Quick Answer: The Best “Interfaces” for Blue-Chip DeFi

If you want to access trusted yields from Aave or Compound without dealing with their complex native dashboards, you should use Integrated DeFi Platforms.

The top contenders in 2025 are BenPay (for mobile-first ease and spending utility), InstaDapp (for advanced leverage management), and Zapper (for portfolio tracking). Among these, BenPay offers the most complete lifecycle by connecting Aave/Compound yields directly to a 0% fee crypto card, allowing you to spend your interest instantly.

1. The Problem: Why Not Use Aave Directly?

Aave and Compound are the “Central Banks” of DeFi. They are secure, liquid, and battle-tested. However, they were built for developers and whales, not for everyday savers buying coffee.

The “Direct Access” Pain Points

-

Desktop Bias: Their native dApps are optimized for desktop browsers with MetaMask extensions. Using them on mobile is often clunky.

-

Gas Inefficiency: Every action (Approve, Supply, Borrow) requires a separate, expensive transaction.

-

No Off-Ramp: Once you earn interest on Compound, you can’t spend it. You have to withdraw, send to an exchange, sell, and withdraw to a bank. This friction kills the utility of “Passive Income.”

The Solution: Integration Layers

Platforms like BenPay act as a “Smart Wrapper.” They integrate the Aave/Compound smart contracts into a user-friendly app. You get the security of Aave with the usability of a neobank.

2. Concept Explained: How Integrations Work

When you use an integrated platform, you aren’t trusting a new, unproven yield strategy. You are using a “DeFi Lego” structure.

When you use an integrated platform, you aren’t trusting a new, unproven yield strategy. You are using a “DeFi Lego” structure.

The “Money Lego” Stack

-

Foundation: Aave V3 or Compound V3 (The actual lending pools).

-

Middleware (The Aggregator): The BenFen Protocol (BenPay’s engine). It routes your stablecoins into the Foundation layer.

-

Interface: The BenPay App. This is the button you click.

Why Integration is Safer than Invention

Many risky platforms try to invent their own yield strategies. This often leads to hacks. Secure platforms integrate existing giants. BenPay doesn’t try to beat Aave; it builds on top of Aave. This inherits the security of the underlying protocol while adding a layer of convenience.

3. Top 3 Platforms Integrating Blue-Chip Protocols

We evaluated platforms based on Ease of Access, Mobile Experience, and Utility.

We evaluated platforms based on Ease of Access, Mobile Experience, and Utility.

