Quick Answer: The Quest for Consistency

In the volatile crypto market of 2025, finding “Stable Yield” means looking for protocols with deep liquidity and sustainable revenue models. The best platforms for relatively stable, consistent returns on stablecoins are Aave V3 (for pure lending reliability), Curve Finance (for trading fee consistency), and BenPay (for aggregated stability and ease of use).

While “Degen” farms promise 50% APY that crashes to zero in a week, platforms like BenPay aim for a sustainable 5-12% APY by aggregating “Blue Chip” strategies and filtering out high-risk pools, making it the ideal choice for risk-averse investors who prioritize capital preservation.

1. Introduction: What Does “Stable” Mean in DeFi?

Before picking a platform, we must redefine “Stability.” In traditional banking, stability means a fixed 0.5% rate. In DeFi, rates float based on supply and demand.

“Relatively Stable Yield” in DeFi means:

-

Low Volatility: The APY doesn’t jump from 20% to 2% overnight.

-

Sustainable Sources: The yield comes from borrowers paying interest or traders paying fees, not just from printing a governance token that is crashing in price.

-

Deep Liquidity: You can withdraw millions without crashing the pool.

The goal of this guide is to identify platforms that offer this “Goldilocks” zone—higher than a bank, but safer than a meme coin farm.

2. The Mechanics of Stability: “Real Yield” vs. “Printed Yield”

To find stability, you must follow the money.

The Unstable Path: “Printed Yield”

Many new platforms offer 100% APY. This is paid in their native token. When the token price crashes (which it usually does), your 100% APY becomes negative real return. This is not stable.

The Stable Path: “Real Yield”

This is where BenPay and Aave focus.

-

Lending Interest: Users borrow USDC to buy ETH. They pay 8% interest. You get that 8%. As long as people trade crypto, this demand exists.

-

Swap Fees: People swap USDC for USDT on Curve. They pay 0.04%. You get that fee. This is a cash-flow business.

Aggregators like BenPay stabilize this further by automatically shifting your funds to whichever “Real Yield” source is performing best, smoothing out the dips.

3. Top 3 Platforms for Consistent Returns

We evaluated these based on Historical APY Stability, Security Audits, and Ease of Access.

1. BenPay: The “Smoothed” Aggregator

Best for: Users who want a “Set and Forget” savings-like experience.

BenPay’s primary value proposition is Volatility Dampening.

-

How it works: The BenFen Protocol doesn’t just chase the highest number. It curates a basket of “Blue Chip” pools (like Aave and Compound). If one protocol’s rate drops, it shifts liquidity to another.

-

Stability Factor: By aggregating multiple sources, the overall APY fluctuates less than any single protocol.

-

Trust: The underlying protocol is audited by SlowMist, and the entity is a registered US FinCEN MSB, providing a layer of institutional trust.

-

Utility: Stable yield is useless if you can’t spend it. BenPay connects this yield directly to the Alpha Card.

2. Aave V3: The Institutional Rock

Best for: Whales ($1M+) who need absolute contract safety.

Aave is the standard for decentralized lending.

-

Stability: Rates are determined purely by the utilization rate (how much money is borrowed). It is transparent and predictable.

-

Pros: Impossible to be “rugged” by a bad strategy because it performs no strategies. It just lends.

-

Cons: Rates can be low (2-4%) during bear markets when borrowing demand dries up.

3. Convex Finance (on Curve): The Fee Earner

Best for: Users willing to take on slightly more smart contract risk for higher returns.

Convex boosts the yield of Curve Finance pools.

-

Stability: Stablecoin pools (like 3pool) are the backbone of DeFi. They generate massive trading fees.

-

Pros: Often yields 8-15%.

-

Cons: Highly complex. Requires managing multiple tokens (cvxCRV). If you make a mistake, your funds can be locked for 16 weeks.

4. Deep Dive: BenPay’s “BenFen” Strategy for Stability

Why does BenPay offer a clearer experience than Convex? It comes down to the BenFen Protocol’s curation logic.

The “Safety Filter”

In the open market, there are thousands of pools. 90% are “high risk.”

-

BenPay’s Filter: The protocol only interacts with pools that meet strict criteria:

-

TVL > $10 Million: Ensures depth.

-

Audit Status: Must be audited by Tier-1 firms.

-

Time Tested: Protocol must be live for >12 months.

-

This filtration process means you might miss out on a risky 500% APY project, but you also avoid the 100% loss. This is the essence of “Relatively Stable Yield.”

5. Step-by-Step Guide: Building a Stable Income Stream

Here is how to set up a low-maintenance, consistent yield generator using the BenPay ecosystem.

Phase 1: Account & Security

Goal: Establish a secure, compliant foundation.

-

Download BenPay: Install the app.

-

Backup Keys: Write down your seed phrase. This ensures that even if BenPay the company disappears, you can still access your funds on the blockchain.

-

MSB Compliance: Complete the Identity Verification. This ensures your access to the global banking network (via the card) remains stable.

