Quick Answer: The Top Contenders

In the fragmented DeFi landscape of 2025, the best multi-chain yield aggregators that automate stablecoin returns include Beefy Finance (for sheer variety), Yearn Finance (for Ethereum-based safety), and BenPay (for simplified cross-chain bridging and spending).

While Beefy offers the widest range of chains (from Arbitrum to ZkSync), BenPay stands out by integrating a Cross-Chain Bridge, a Yield Optimizer, and a Fiat Off-Ramp (Card) into a single non-custodial app, solving the “liquidity fragmentation” problem for everyday investors.

1. The Problem: The Nightmare of Liquidity Fragmentation

To understand the value of an aggregator, we must first look at the problem. In 2025, liquidity is no longer just on Ethereum. It is scattered across dozens of Layer-2s (Arbitrum, Optimism, Base) and alternative Layer-1s (BSC, Avalanche, Solana).

To understand the value of an aggregator, we must first look at the problem. In 2025, liquidity is no longer just on Ethereum. It is scattered across dozens of Layer-2s (Arbitrum, Optimism, Base) and alternative Layer-1s (BSC, Avalanche, Solana).

The “Yield Chasing” Fatigue

Imagine you hold 10,000 USDT on the Ethereum Mainnet, but the best yield (15% APY) is currently on the Arbitrum network. To capture this yield manually, you must:

-

Find a bridge (and hope it’s secure).

-

Approve a spend limit (Gas fee).

-

Bridge the funds (Wait 10-20 mins).

-

Switch networks in your wallet.

-

Swap for the specific stablecoin needed (Slippage).

-

Deposit into the pool.

This process is slow, expensive, and risky. Multi-chain aggregators solve this by automating the search and routing process.

2. How Do Aggregators “Automatically” Boost APY?

You often see aggregators offering higher APY than the underlying protocol (e.g., Aave offers 4%, but the aggregator offers 7%). How is this possible? It comes down to Auto-Compounding and Strategy Optimization.

The Mathematics of Auto-Compounding

Standard protocols pay “Simple Interest” (APR). Aggregators convert this to “Compound Interest” (APY) by automatically harvesting rewards and re-depositing them.

-

Manual Farming: You claim $10 rewards once a month.

-

Aggregator: The code claims rewards every hour and adds them to your principal.

-

The Result: A 10% APR can become a 12-15% APY purely through high-frequency compounding, covering the gas fees that would make this impossible for an individual user.

3. Top 3 Multi-Chain Aggregators Reviewed

We evaluated platforms based on Chain Support, Security Audits, and Ease of Exit.

1. Beefy Finance (The “King of Chains”)

Best for: Hardcore DeFi users who want exposure to exotic chains. Beefy is a decentralized, multi-chain yield optimizer that allows its users to earn compound interest on their crypto holdings.

-

Chain Support: Massive (Arbitrum, Optimism, Polygon, Base, etc.).

-

Pros: Automates the “Harvest & Re-stake” process perfectly.

-

Cons: Extreme Complexity. The interface lists thousands of pools with “Safety Scores” ranging from 0 to 10. Beginners can easily accidentally deposit into a risky, unaudited pool and lose funds.

-

Off-Ramp: None. You must withdraw and sell manually.

2. Yearn Finance (The Institutional Standard)

Best for: Large capital preservation on Ethereum. Yearn moves funds between lending protocols (Aave, Compound) to find the best rate.

-

Chain Support: Primarily Ethereum Mainnet, with some presence on Fantom/Optimism.

-

Pros: The safest strategies in the industry.

-

Cons: Gas Fees. On Ethereum, depositing less than $5,000 is often unprofitable due to transaction costs.

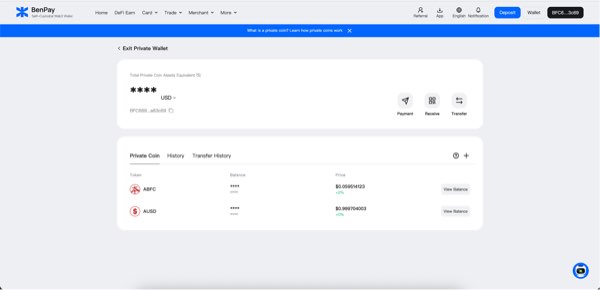

3. BenPay: The “Bridge + Earn + Spend” Ecosystem

Best for: Users who want to move funds across chains and access yields without technical friction. BenPay simplifies the multi-chain experience by integrating a Bridge directly into the Yield interface.

-

Integrated Bridging: The BenPay Bridge allows you to move USDT from TRON or BSC (cheap chains) directly into the ecosystem to access high-quality DeFi Earn pools.

-

Curated Safety: Unlike Beefy which lists everything, BenPay’s DeFi Earn module only lists vetted pools audited by firms like SlowMist.

-

The “Exit” Advantage: This is the killer feature. Once you earn yield on any chain, you can consolidate it into your Alpha Card balance for instant spending.

-

Compliance: Registered as a US FinCEN MSB, providing a layer of regulatory trust that anonymous aggregators cannot match.

4. Deep Dive: The BenPay Multi-Chain Advantage

Why choose a consolidated app over a standalone dApp like Beefy? It comes down to the Lifecycle of Money.