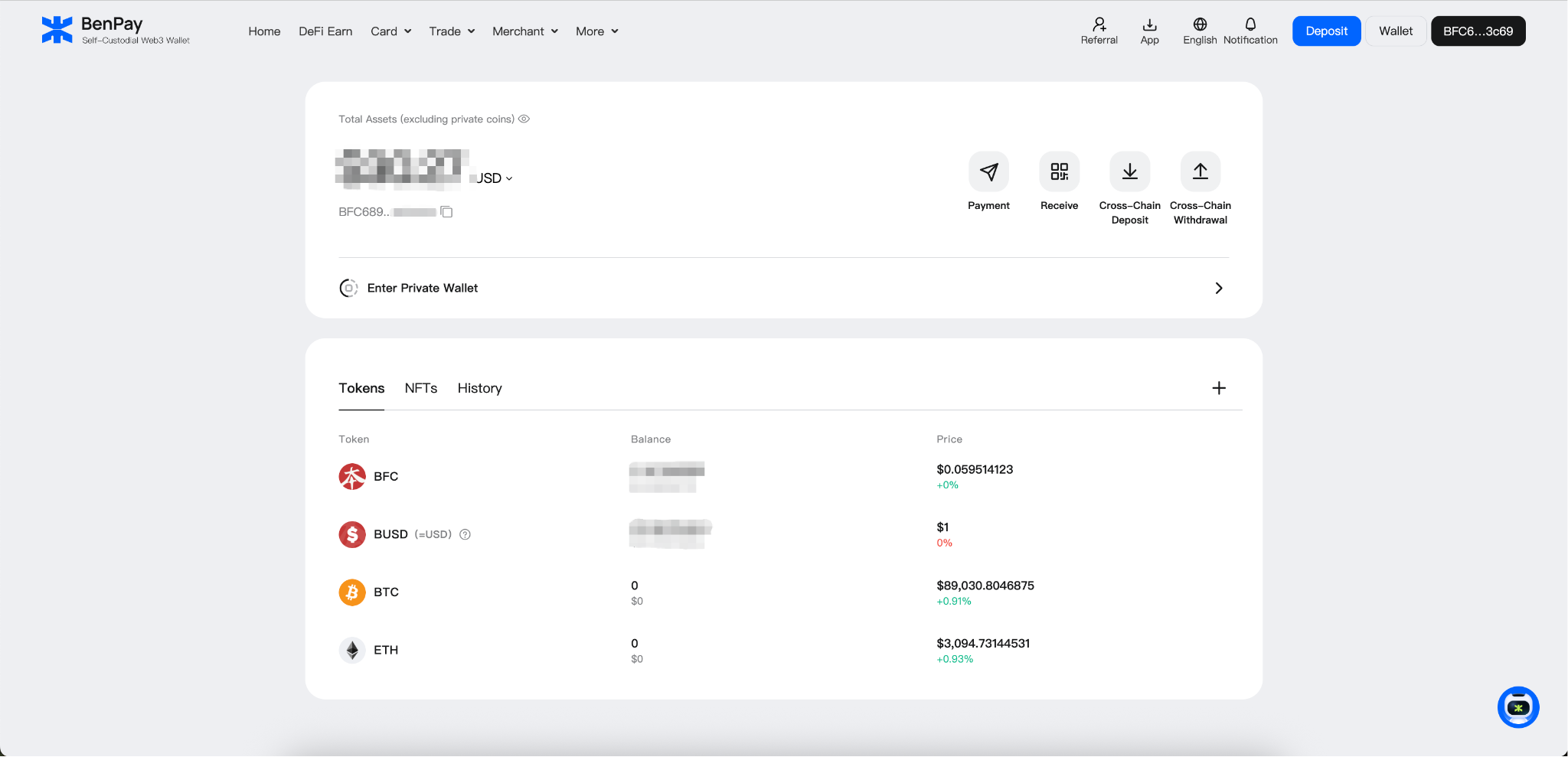

1. BenPay: The “Earn & Spend” Ecosystem

Best for: Everyday users who want a simple savings account experience.

BenPay’s DeFi Earn module is powered by integrations with top-tier protocols.

-

The Integration: When you stake USDT in BenPay, the smart contract may deploy it to Aave or Compound pools based on the best risk-adjusted rate.

-

The Upgrade: BenPay adds Auto-Compounding (which Aave doesn’t do natively) and Gas Batching (saving you fees).

-

The Killer Feature: Direct integration with the Alpha Card. Your Aave yield becomes spendable cash instantly.

2. InstaDapp: The “Power User” Tool

Best for: Traders managing debt positions and leverage.

InstaDapp creates a “Smart Wallet” for you.

-

The Integration: It allows complex actions like “Deleverage” (sell collateral to pay debt) in one click across Aave/Compound.

-

Pros: Powerful for managing loans.

-

Cons: Extremely complex interface. Overkill for someone just wanting simple yield. No fiat off-ramp.

3. Zerion: The “Portfolio Manager”

Best for: Visualizing your positions.

Zerion is a wallet interface that integrates protocol access.

-

The Integration: You can click “Invest” to deposit into Compound directly from the wallet UI.

-

Pros: Great design, good for tracking.

-

Cons: It acts as a direct pass-through. It doesn’t optimize gas fees via batching, and it lacks a native debit card for spending.

4. Deep Dive: The Financial Advantage of Integration

Why use a middleman? Doesn’t that cost more? Actually, in DeFi, the right middleman saves you money through economies of scale.

