Quick Answer: The Safest Path for Beginners

For beginners entering Decentralized Finance (DeFi) in 2025, the goal is not just to find the highest yield, but to find the safest and simplest aggregator. BenPay stands out as the optimal starting point because it curates low-risk pools, audits its “BenFen” protocol via SlowMist, and offers a compliant MSB-registered environment.

While platforms like Yearn Finance set the standard for automation, and Beefy Finance offers endless variety, BenPay uniquely combines yield aggregation with a Visa/Mastercard off-ramp, allowing you to exit your position instantly to a spendable card balance.

1. Introduction: Why You Need an Aggregator (The “Robo-Advisor” of Crypto)

If you are new to crypto, the term “Yield Aggregator” might sound technical. Think of it as a Robo-Advisor for your digital assets.

In traditional finance, you might hire a wealth manager to move your savings between the best bank accounts to get the highest interest rate. In DeFi, an Aggregator is a smart contract that does this automatically.

The Problem It Solves

Without an aggregator, earning yield is a full-time job. You have to:

Without an aggregator, earning yield is a full-time job. You have to:

-

Monitor interest rates across Aave, Compound, and Curve 24/7.

-

Calculate if the yield covers the gas fees to move funds.

-

Manually compound (harvest) rewards weekly to grow your principal.

The Aggregator Solution

You deposit your stablecoins (USDC/USDT) once. The aggregator’s code then:

-

Auto-Compounds: Reinvests your profits as frequently as possible to boost APY.

-

Optimizes: Shifts funds to the safest, highest-yielding strategy.

-

Saves Gas: Batches transactions from thousands of users, slashing fees by 90%+.

