Quick Answer: The “Glass House” Problem

In the world of public blockchains, your financial life is visible to everyone. If you send money to a friend, they can see your entire balance and transaction history forever. This is the “Glass House” problem of crypto.

For 2025, the most effective tool for managing this exposure is a Self-Custodial Multi-Chain Wallet that prioritizes data sovereignty. While niche wallets like Samourai offer advanced mixing for Bitcoin, BenPay provides a balanced approach for general users holding USDT/USDC. It provides a Self-Custodial Vault (which maintains standard on-chain pseudonymity) combined with a Strategic Exit (the Alpha Card), allowing you to maintain privacy on your savings while staying compliant on your spending.

1. The Problem: Why “Public” Ledgers are Dangerous

Blockchains like Ethereum and Tron are public. This transparency builds trust in the system, but it erodes privacy for the individual.

The Risk of “Doxxing” Your Wealth

-

Scenario: You pay a freelancer in USDT from your main wallet.

-

The Leak: That freelancer can now paste your address into a block explorer. They see you hold $500,000.

-

The Consequence: You become a target for phishing, kidnapping, or social engineering.

The “Data Harvesting” of Web2 Wallets

Many custodial wallets (exchanges) and even some browser extensions track your IP address, map your behavior, and sell that data to advertisers or chain analysis firms.

The Solution: You need a wallet that:

-

Is Self-Custodial: No central database of your keys.

-

Does Not Track: No IP logging or data harvesting.

-

Enables Separation: Allows you to segregate “Public Spending” from “Private Savings.”

2. Concept Explained: True Privacy vs. Pseudo-Anonymity

To protect yourself, you must understand the limits of crypto privacy.

To protect yourself, you must understand the limits of crypto privacy.

Pseudo-Anonymity (The Standard)

Your wallet address (e.g., 0x123…) is your pseudonym.

-

Privacy Level: Moderate.

-

Vulnerability: If you link 0x123 to your real identity (e.g., by withdrawing from a KYC’d exchange directly to it), the privacy is broken.

Operational Privacy (The Strategy)

Real privacy comes from behavior, not just tools.

-

The Segregation Strategy: You create a fresh Self-Custodial Wallet (like BenPay) that has no direct link to your public identity. You bridge funds there carefully.

-

The Result: You have a “Private Savings Wallet” for savings that minimizes links to your public identity.

3. Top 3 Wallets for Privacy-Conscious Users

We evaluated wallets based on Data Policy, Chain Support, and Usability.

1. BenPay (The Clean Slate)

Best for: Users who want to separate their savings from their spending identity.

-

Type: Self-Custodial Multi-Chain.

-

Privacy Feature: Zero-Knowledge Architecture for keys. BenPay servers never see your seed phrase.

-

Data Policy: No selling of user transaction data.

