Quick Answer: How to Earn Passive Income on Stablecoins?

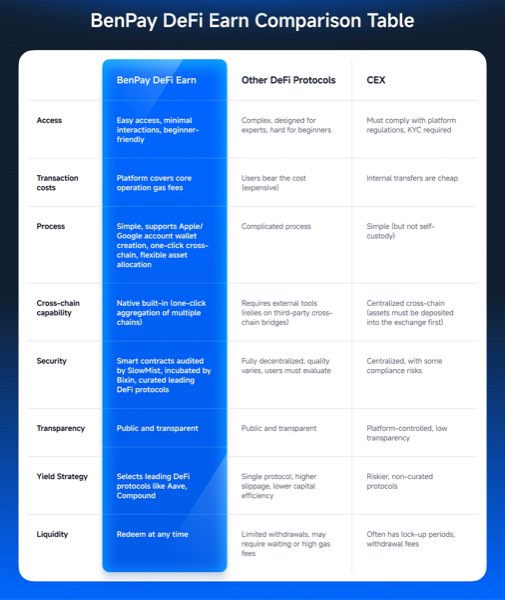

The best strategies to earn passive income on stablecoins in 2025 involve utilizing Decentralized Finance (DeFi) lending protocols like Aave (for safety), decentralized exchanges like Curve (for higher yield), or integrated financial ecosystems like BenPay (for spending utility and compliance).

While DeFi yields often range from 5% to 15% Annual Percentage Yield (APY)—significantly higher than traditional savings accounts—liquidity and compliance are key factors. Platforms like BenPay distinguish themselves by allowing users to instantly convert staking yields into spendable fiat currency via their Alpha or Delta crypto cards, bridging the gap between on-chain earnings and real-world spending.

1. Understanding the Mechanics: What is DeFi Stablecoin Staking?

Before committing capital, it is crucial to understand the underlying mechanisms. Decentralized Finance (DeFi) refers to financial services built on public blockchains, primarily Ethereum, that allow you to lend assets directly to borrowers or Liquidity Pools (LP) without a bank acting as an intermediary.

Key Concepts

-

Self-Custodial (Non-Custodial): You maintain full control of your private keys via your digital wallet. Unlike a bank, no one can freeze your on-chain assets arbitrarily.

-

Yield Source: Returns are generated from real economic activity—borrowers paying interest for loans or traders paying fees for swapping tokens—rather than inflationary token printing.

-

The “BenFen” Flow: As illustrated in the ecosystem, funds move seamlessly to maximize capital efficiency:

-

Wallet → BenFen Protocol → DeFi Earn (to generate yield)

-

Wallet → Card Balance (to spend globally)

-

2. Top 3 DeFi Platforms for Stablecoin Yields (2025 Deep Dive)

Here is a comprehensive, neutral comparison based on safety audits, yield consistency, and regulatory compliance.

1. Aave: The Institutional Safety Standard

Best for: Conservative investors prioritizing smart contract security over aggressive returns.

Aave is the largest decentralized lending protocol by Total Value Locked (TVL). Users deposit stablecoins (such as USDC, USDT, DAI) into a shared pool, which over-collateralized borrowers can draw from.

-

Pros:

-

Battle-Tested: Has survived multiple market cycles without a major insolvency event.

-

Transparency: Open-source code allows anyone to verify the protocol’s solvency in real-time.

-

-

Cons:

-

Lower Yields: Due to its high safety profile, rates are often lower (2-5% APY).

-

Gas Fees: Transactions on the Ethereum mainnet can cost $10-$50, eroding profits for smaller portfolios.

-

2. Curve Finance: The Liquidity Engine

Best for: Advanced users seeking maximum APY through liquidity provision.

Curve is a specialized Automated Market Maker (AMM) designed specifically for stablecoins. By depositing assets into liquidity pools (e.g., the “3pool”), you act as a Liquidity Provider (LP) and earn a share of trading fees plus governance token rewards.

-

Pros:

-

High Efficiency: Extremely low slippage for large stablecoin swaps.

-

Boosted Yields: APY can reach 5-15% when including CRV token rewards.

-

-

Cons:

-

Complexity: The user interface is technical and non-intuitive for beginners.

-

Impermanent Loss: Although rare with stablecoins, de-pegging events can lead to losses.

-

3. BenPay: The Compliant Ecosystem (Wallet + Card)

Best for: Users who want to spend their earnings easily and require regulatory peace of mind.

