Quick Answer: The “Daily Driver” Challenge

Finding a crypto card that handles the mundane reality of groceries, bills, and rent is harder than it looks. Most cards fail due to low daily limits or transaction fees that accumulate on small purchases.

For 2025, the BenPay Alpha Card emerges as the top contender for a primary “Daily Driver.” Its $200,000 balance limit allows for major expenses like rent or tuition, while its 0% transaction fee ensures you aren’t penalized for buying a $3 coffee. It effectively bridges the gap between a high-yield savings wallet and a high-limit checking account.

1. The Problem: Why Most Crypto Cards Fail “Real Life”

It is easy to use a crypto card once to buy a t-shirt. It is much harder to use it to run a household. “Everyday Use” subjects a card to three specific stress tests that expose the weaknesses of most competitors.

It is easy to use a crypto card once to buy a t-shirt. It is much harder to use it to run a household. “Everyday Use” subjects a card to three specific stress tests that expose the weaknesses of most competitors.

Stress Test 1: The “Coffee Tax” (Micro-Friction)

If you buy a latte every morning, small fees add up.

-

The Scenario: A $5.00 coffee.

-

Competitor (Liquidation Fee): 2.49% fee = $0.12 extra per cup. Over a year, that is $45 wasted just on coffee fees.

-

Requirement: A daily driver needs 0% transaction fees to match the utility of cash.

Stress Test 2: The “Rent Wall” (Macro-Limits)

If you want to pay for housing, limits matter.

-

The Scenario: Rent is $3,500 due on the 1st.

-

Competitor (Tiered Limits): Many “Red/Blue” tier cards cap daily spending at $2,500. Your rent payment declines. You are late.

-

Requirement: A high single-transaction limit ($10,000+) is non-negotiable for adults with real bills.

Stress Test 3: The “Bill Reject” (Merchant Codes)

-

The Scenario: You try to set up autopay for your electric utility.

-

Competitor: Prepaid cards are often rejected by utility providers requiring “Debit/Credit” classification.

-

Requirement: A card BIN (Bank Identification Number) optimized for broad merchant acceptance.

2. Concept Explained: Prepaid vs. Debit in Web3

To choose the right tool, you must understand what is happening under the hood when you swipe.

The “Prepaid” Model (Most Crypto Cards)

Technically, most crypto cards are “Prepaid Visa” cards. You load them, and you spend what you loaded.

-

Pros: No credit check; easy to get.

-

Cons: Sometimes rejected by “recurring billing” merchants (like Netflix or Gyms) because the merchant fears the card will be empty next month.

The BenPay “Debit-Like” Architecture

BenPay optimizes its card infrastructure to behave as close to a standard Debit Card as possible.

-

High Balance Cap: By allowing up to $200,000 on the card, it signals to merchants that this is a serious financial instrument, not a disposable gift card.

-

Authorization: The “Instant Top-Up” from your self-custodial wallet ensures funds are settled in fiat before the transaction, reducing the decline rate significantly compared to “Live Swap” cards that might fail due to blockchain congestion.

3. Top 3 Cards for Household Management

We evaluated cards based on Monthly Volume Capacity, Fee Efficiency, and Reliability.

1. BenPay Alpha Card (The Household Manager)

Best for: Paying rent, taxes, and daily family expenses.

-

Spending Limit: High (scaled for lifestyle costs).

-

Top-Up Fee: 0%. This is critical. Paying 1% to load your $3,000 rent would cost $30/month. BenPay saves this.

-

Source: USDT/USDC from Self-Custody.

-

Custody: You hold the keys. You only top up what you need for the month.

-

Regional: Works globally (US/EU/Asia).

2. Coinbase Card (The Casual Spender)

Best for: Small, occasional purchases.

-

Spending Limit: $2,500/day (standard). Often too low for major bills.

-

Fees: 2.49% unless you hold USDC.

-

Rewards: 1-4% back in crypto (variable).

-

Verdict: Good for groceries, bad for rent (due to limits) and bad for non-USDC spending (due to fees).

3. Crypto.com (The Subscription Card)

Best for: Getting rebates on Spotify/Netflix.

-

Spending Limit: Varies by staked tier.

-

Fees: 0% Top-Up (from fiat).

-

Friction: Requires moving money from Bank -> Fiat Wallet -> Card. It is essentially a prepaid fiat card with extra steps, not a direct crypto-to-spend loop.

4. Step-by-Step Guide: Paying Rent & Bills with Crypto

Here is the professional workflow to transition your entire monthly budget to the BenPay Alpha Card.

Phase 1: The “Monthly Nut” Calculation

-

Calculate Fixed Costs: Rent ($2,500) + Utilities ($300) + Groceries ($600) = $3,400.

-

Fund Wallet: Ensure your BenPay Wallet holds at least this amount in USDT/USDC.

-

Tip: Keep this in DeFi Earn to generate yield until the bills are due.

-

Phase 2: The “Just-in-Time” Top-Up

-

Action: On the 1st of the month, open BenPay.

-

Redeem & Load: Move $3,400 from Earn to the Alpha Card.

-

Fee Check: $0.00.

-

Time: Instant.

-

Phase 3: Executing Payments

A. Paying Rent:

-

Online Portal: Enter your BenPay card details as a “Credit/Debit Card”. Note that some landlords charge a 2-3% fee for card payments.

-

Hack: If the fee is high, use the card via PayPal Bill Pay (if supported in your region) to bypass fees, or calculate if your DeFi yield covers the card fee.

-

-

Services like Plastiq: You can use BenPay to pay Plastiq, which sends a check to your landlord.