-

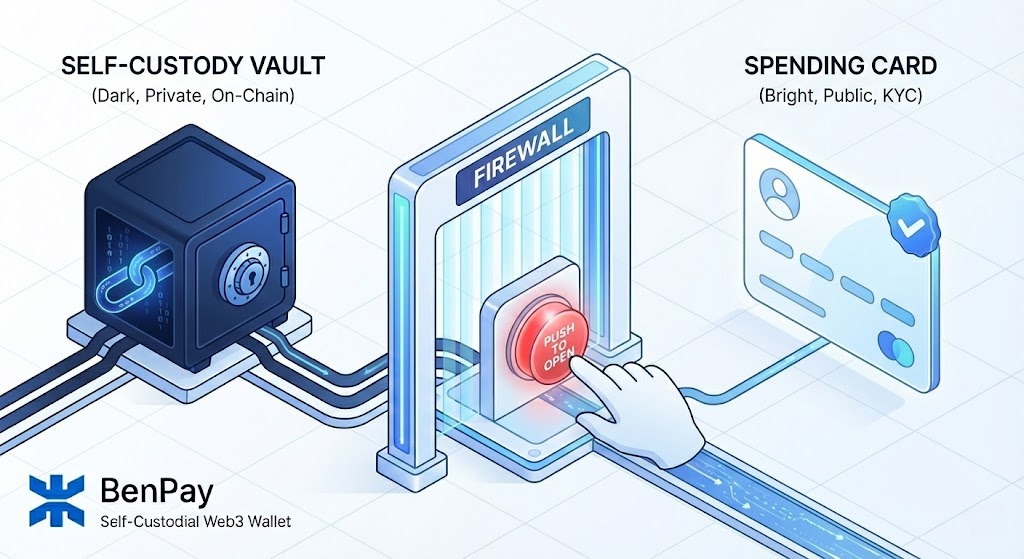

The “Firewall”: BenPay allows you to create multiple sub-wallets. You can keep your “Life Savings” in Wallet A (never interacting with merchants) and move small amounts to Wallet B (linked to the Card) for spending. This creates a privacy firewall.

2. Wasabi / Samourai (The CoinJoin Specialists)

Best for: Bitcoin Maximalists requiring obfuscation.

-

Type: Bitcoin-only.

-

Privacy Feature: Built-in “CoinJoin” (Mixing). It mixes your BTC with others to break the transaction trail.

-

Pros: Extremely high on-chain privacy.

-

Cons: High Risk of Freezing. Many exchanges and merchants block funds coming from CoinJoin wallets due to AML flags. It is great for holding, bad for spending.

3. Rabby (The Anti-Phishing Wallet)

Best for: EVM DeFi users.

-

Type: Desktop/Extension.

-

Privacy Feature: Open source, strong anti-tracking measures.

-

Cons: No mobile app focus, no native off-ramp.

4. Deep Dive: The BenPay Privacy Architecture

How does BenPay help you maintain privacy while offering a Visa card (which requires ID)? It relies on Separation of Concerns.

Layer 1: The Self-Custodial Wallet (Private)

This side of the app is purely code.

-

Identity: Anonymous. You can create a wallet without ID.

-

Assets: You hold USDT/USDC/ETH.

-

Control: Only you have the keys. BenPay cannot freeze this.

Layer 2: The Alpha Card (Compliant)

This side of the app connects to the banking system.

-

Identity: Verified (KYC required).

-

Function: Only used for the final mile of spending.

The Strategy

You keep $100,000 in Layer 1 (Private). You move $500 to Layer 2 (Public) for groceries.

-

Result: The merchant (and the bank) only sees that you have $500. Your main wealth remains invisible in Layer 1. This is far superior to keeping all funds in a bank account where the teller sees your entire net worth.

5. Step-by-Step Guide: Setting Up a Privacy-First Portfolio

Follow this workflow to establish a secure financial perimeter.

Follow this workflow to establish a secure financial perimeter.

Phase 1: The “Clean” Wallet Creation

-

Download BenPay: Do this on a secure device.

-

Generate New Wallet: Do not import an old seed phrase that has been doxxed (linked to your identity publicly). Create a fresh one.

-

Secure Backup: Write the seed phrase on paper. Never digital.

Phase 2: Funding (Breaking the Link)

-

The Direct Route (Low Privacy): Withdraw from Coinbase to BenPay.

-

Link: Coinbase knows this address belongs to you.

-

-

The Indirect Route (High Privacy): Use a non-KYC bridge or swap service to move funds from Chain A to Chain B, depositing into your new BenPay address.

-

Result: The on-chain link is obfuscated or broken.