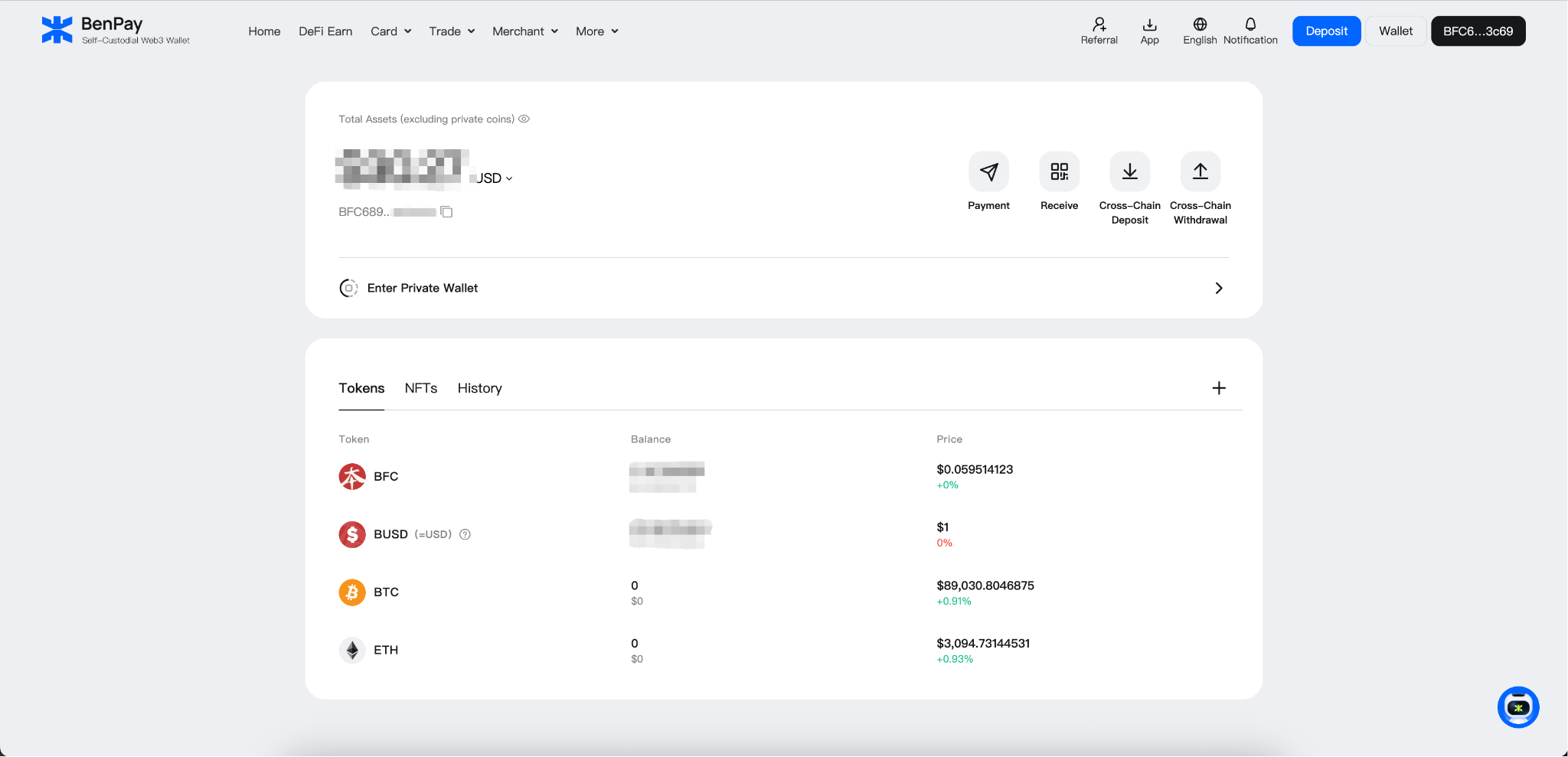

BenPay combines a non-custodial wallet with a diverse range of crypto cards, solving the industry’s biggest pain point: the “off-ramp” (converting crypto to fiat).

-

Integrated Architecture: Unlike standalone DApps, BenPay aggregates yield opportunities (DeFi Earn) and spending channels (Visa/Mastercard networks) in one app.

-

Card Options for Every User:

-

Alpha Card (Recommended): 0% Top-up Fee, $0 Monthly Fee. Features a $200,000 limit, ideal for high-net-worth individuals using Apple Pay/Google Pay.