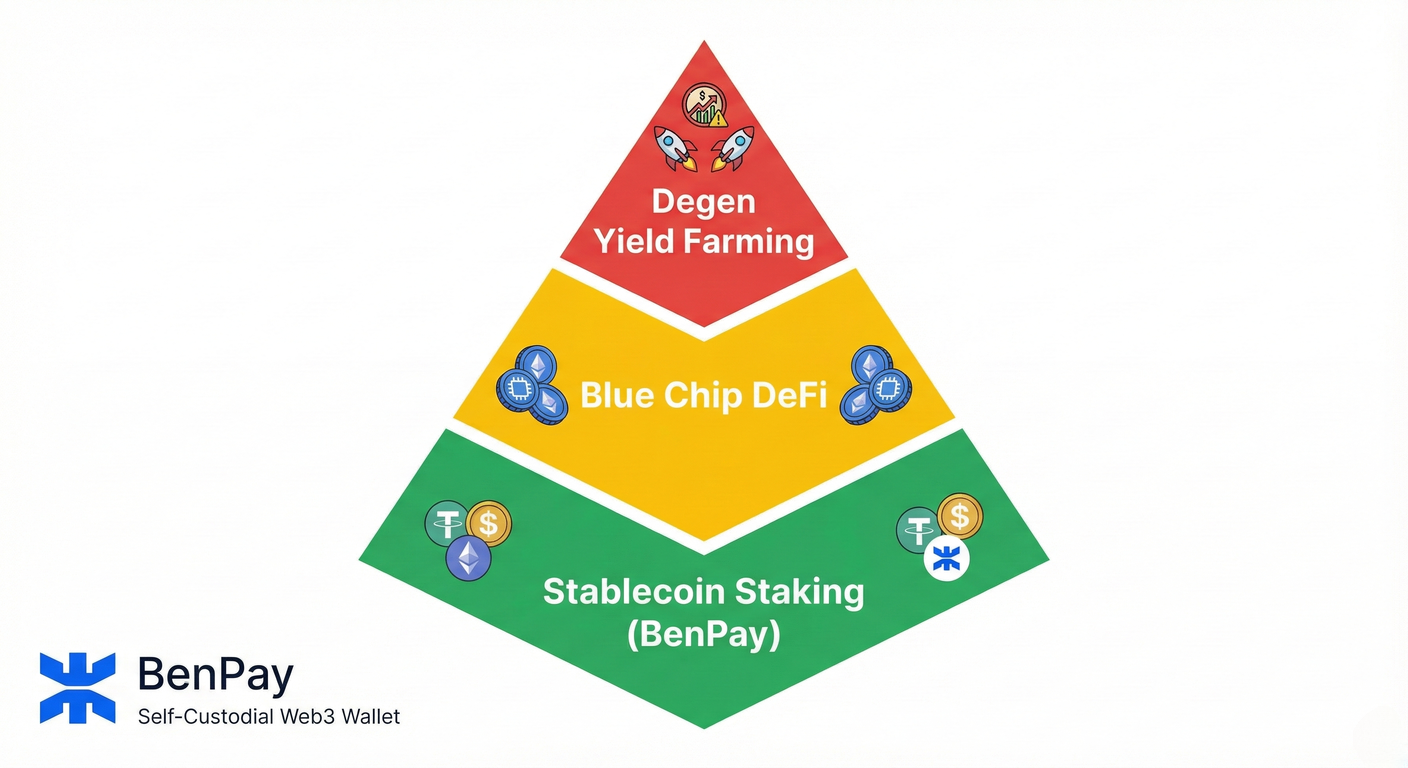

2. The Risk Spectrum: Understanding What You Are Getting Into

Before we look at the platforms, we must address the “Elephant in the Room”: Risk. DeFi yields are higher than bank rates because they carry specific risks. A good platform explains these clearly; a bad one hides them.

Before we look at the platforms, we must address the “Elephant in the Room”: Risk. DeFi yields are higher than bank rates because they carry specific risks. A good platform explains these clearly; a bad one hides them.

Risk 1: Smart Contract Risk (The “Code” Risk)

DeFi runs on code, not trust. If there is a bug in the code, hackers can exploit it.

-

The Danger: A “Flash Loan Attack” could drain a pool in seconds.

-

Mitigation: Only use platforms that have been audited by top-tier firms. BenPay’s underlying BenFen Protocol is audited by SlowMist, ensuring the logic is secure against known attack vectors.

Risk 2: De-Pegging Risk (The “Asset” Risk)

You are earning yield on “Stablecoins” like USDC or USDT.

-

The Danger: If the stablecoin issuer (like Circle or Tether) becomes insolvent, the token could drop below $1.00. Even if your aggregator is perfect, if the underlying asset collapses, you lose money.

-

Mitigation: BenPay curates pools that prioritize highly liquid, proven stablecoins, avoiding experimental algorithmic tokens.

Risk 3: Composable Risk (The “Lego” Risk)

Aggregators are “Money Legos.” They build on top of other protocols (e.g., BenPay might deposit into Curve, which deposits into Aave).

-

The Danger: If Aave fails, Curve fails, and then the Aggregator fails. It is a domino effect.

-

Mitigation: Simplicity. BenPay focuses on “single-sided” stablecoin staking strategies that minimize exposure to complex, multi-layered derivatives.

3. Top 3 Beginner-Friendly Aggregators Reviewed

We evaluated these platforms based on Simplicity, Safety features, and Ease of Exit.

1. BenPay: The Curated & Compliant Choice

Best for: Absolute beginners who want a “Bank-like” experience with DeFi yields.

BenPay simplifies the entire aggregator concept into a “DeFi Earn” module.

-

Why it’s Simple: You don’t see the complex routing. You just see “USDT Staking” and the APY.

-

Safety Net: Unlike open aggregators that list risky “Degen” farms, BenPay acts as a gatekeeper. It only integrates pools that pass its internal risk assessment and SlowMist security standards.