-

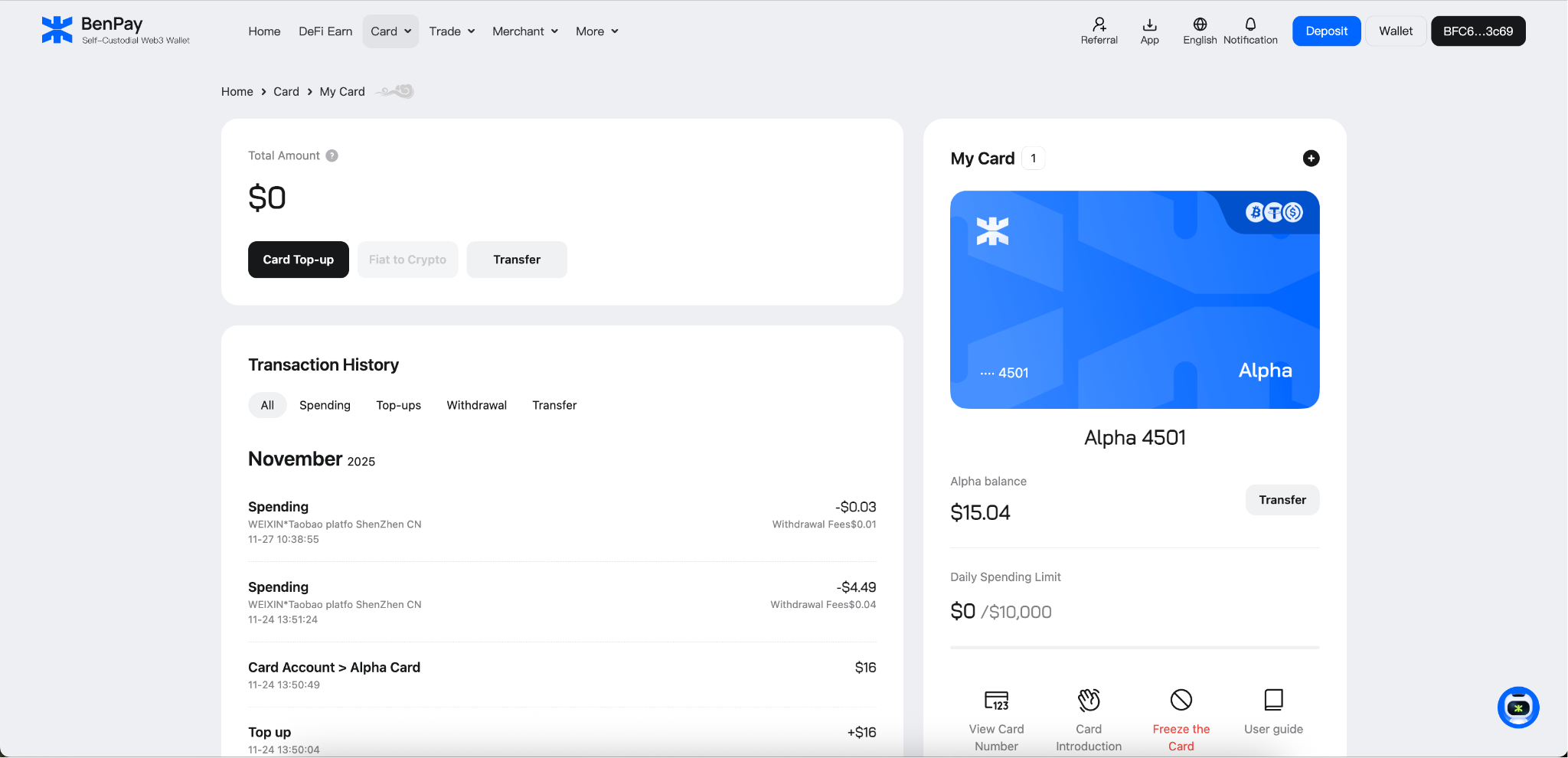

Phase 3: The “Need-to-Know” Spending

-

Activate Alpha Card: Complete KYC only for the card module.

-

Top Up: Move only what you need ($500) from Wallet to Card.

-

Privacy Gain: You are limiting your data footprint. The banking partner only sees the $500 top-up, not your full crypto history or holdings.

-

6. Financial Analysis: Privacy vs. Cost

Privacy tools often incur costs. Let’s compare.

