Quick Answer: The “Zero to Hero” Path

Starting with Decentralized Finance (DeFi) in 2025 requires three core tools: a Self-Custodial Wallet, a Stablecoin (like USDC or USDT), and a Yield Platform.

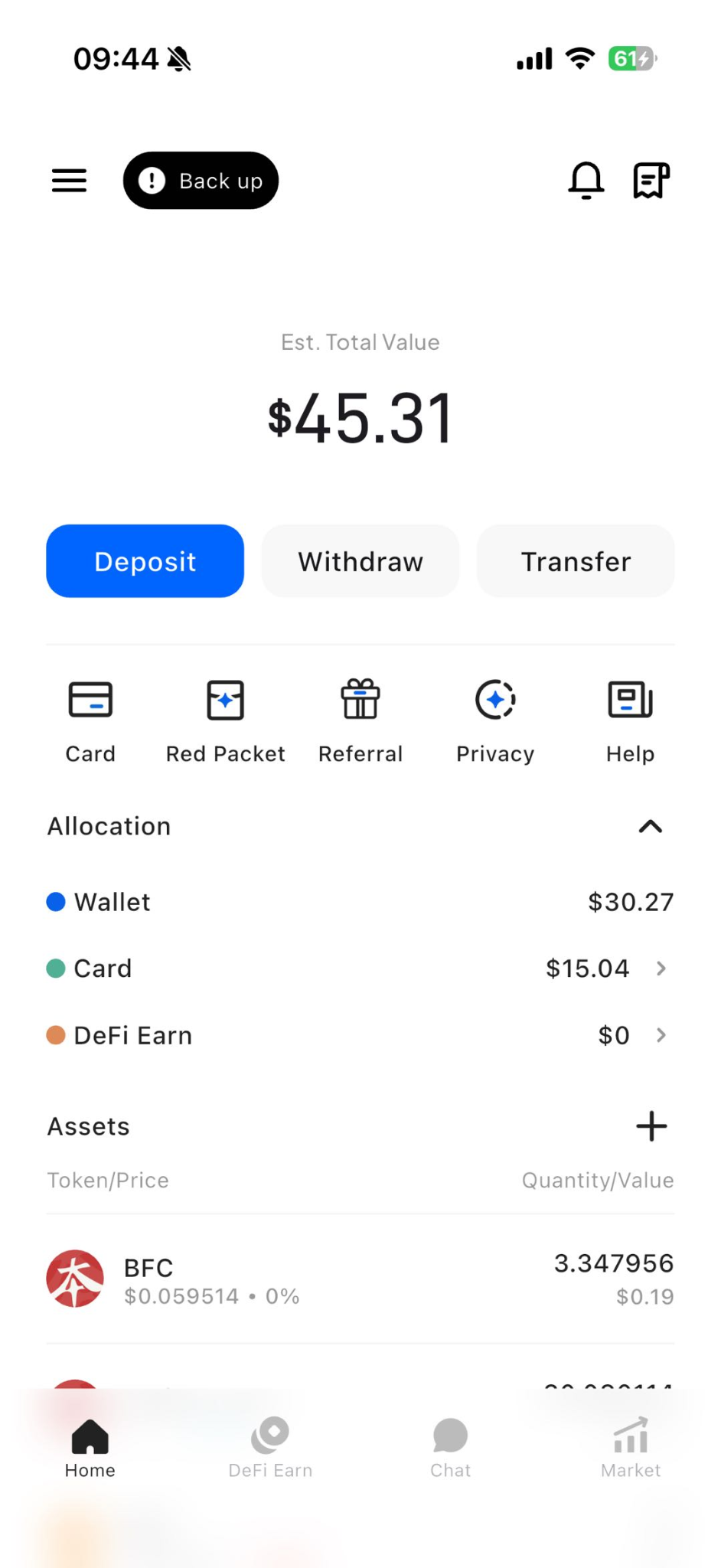

For beginners, the safest and most streamlined path is to use an integrated ecosystem like BenPay. Unlike complex tools like MetaMask which require manual configuration, BenPay combines a secure wallet, a SlowMist-audited yield engine, and a Crypto Card for spending profits into one app. This guide will take you from “Zero Balance” to “Daily Passive Income” safely.