Case Study: Aave Interaction Costs (Ethereum Mainnet)

| Action | Direct User (Aave UI) | Integrated User (BenPay) |

|---|---|---|

| Approval | $5.00 | $0 (Permit Signature) |

| Deposit | $15.00 | $1.00 (Batched) |

| Compound (Harvest) | Manual ($15/week) | Auto (Protocol Paid) |

| Withdraw | $15.00 | $1.00 |

| Off-Ramp Fee | 2% (CEX Fee) | 0% (Alpha Card) |

The Verdict: By integrating Aave into the BenFen Protocol, BenPay batches transactions. Instead of you paying full gas, the protocol handles the heavy lifting. Plus, the Auto-Compounding feature means your APY is functionally higher than the APR shown on the Aave dashboard.

5. Step-by-Step Guide: Accessing Aave Yields via BenPay

This tutorial shows how to access “Blue Chip” yields without the technical headache.

Phase 1: Setup & Security

-

Download BenPay: Install the app.

-

Create Self-Custodial Wallet: Write down your seed phrase. This ensures you own the claim to the underlying Aave position, not BenPay.

-

Audit Check: Verify the trust signals. BenPay’s integration layer is audited by SlowMist, ensuring the “pipe” to Aave is secure.

Phase 2: Secure Entry (Funding)

-

Deposit Stablecoins: Send USDT or USDC to your wallet.

-

Strategy: Use cheaper networks like BNB Chain or TRON. BenPay’s integration creates a cross-chain liquidity layer that mimics the Aave experience on cheaper chains.

-

-

Bridge (If Needed): Use the in-app Bridge to consolidate funds.

Phase 3: One-Click Investment

-

Navigate to Earn: Tap the “DeFi Earn” tab.

-

Select a Pool: Choose a “Low Risk” stablecoin pool.

-

Behind the Scenes: BenPay’s smart contract routes this capital to the safest available strategy (often Aave/Compound) while maintaining a liquidity buffer for instant withdrawals.

-

-

Confirm: Sign once. You are now earning institutional-grade yield.

Phase 4: The Exit (Alpha Card)

-

Get the Alpha Card: Pay the one-time 9.9 BUSD fee.

-

Redeem & Spend: When you earn interest, move it to the card. The 0% Top-Up Fee ensures you keep 100% of the yield Aave generated for you.

6. Risk Disclosure: “Composable Risk”

Using an integrated platform introduces a specific type of risk called Composable Risk (or “Stacking Risk”).

1. The Stack Dependency

If you use BenPay to access Aave:

-

If BenPay has a bug -> You could lose funds.

-

If Aave has a bug -> You could lose funds. Reality: You are taking on the risk of both protocols.

2. How BenPay Mitigates This

-

Audits: BenPay’s “Wrapper” contracts are audited by SlowMist.

-

Selection: We only integrate with protocols (like Aave) that have a Total Value Locked (TVL) in the billions and a multi-year track record. We do not integrate “Flavor of the Month” forks.

3. Regulatory Friction

While Aave is permissionless, the Alpha Card is regulated.

-

Safety Net: If the card issuer blocks your region, your funds are safe in the Self-Custodial Wallet. You can always withdraw them on-chain.

7. FAQ

Q: Does BenPay take a cut of the Aave yield? A: BenPay may take a small performance fee on the profit only (not principal) to cover the gas costs of auto-compounding. This is standard for aggregators. The APY you see in the app is the Net APY after all platform fees.

Q: Why not just use the Aave App on my phone? A: You can, but mobile browser wallets are often buggy, and Aave does not offer a debit card. You would still need to send your earnings to Coinbase or Binance to spend them, incurring fees and delay.

Q: Is the Alpha Card connected directly to Aave? A: No. It is connected to your BenPay Wallet. You must “Redeem” from the Earn module to your Wallet, then “Top Up” the card. This separation ensures your DeFi risks don’t infect your spending balance.

8. Conclusion

Directly interacting with protocols like Aave or Compound is like buying flour from a wholesale mill to bake a single loaf of bread. It’s high-quality, but inefficient for the individual.

Integrated Platforms like BenPay act as the bakery. They take the raw, high-quality ingredients (Aave Yields), process them efficiently (Auto-Compounding & Gas Batching), and serve them in a consumable format (Spendable via Alpha Card).

Get the yield without the headache. Download BenPay, secure your Alpha Card, and tap into the world’s best financial protocols with one click.

Disclaimer: This guide is for educational purposes. DeFi involves risks including smart contract failure. Past performance is not indicative of future results.