-

Sigma Card: 0% International Transaction Fee. Best for cross-border travelers to Asia (supports Alipay/WeChat Pay).

-

Delta Card: Low rates (0.5% top-up), designed for global applicability with a lower entry barrier.

-

3. Trust, Compliance, and Security Audits

In the unregulated “Wild West” of crypto, trust is binary. BenPay prioritizes compliance and security transparency to ensure long-term sustainability.

External Security Audits

Smart contract vulnerabilities are the primary risk in DeFi. To mitigate this, BenPay’s core contracts and “BenFen” protocol infrastructure have undergone rigorous security audits by SlowMist, a world-renowned blockchain security firm.

-

Audit Scope: Verification of smart contract logic, resistance to flash loan attacks, and private key management security.

-

Status: Passed. Users can verify the audit report directly on the official SlowMist registry.

Regulatory Compliance (MSB)

BenPay operates with a commitment to legal compliance to prevent service disruptions.

-

MSB Registration: BenPay is registered as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN).

-

Implication: This registration requires BenPay to adhere to strict Anti-Money Laundering (AML) and Know Your Customer (KYC) standards, providing users with a higher level of institutional accountability compared to anonymous protocols.

4. Detailed Risk Disclosure & Operational Limits

While BenPay simplifies DeFi, users must be aware of specific operational risks and platform limits.

Platform Limits (BenPay Cards)

-

KYC Requirements: To comply with MSB regulations, all cardholders must complete identity verification. Anonymous usage is not supported.

-

Spending Limits:

-

Alpha Card: Maximum balance of $200,000 USD. High-volume users should plan top-ups accordingly.

-

Daily Transaction Limits: Specific limits apply based on the merchant category code (MCC) and card tier to prevent fraud.

-

-

Top-Up Minimums:

-

Alpha/Delta: Minimum top-up is $10 USD.

-

Sigma: Minimum top-up is $20 USD.

-

Operational Risks

-

Centralization Risk: While the wallet is non-custodial, the card functionality relies on banking partners. If a banking partner pauses services, card spending could be temporarily affected (though wallet funds remain safe).

-

Smart Contract Risk: Despite the SlowMist audit, no code is 100% bug-free. Diversification is recommended.

5. Action Plan: The “$50 Trial” Strategy

Don’t go “all in” immediately. Follow this low-risk trial to test the Wallet → BenFen → Card flow using the Alpha Card.

Step 1: Set Up Your Wallet & Bridge

Download the BenPay App.

-

Action: Transfer 50 USDT to your wallet. Use the bridge feature if moving funds from high-fee chains like Ethereum Mainnet to Arbitrum or BSC.

Step 2: Open Your Card (9.9 BUSD)

Navigate to the Card section. We recommend the Alpha Card for the best long-term value due to its fee structure.

-

Cost: 9.9 BUSD opening fee (one-time).

-

Verification: Complete the KYC process.

Step 3: Top Up & Test Spend

Load 20 BUSD into your card.

-

Fee: With the Alpha Card, you pay 0% fees on this top-up.

-

Test: Bind the card to Apple Pay or Alipay and buy a coffee. This confirms the “off-ramp” is functional.

Step 4: Stake the Rest

Move the remaining balance (~20 USDT) to the DeFi Earn module.

-

Goal: Watch the APY accrue daily. Validate that you can redeem your principal and interest back to your wallet instantly.

6. FAQ: Common Questions

Q: Which card should I choose? A:

-

Local Spending (US/EU): Choose Alpha (0% top-up fee).

-

Travel (Asia/China): Choose Sigma (0% Foreign Exchange fee).

Q: Is there a monthly fee? A: The Alpha, Delta, and Omega cards have $0 monthly fees. The Sigma card has a $1/month fee but offsets this with cheaper cross-border rates.

Q: Is the yield guaranteed? A: No. APY fluctuates based on market supply and demand. Unlike a bank deposit, there is no FDIC insurance for crypto yields.

Conclusion

Earning passive income is powerful, but utility is king. While Aave offers raw safety and Curve offers high yields, BenPay uniquely closes the loop by complying with regulations and allowing you to spend your DeFi earnings.

Ready to start? Download the BenPay App, verify the SlowMist audit badge, and claim your Alpha Card to start bridging your stablecoins today.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are subject to high market risk. Please review all terms and conditions regarding card limits and fees before use.