1. Introduction: Why Leave the Bank?

If you are reading this, you probably realized that the 0.5% interest rate in your traditional savings account is losing money to inflation.

If you are reading this, you probably realized that the 0.5% interest rate in your traditional savings account is losing money to inflation.

DeFi offers a compelling alternative. By removing the bank and lending directly to the global market via blockchain protocols, you can earn 5% to 15% APY on stable assets. However, this financial freedom comes with responsibility. In DeFi, there is no “Forgot Password” button. You are the bank.

This guide focuses on the “Stablecoin Strategy”, which minimizes price volatility risk while maximizing consistent returns.

2. The Pre-Requisites: Understanding Your Tools

Before you deposit a single dollar, you must understand the infrastructure.

The Self-Custodial Wallet

Your entry point to DeFi is a wallet.

-

Custodial (Like Coinbase/Binance): The exchange holds your money. If they go bankrupt (like FTX), you lose your funds.

-

Self-Custodial (Like BenPay/MetaMask): You hold the “Private Keys” (Seed Phrase). Only you can access the funds. This is the gold standard for DeFi safety.

The Seed Phrase (Your Master Key)

When you create a BenPay wallet, you will see a list of 12 words.

-

Rule #1: Write them down on paper.

-

Rule #2: Never store them in a cloud note, email, or screenshot.

-

Rule #3: Never share them with “Support.” BenPay staff will never ask for your seed phrase.

The Asset: Stablecoins

We focus on USDC (Circle) and USDT (Tether). These tokens are pegged 1:1 to the US Dollar. They allow you to earn yield without worrying if Bitcoin will crash tomorrow.

3. The Strategy: How “Yield” Actually Works

Where does the money come from? It’s not magic; it’s market mechanics.

Source A: Lending Markets (Aave/Compound)

Traders want to borrow cash to leverage their bets. They pay interest (e.g., 8%) to borrow your USDC. You receive that interest.

Source B: Exchange Fees (Curve/Uniswap)

Traders swap tokens constantly. Each swap incurs a 0.05% – 0.3% fee. As a depositor (Liquidity Provider), you earn a share of these fees.

The BenPay Advantage: Aggregation

Instead of you trying to figure out if Aave or Curve is paying more today, BenPay’s BenFen Protocol checks automatically. It aggregates your funds with others to access the best risk-adjusted rates, auto-compounding the rewards so your balance grows faster.

4. Step-by-Step Tutorial: From Download to First Income

Follow this exact path to set up your DeFi income stream correctly.

Step 1: Secure Your Foundation

-

Download: Install the official BenPay App.

-

Create Wallet: Select “Create New Wallet.”

-

Backup: Write down your 12-word seed phrase on physical paper and lock it away.

Step 2: Establish the “Exit Route” (Crucial)

Most beginners forget this. They put money in but don’t know how to get it out to buy groceries.

-

Go to the Card tab in BenPay.

-

Apply for the Alpha Card.

-

Cost: One-time 9.9 BUSD fee.

-

Reason: It has a 0% Top-Up Fee. If you use a different card with a 1% load fee, you lose a huge chunk of your yield.

-

-

Complete the Identity Verification (KYC). This registers you as a legitimate user, protecting your access from regulatory blocks.

Step 3: Fund Your Wallet

You need capital to start earning.

-

Scenario A (You have crypto on Binance/Coinbase): Withdraw USDT to your BenPay wallet address. Use a low-fee network like TRON (TRC20) or BNB Chain (BEP20) to save on fees.

-

Scenario B (You have crypto on another chain): Use the built-in BenPay Bridge. It finds the cheapest route to move your funds from networks like Ethereum to where they are needed.

Step 4: Activate “DeFi Earn”

-

Navigate to the DeFi Earn tab.