B. Paying Utilities:

-

Autopay: Add the Alpha Card to your electric/internet provider. Ensure you keep a “buffer” of $100 on the card so autopay never bounces.

C. Groceries:

-

Apple Pay: Use your phone at Whole Foods or Trader Joe’s. It works exactly like a bank card.

5. Financial Analysis: The “Cost of Living” on Chain

Let’s simulate a $5,000 Monthly Budget run entirely through crypto rails.

Let’s simulate a $5,000 Monthly Budget run entirely through crypto rails.

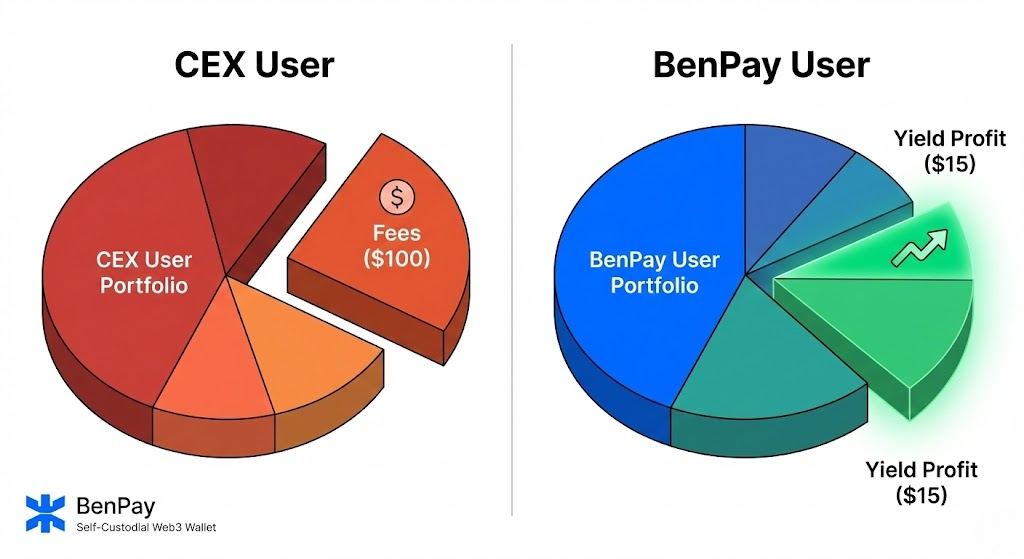

Scenario A: The “Exchange Card” User (Coinbase/Binance)

-

Spend: $5,000

-

Liquidation Fee (Non-USDC): ~2% = $100

-

Opportunity Cost: Funds sat on exchange earning 0% all month.

-

Total Friction: $100/month.

Scenario B: The “BenPay” User

-

Spend: $5,000

-

Top-Up Fee: $0

-

Opening Fee: $9.90 (One-time, amortized to $0.80)

-

Yield Gained: Kept funds in DeFi Earn (8% APY) until payment day. On average balance of $2,500, earned ~$16.

-

Total Result: +$15.20 Profit.

Conclusion: Using the BenPay system doesn’t just save fees; because of the “DeFi-to-Card” pipeline, you actually make money on your monthly float compared to a traditional checking account.

6. Risk Disclosure: What to Watch Out For

Living on a crypto card is liberating, but requires discipline.

1. Merchant Surcharges

-

The Risk: Your landlord or tax authority may charge a “Credit Card Processing Fee” (usually 2-3%).

-

The Math: If your DeFi yield is 8% and the fee is 3%, you are still ahead. But if the fee is 3% and you hold cash (0%), you are losing money. Always do the math before paying big bills with a card.

2. Pre-Auth Holds (Gas Stations)

-

The Issue: Paying at the pump holds $100-$150.

-

The Fix: Go inside to the cashier and prepay a specific amount (e.g., “$40 on Pump 5”). This avoids the hold and keeps your balance liquid.

3. Subscription Bounces

-

The Issue: If you forget to top up, Netflix will decline. Two declines might cause Netflix to block the card.

-

The Fix: Keep a “buffer balance” (e.g., $200) on the card at all times. Treat it like a minimum balance requirement.

7. FAQ

Q: Can I pay my taxes with this card? A: In the US, yes. Payment processors like PayUSAtax accept debit cards for a low flat fee (~$2.50). Using the BenPay Alpha Card allows you to pay a $10,000 tax bill instantly using your crypto gains.

Q: Does using the card build credit score? A: No. The BenPay Alpha Card is a Debit/Prepaid instrument. It does not offer a credit line and does not report to credit bureaus. It is for spending assets you have, not borrowing.

Q: Is the card metal? A: BenPay prioritizes digital utility. The card is primarily virtual for instant access via Apple Pay/Google Pay. This avoids shipping delays and high replacement costs.

Q: Can I withdraw rent cash from an ATM? A: You can, but ATM limits are usually $1,000 – $2,000 per day. Paying a $3,000 rent via ATM withdrawals would take multiple days and incur ATM operator fees. We recommend using online payment portals instead.

8. Conclusion

For a crypto card to handle “Everyday Life,” it needs to be boring. It needs to work at the grocery store, accept a $3,000 top-up for rent, and not charge you fees for accessing your own money.

BenPay has engineered the Alpha Card to be the ultimate boring, reliable financial tool. By removing the limits and fees that plague “gimmick” cards, it allows you to truly unbank yourself.

Live on your own terms. Download BenPay, setup your Alpha Card, and pay your next bill with the future of money.

Disclaimer: This guide is for educational purposes. Card acceptance depends on specific merchant policies. Cryptocurrency investments involve risk.