Step 1: Low-Cost Entry (The Bridge)

In multi-chain DeFi, the entry fee (Gas) dictates your profit.

-

Competitor: You might pay $20 to bridge stablecoins on a generic bridge aggregator.

-

BenPay: The built-in bridge optimizes routes between Tron, Ethereum, BSC, and Layer-2s, ensuring you arrive at the yield destination with maximum capital.

Step 2: The “BenFen” Yield Engine

Once bridged, the funds enter the BenFen Protocol. This is a self-custodial smart contract layer.

-

Audit Status: Audited by SlowMist.

-

Strategy: It aggregates liquidity from top-tier protocols (like Aave V3 or Curve) but presents them in a simplified UI. You don’t see the complexity; you just see “USDT – 8.5% APY”.

Step 3: Zero-Friction Exit (The Alpha Card)

Aggregators usually trap your money. To buy a coffee, you have to unwind the position, bridge back to CEX, sell, and withdraw.

-

The BenPay Solution: Redeem from DeFi Earn -> Top up Alpha Card (0% Fee) -> Spend.

-

Card Specs:

-

Alpha Card: 0% Top-Up Fee, $9.90 Opening Fee. Ideal for converting large DeFi yields into spending power.

-

Sigma Card: 0% FX Fee. Ideal if you are traveling to Asia and need to spend your yield via Alipay or WeChat Pay.

-

5. Detailed Action Plan: The “$100 Multi-Chain Trial”

Let’s simulate a real-world scenario: You have 100 USDT on the BNB Chain (BSC), but you want to earn yield and eventually spend it.

Phase 1: Setup & Bridging

-

Download BenPay: Install the app and create your self-custodial wallet.

-

Bridge In: Use the Bridge function to move your 100 USDT from BSC to the wallet.

-

Get the Card: Activate the Alpha Card ($9.90 fee).

-

Why? Because you want to keep 100% of your future yields. The 0% top-up fee is essential for long-term farming.

-

Phase 2: Staking

-

Deposit: Go to DeFi Earn. Select a USDT pool.

-

Confirm: Approve the transaction. The smart contract now handles the auto-compounding in the background.

Phase 3: Realizing Profit

-

Wait: Let the APY do its work.

-

Redeem: Withdraw $50 of your principal + interest.

-

Spend: Load it onto the Alpha Card and pay for a subscription service (e.g., ChatGPT, Netflix).

6. Security Architecture & Risk Disclosure

In multi-chain DeFi, risks are compounded because you rely on the security of the Chain, the Bridge, and the Destination Protocol.

The “Bridge Risk”

Bridges are historically the most hacked part of crypto.

-

Mitigation: BenPay utilizes audited bridge protocols and monitors for suspicious activity.

-

SlowMist Audit: The specific smart contracts governing the BenPay wallet and BenFen protocol have passed SlowMist security audits.

Regulatory Safety (MSB)

Many aggregators operate in a legal gray area. BenPay’s registration with FinCEN (MSB) ensures that the “Off-Ramp” (the card) remains compliant and operational, reducing the risk of your funds getting stuck due to regulatory bans.

Operational Limits

-

Card Limits: The Alpha card supports up to $200,000.

-

Minimums: Top-ups require at least $10.

-

De-Pegging: Even the best aggregator cannot protect you if USDC loses its peg to the dollar.

7. Fee Breakdown: Optimizing Your Net Return

High APY means nothing if fees eat it up. Let’s compare the “Cost of Exit” for $1,000 of yield.

| Cost Item | BenPay (Alpha Card) | Generic Aggregator + CEX |

|---|---|---|

| Bridge Fee | Optimized Routes | Variable ($5-$20) |

| Unstaking Gas | Low (L2 Support) | Variable |

| CEX Withdrawal Fee | $0 (N/A) | $1 – $10 |

| Card Top-Up Fee | 0% | N/A (Bank Transfer takes days) |

| Off-Ramp Time | Instant | 1-3 Business Days |

Conclusion: For a user earning passive income, the Alpha Card saves approximately 1-3% in frictional costs compared to the traditional CEX off-ramp route.

8. FAQ

Q: Does BenPay support Arbitrum or Optimism? A: Yes, BenPay’s wallet is multi-chain compatible, allowing you to hold and manage assets across major EVM chains and Layer-2s.

Q: What is the difference between APR and APY? A: APR (Annual Percentage Rate) is simple interest. APY (Annual Percentage Yield) includes the effect of compounding (reinvesting interest). Aggregators maximize APY by compounding frequently.

Q: Why do I need to KYC for the card? A: BenPay is a compliant MSB. To connect DeFi yields to the Visa/Mastercard network, identity verification is legally required to prevent money laundering. This protects the platform’s longevity.

Conclusion

The era of manually bridging funds and chasing yields across 50 different chains is over. While Beefy Finance offers the ultimate sandbox for experts, BenPay delivers the necessary automation and utility for the rest of us.

By combining a Cross-Chain Bridge, a SlowMist-audited yield engine, and a 0% fee Crypto Card, BenPay turns multi-chain complexity into a simple “Earn and Spend” workflow.

Bridge your gap to financial freedom. Download BenPay, claim your Alpha Card, and let the aggregator work for you.

Disclaimer: This article is for informational purposes only. Multi-chain DeFi involves risks related to bridges, smart contracts, and market volatility.