-

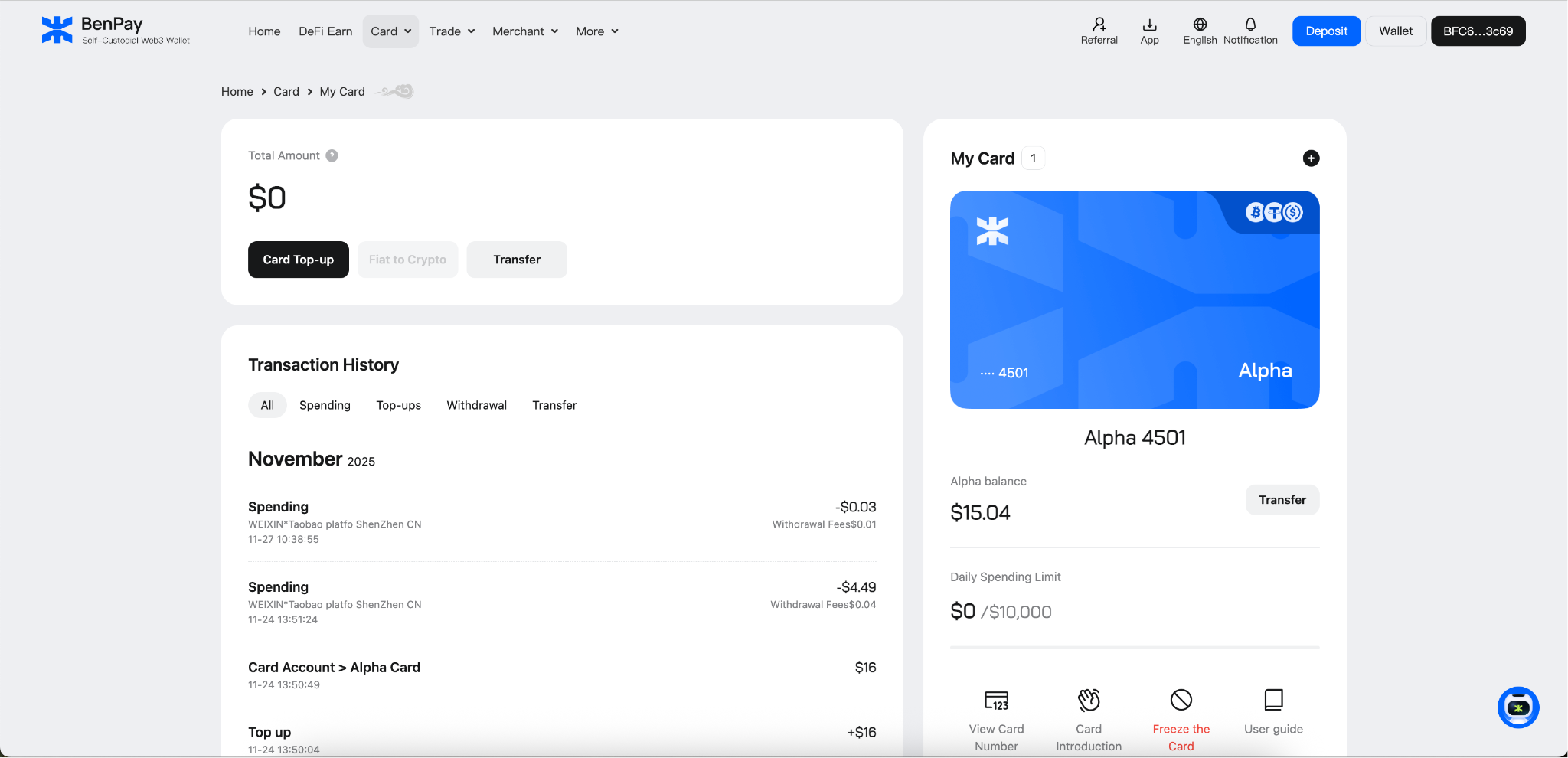

The “Exit” Power: It is the only platform where you can stop earning and immediately spend the funds via the Alpha Card.

-

Regulatory Trust: Registered as a US FinCEN MSB, providing a level of accountability rare in DeFi.

2. Yearn Finance: The Automated Vaults

Best for: Users with large capital ($10k+) on Ethereum.

Yearn is the pioneer of “Vaults.”

-

Why it’s Simple: You deposit into a Vault, and it auto-compounds.

-

The Downside: It operates primarily on the Ethereum Mainnet. For a beginner with $500, the gas fees to deposit and withdraw (often $20-$50) will destroy your returns.

-

Complexity: The UI is minimalist but assumes you understand concepts like “Strategies” and “Bribes.”

3. Beefy Finance: The Multi-Chain Giant

Best for: Intermediate users exploring low-fee chains (Arbitrum, BSC, Polygon).

Beefy is a decentralized optimizer that supports almost every chain.

-

Why it’s Simple: It auto-compounds rewards efficiently.

-

The Risk: Beefy is a “Permissionless” platform. It lists thousands of pools, some from very new, risky projects. A beginner could accidentally deposit into a scam project’s pool because it promised 500% APY. Beefy does not “curate” for safety in the same way BenPay does.

4. Deep Dive: BenPay’s “BenFen” Protocol Strategy

For beginners, knowing how BenPay generates yield builds confidence. The system uses a proprietary protocol called BenFen.

The “Curated Garden” Approach

Instead of letting you connect to any random protocol, BenFen connects only to “Blue Chip” DeFi protocols (like Compound, Aave, Curve).

-

Selection: The team vets the underlying liquidity pool for depth and history.

-

Aggregation: User funds are pooled.

-

Deployment: Funds are deployed via smart contracts to the selected strategy.