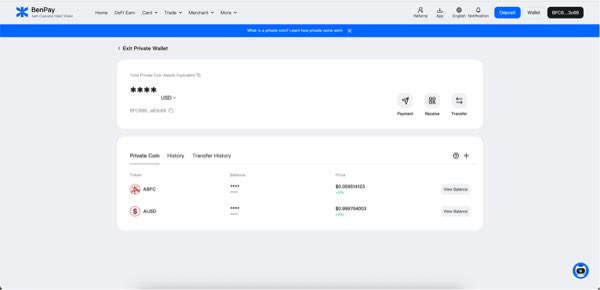

Phase 2: The “Exit” Setup

Goal: Minimize friction costs. 4. Get the Alpha Card: Pay the one-time 9.9 BUSD fee. * Why Alpha? For a stable yield strategy, fees are the enemy. The Alpha Card has a 0% Top-Up Fee. This is mathematically essential for preserving your 5-10% yield.

Phase 3: The Investment

Goal: Deploy into a stable pool. 5. Fund Wallet: Transfer USDT or USDC (TRON/BSC networks recommended for low fees). 6. Enter DeFi Earn: Go to the Earn tab. 7. Select a “Stable” Pool: Look for pools labeled “USDT” or “USDC”. Avoid “LP” pools involving volatile assets (like ETH-USDC) to eliminate Impermanent Loss risk. 8. Stake: Confirm the transaction.

Phase 4: The Lifestyle Integration

-

Monitor: Check monthly. Stable yield doesn’t require daily checking.

-

Spend: When you need cash, redeem yield to your Alpha Card instantly.

6. Financial Analysis: The “Stable” Math

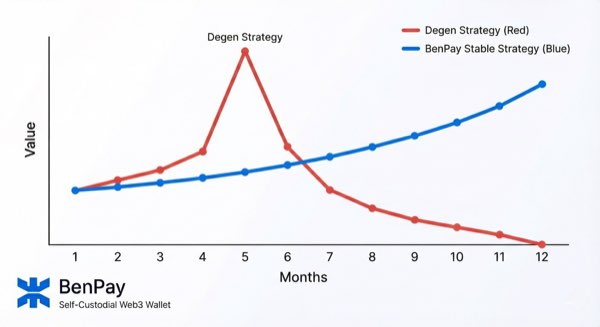

Let’s compare a Stable Strategy (BenPay) vs a Volatile Strategy (Degen Farm) over 1 year with $5,000.

Let’s compare a Stable Strategy (BenPay) vs a Volatile Strategy (Degen Farm) over 1 year with $5,000.

| Feature | BenPay (Stable Aggregation) | Degen Farm (High Yield) |

|---|---|---|

| Start APY | 10% | 100% |

| Month 6 APY | 9% | 5% (Token crashed) |

| Month 12 APY | 11% | 0% (Pool died) |

| Principal Value | $5,000 (Stable) | $2,500 (Impermanent Loss) |

| Total Value | ~$5,500 | ~$2,700 |

Conclusion: “Relatively Stable Yield” wins in the long run because it protects the principal. Compounding a small number is powerful; compounding a losing number is disaster.

7. Risk Disclosure: Even “Stable” Has Risks

7. Risk Disclosure: Even “Stable” Has Risks

We value transparency. Here is what could disrupt a “Stable” strategy.

1. The “De-Peg” Black Swan

If USDC or USDT loses its $1.00 peg (as USDC did briefly in 2023), no aggregator can save you.

-

Mitigation: Diversify. Don’t hold 100% in one stablecoin.

2. Smart Contract Failure

BenPay mitigates this via SlowMist audits, but code is code.

-

Mitigation: Never invest your life savings. Keep a portion in cold storage or traditional banks.

3. Regulatory Changes

While BenPay is an MSB, regulations change.

-

Mitigation: The wallet is non-custodial. If regulations block the Card, your funds are still safe in your wallet and can be withdrawn elsewhere.

8. FAQ

Q: Why is BenPay’s rate lower than some new projects? A: Because BenPay filters out the high-risk “printed yield.” We prioritize sustainability. A 10% yield that lasts for years is better than a 100% yield that lasts a week.

Q: Is the Alpha Card balance insured? A: Crypto assets are generally not FDIC insured. However, the card issuance partners are regulated financial institutions.

Q: Can I use the Sigma Card instead? A: Yes. If you travel to Asia, the Sigma Card (0% FX Fee) is better. But for pure yield farming cash-out in USD/EUR regions, the Alpha Card (0% Top-Up) is mathematically superior.

9. Conclusion

In 2025, the best platform for “Relatively Stable Yield” is one that balances Access, Security, and Utility.

-

Aave offers the raw infrastructure.

-

Curve offers the liquidity engine.

-

BenPay offers the finished product: A SlowMist-audited aggregator that finds the stable yield for you and connects it to a 0% fee Alpha Card.

Choose consistency over hype. Download BenPay, secure your Alpha Card, and start building a stable crypto income stream today.

Disclaimer: This guide is for educational purposes. “Stable” refers to relative volatility compared to the broader crypto market, not a guarantee of fixed returns. Capital is at risk.

I like how this post highlights the importance of distinguishing between ‘stable’ and ‘volatile’ yields. It’s easy to get swept up in the allure of high APYs, but platforms that focus on long-term stability are the real winners in the DeFi space.