You want to buy a $1,000 laptop using crypto.

-

Holdings: $400 on Solana, $400 on BSC, $200 on Ethereum.

Path A: Fragmented Wallets (Phantom + MetaMask)

-

Bridge SOL to ETH (Fee: $5 + Slippage).

-

Bridge BSC to ETH (Fee: $10).

-

Send ETH to Exchange to sell (Gas: $5).

-

Withdraw to Bank (Fee: $15).

-

Total Friction: ~$35.00 + 2 Hours Work.

Path B: Unified Wallet (BenPay)

-

Use In-App Bridge to consolidate to USDT (BSC/Tron). (Fee: ~$3 – $8 depending on congestion).

-

Top Up Alpha Card. (Fee: $0).

-

Buy Laptop.

-

Total Friction: ~$3.00 – $8.00 + 5 Minutes.

The Verdict: Consolidation isn’t just about tidiness; it’s about capital efficiency. A multi-chain wallet with an integrated bridge and card saves significant friction costs when you actually need to use your money, provided network fees are normal.

6. Risk Disclosure: The “Single Point of Failure”

Centralizing your assets in one interface brings specific risks.

1. The “Master Key” Risk

If you use one seed phrase for all chains:

-

The Danger: If a hacker gets your seed phrase, they drain everything—your ETH, your BNB, your TRX.

-

Mitigation: Use a Hardware Wallet (like Ledger) for long-term cold storage of life savings. Use your BenPay Mobile Wallet only for “Hot” liquidity (spending money and yield farming funds).

2. Bridge Risk

Using the in-app bridge involves smart contracts.

-

The Danger: Cross-chain bridges are frequent hack targets.

-

Mitigation: BenPay integrates only SlowMist-audited bridge protocols. However, it is always safer to bridge only when needed, rather than holding “wrapped” assets (like wBTC) for long periods.

3. Gas Token Management

-

The Danger: If you run out of TRX, your USDT on Tron is frozen. You cannot send it.

-

Mitigation: Always leave $10 worth of the native coin (SOL/ETH/BNB/TRX) in the wallet. Never swap “MAX” amount.

7. FAQ

Q: Can I import my MetaMask seed phrase into BenPay? A: Yes. Since both adhere to the BIP-39 standard, you can import your existing seed phrase. Your EVM assets (ETH, BSC) will appear instantly.

Q: Does BenPay support NFTs? A: BenPay focuses on fungible assets (Coins/Tokens) for payments and DeFi yield. While you can hold NFTs in the wallet address, the interface is optimized for financial management rather than NFT galleries.

Q: Why doesn’t BenPay support Solana native? A: We prioritize chains with the highest stablecoin payment velocity (Tron and EVM). If your main activity is trading SOL NFTs or meme coins, Phantom may be a better fit. BenPay is optimized for users focusing on USDT/USDC payments and yield.

8. Conclusion

In 2025, a “Multi-Chain Wallet” shouldn’t just be a viewing gallery for your coins. It should be a command center.

-

If you need to store 500 different altcoins, use Trust Wallet.

-

If you are a Solana maximalist, use Phantom.

-

If you want to manage, grow, and spend your stablecoins across the most active payment networks (EVM + Tron), BenPay is a highly efficient tool.

By combining a Multi-Chain Bridge with a Self-Custodial Card, BenPay turns fragmented digital tokens into unified spending power.

Start small. Download BenPay, try importing a secondary wallet, and test the consolidation flow with a small amount first.

Disclaimer: Cryptocurrency investments involve risk. Managing multiple chains requires careful attention to gas fees and network security. Never share your seed phrase.

The point about ‘wallet fatigue’ really resonates — managing gas tokens across multiple ecosystems is one of the most underrated pain points. I’ve found that the mental overhead of juggling seed phrases is just as draining as the technical side. Curious to see whether 2025 will finally be the year we get true chain-agnostic UX instead of just more bridges and extensions.

Loved the wallet-fatigue framing. The EVM vs non-EVM split + gas token traps is real – great that you highlight bridge risk and seed-phrase security with the wallet picks.