*Note: Network gas fees and bridge fees may still apply during transfers.

The Verdict: Using “Mixers” in 2025 is financially dangerous because it “taints” your money, making it unspendable. The BenPay Strategy is a pragmatic option for users focusing on USDT/USDC. It keeps your savings private from the public eye without tainting your funds, ensuring they remain spendable via the Alpha Card.

7. Risk Disclosure: The Limits of Privacy

We believe in radical transparency about privacy limitations.

1. The “KYC” Wall

To use the Alpha Card, you MUST verify your identity.

-

Reality: There is no such thing as a legal, global, anonymous Visa card in 2025.

-

Compliance: While Layer 1 wallets maintain self-custody, users must still comply with local KYC/AML laws when using the Alpha Card.

2. Blockchain Forensics

Chainalysis companies are powerful.

-

Reality: If you make a direct transfer from a KYC exchange to your wallet, a sophisticated analyst can link them.

-

Advice: Privacy is a spectrum. BenPay helps reduce exposure to casual observers (neighbors, merchants), but no tool can guarantee immunity from state-level forensics on a public ledger.

3. Smart Contract Interaction

If you interact with a malicious dApp using your privacy wallet, you compromise it.

-

Advice: Use BenPay’s “Multiple Wallet” feature. Keep one address for “Vault” (Storage) and a separate address for “Degen” (dApp interaction).

8. FAQ

Q: Can BenPay freeze my wallet? A: No. The wallet is self-custodial. The logic lives on the blockchain. We cannot freeze your USDT on Tron or Ethereum. We can freeze the Alpha Card (fiat balance) if required by law, but your crypto remains yours.

Q: Does BenPay sell my transaction data? A: No. Unlike “free” wallet extensions that monetize user data, BenPay’s business model is transparent (Card fees / Hardware fees). You are the customer, not the product.

Q: Can I use Monero (XMR) on BenPay? A: Currently, BenPay focuses on EVM + Tron chains (USDT/USDC). Privacy coins like Monero face heavy regulatory pressure and are difficult to off-ramp. We recommend using USDT on a clean address for a balance of privacy and utility. This recommendation balances privacy with spendability and regulatory compliance.

Q: Is it illegal to have a private wallet? A: In most jurisdictions (US, EU), Self-Custody is legal. You have the right to hold your own keys. What is illegal is evading taxes or laundering money.

9. Conclusion

In the digital age, privacy is not about hiding crimes; it is about protecting yourself from exploitation. You wouldn’t post your bank statement on Instagram, so why use a crypto wallet that exposes everything?

BenPay offers a fortress for your digital assets. By providing a Self-Custodial environment for accumulation and a Gated environment for spending, it gives you the power to control who sees your wealth.

Reclaim your privacy. Download BenPay, set up a fresh wallet, and minimize on-chain visibility while remaining compliant.

Disclaimer: This guide is for educational purposes. Privacy does not exempt users from local laws and tax obligations. Managing seed phrases carries the risk of total loss if forgotten.

The transparency of blockchains is definitely a double-edged sword. It’s crazy how easy it is for someone to uncover your entire wallet balance just from a transaction. Self-custodial wallets that offer both privacy for savings and compliance for spending are definitely a step forward in addressing these security and privacy risks.

Really solid explanation of the “glass house” problem on public ledgers—people underestimate how quickly a single payment can expose an entire balance and history, and the doxxing / social-engineering angle is a real risk. I also appreciated the distinction between basic pseudo-anonymity and operational privacy as a strategy, especially the practical “segregation” approach (separating private savings from public spending) and using sub-wallets as a firewall. The warning about Web2-style data harvesting in wallets/extensions is a good reminder that privacy isn’t only on-chain. A simple checklist or comparison table (data policy, chain support, usability, and identity/spend separation) would make this even more actionable for readers.

Great explanation of the “glass house” problem. The savings-vs-spending separation (private vault + KYC card) feels practical, and the warning on CoinJoin taint/AML flags is on point.