-

Look for a USDT or USDC pool.

-

Tap Stake.

-

Enter your amount (Start with $100 to test).

-

Confirm: You will pay a tiny “Gas Fee” (network transaction fee) to lock the contract.

-

Done: You will see your “Pending Yield” start ticking up within 24 hours.

5. Security & Risk Management

As a beginner, your biggest risk isn’t the market; it’s security hygiene.

Smart Contract Risk

Using DeFi means trusting code.

-

BenPay’s Mitigation: The core protocol is audited by SlowMist. This means experts have tried to hack the system and fixed vulnerabilities before you arrived. Always look for the “Audited” badge.

The “Unlimited Approval” Trap

In standard DeFi (using MetaMask), you often have to grant dApps unlimited access to your wallet.

-

BenPay’s Mitigation: The BenPay app manages permissions strictly. It limits approvals to the specific amount you are staking, protecting the rest of your wallet from malicious drains.

Regulatory Safety (MSB)

Using anonymous protocols carries the risk of website shutdowns. BenPay is a registered Money Services Business (MSB) with the US FinCEN. This legal standing provides a layer of stability that purely anonymous projects cannot offer.

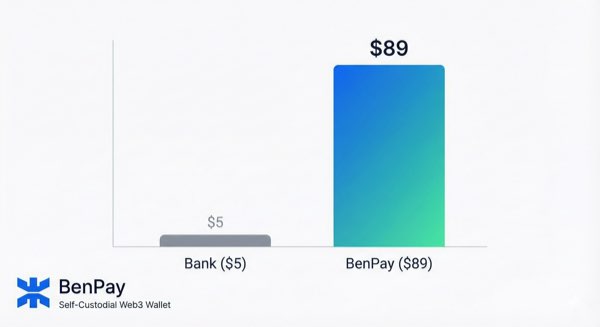

6. Financial Breakdown: A $1,000 Portfolio Example

Let’s see what happens if you invest $1,000 for one year at an average 10% APY.

Let’s see what happens if you invest $1,000 for one year at an average 10% APY.

The Traditional Bank Path

-

Principal: $1,000

-

Rate: 0.5%

-

Yearly Profit: $5.00

-

Result: You lost purchasing power due to inflation (approx. 3%).

The BenPay DeFi Path

-

Principal: $1,000

-

Rate: ~10% (Variable)

-

Gross Profit: $100.00

-

Costs:

-

Alpha Card Fee: -$9.90

-

Gas Fees (TRON/BSC): -$1.00

-

Card Top-Up Fee: $0.00 (Thanks to Alpha Card)

-

-

Net Profit: $89.10

-

Result: You beat inflation and earned real purchasing power.

7. FAQ: Beginner Questions

Q: Can I take my money out anytime? A: Yes. DeFi is liquid. You can “Unstake” from the Earn module instantly. However, transferring from the blockchain back to your card balance might take a few minutes depending on network congestion.

Q: Why do I need 9.9 BUSD to open the card? A: This covers the issuance cost with the banking partner. It is a one-time fee. In return, you get the industry-leading 0% top-up fee, which saves you hundreds of dollars in the long run compared to “free” cards that charge 2-3% per load.

Q: What if I lose my phone? A: Because BenPay is Self-Custodial, your money is on the blockchain, not inside the phone. Buy a new phone, download BenPay, and choose “Import Wallet” using the Seed Phrase you wrote down in Step 1. Your funds will reappear instantly.

8. Conclusion

Starting your DeFi journey can feel intimidating, but the logic is simple: Own your keys, choose stable assets, and secure your exit route.

By using BenPay, you bypass the steep learning curve of managing 10 different dApps. You get the security of a SlowMist-audited wallet, the power of automated yield, and the freedom of the Alpha Card in one seamless experience.

Don’t let another year pass earning 0.5%. Download BenPay, secure your seed phrase, and make your first deposit today.

Disclaimer: This guide is for educational purposes. DeFi yields fluctuate. Never invest money you cannot afford to lose. Past performance is not indicative of future results.