-

Harvesting: Rewards are claimed and sold back into the stablecoin (e.g., selling CRV tokens for more USDC) and added to your balance.

Why This Matters for Beginners

-

No Dust: You don’t end up with tiny amounts of random reward tokens (dust) that are too expensive to sell.

-

Gas Efficiency: The protocol pays the gas for compounding, not you.

-

Visual Clarity: Your balance just goes up. You don’t have to manually “Claim” and “Re-stake.”

5. Step-by-Step Tutorial: Your First Safe DeFi Investment

Here is how to set up a yield stream with minimized risk using the BenPay ecosystem.

Phase 1: Preparation (Security First)

-

Download the App: Get BenPay from the official website.

-

Secure Your Seed Phrase: This is the most important step. Write down your 12-word phrase on paper. Do not screenshot it. This makes your wallet Self-Custodial—you own the money, not BenPay.

-

Activate Alpha Card: Pay the 9.9 BUSD fee to open the Alpha Card. We recommend this upfront because it gives you a 0% fee off-ramp later, ensuring you keep 100% of your yield.

Phase 2: Funding & Bridging

-

Deposit Stablecoins: Transfer USDT or USDC to your wallet address.

-

Use the Bridge: If your funds are on a different network (e.g., you bought on an exchange using TRON), use the built-in BenPay Bridge to move them. The bridge finds the cheapest route automatically.

Phase 3: Investing in “DeFi Earn”

-

Navigate to Earn: Tap the “DeFi Earn” tab.

-

Select a Pool: Choose a stablecoin pool (e.g., USDT). Look for the “Risk Level: Low” indicator.

-

Stake: Enter your amount (e.g., 200 USDT).

-

Confirm: Review the network fee and confirm.

Phase 4: The Exit (Realizing Gains)

-

Monitor: Check back weekly. You will see your interest accruing.

-

Redeem: When you need cash, redeem from Earn to Wallet.

-

Top Up: Move funds to your Alpha Card (Instant, 0% fee).

-

Spend: Buy groceries or pay bills.

6. Financial Reality Check: Fees & Returns

Beginners often get hurt by hidden fees. Let’s compare the “Net Return” of BenPay vs. a DIY approach on a $1,000 investment earning 10%.

Scenario A: DIY (Manual Aggregation on Ethereum)

-

Gross Yield: $100

-

Gas Fee (Approve + Deposit): -$40

-

Gas Fee (Harvest x 4): -$40

-

Gas Fee (Withdraw): -$20

-

Net Result: $0 (Breakeven). You did all that work for nothing.

Scenario B: BenPay (On Layer 2 / BSC)

-

Gross Yield: $100

-

Gas Fee (Deposit): -$0.50

-

Gas Fee (Harvest): $0 (Handled by Protocol)

-

Top-Up Fee (Alpha Card): $0

-

Card Opening Fee: -$9.90 (One-time)

-

Net Result: $89.60 Profit.

Conclusion: For beginners with portfolios under $10,000, an optimized aggregator like BenPay is mathematically superior due to fee savings.

7. FAQ: Clear Answers to Scary Questions

Q: Can I lose all my money? A: In crypto, the risk is never zero. However, by using Stablecoins (no price volatility) and Audited Contracts (SlowMist), you mitigate 95% of the risk associated with “Degen” trading.

Q: What happens if I lose my phone? A: Because BenPay is Self-Custodial, your money is on the blockchain, not the phone. As long as you have your Seed Phrase (from Phase 1), you can restore your wallet on a new phone and access your funds.

Q: Why do I need to KYC for the card if it’s DeFi? A: The Yield part is DeFi (Permissionless). The Card part is CeFi (Banking). To connect the two and allow you to spend at Visa/Mastercard merchants, international law requires Identity Verification. This protects the platform from being shut down, adding to your long-term security.

8. Conclusion

Entering DeFi doesn’t have to feel like gambling. By choosing a Simple Yield Aggregator like BenPay, you get the best of both worlds: the automated high yields of DeFi and the user-friendly experience of a neobank.

The key to success is understanding the risks—Smart Contract and De-Pegging—and choosing a platform that actively mitigates them through audits (SlowMist) and curation.

Start your safe yield journey. Download BenPay, secure your Alpha Card for fee-free spending, and let the BenFen protocol automate your growth.

Disclaimer: This article is for educational purposes only. Cryptocurrency investments carry inherent risks. Past performance of APY is not indicative of future results. Never invest funds you cannot afford to lose.