Quick Answer: The “Self-Custodial Salary” Solution

For freelancers and digital nomads paid in crypto, the biggest challenge isn’t earning money—it’s spending it without triggering bank freezes or losing 5% to fees.

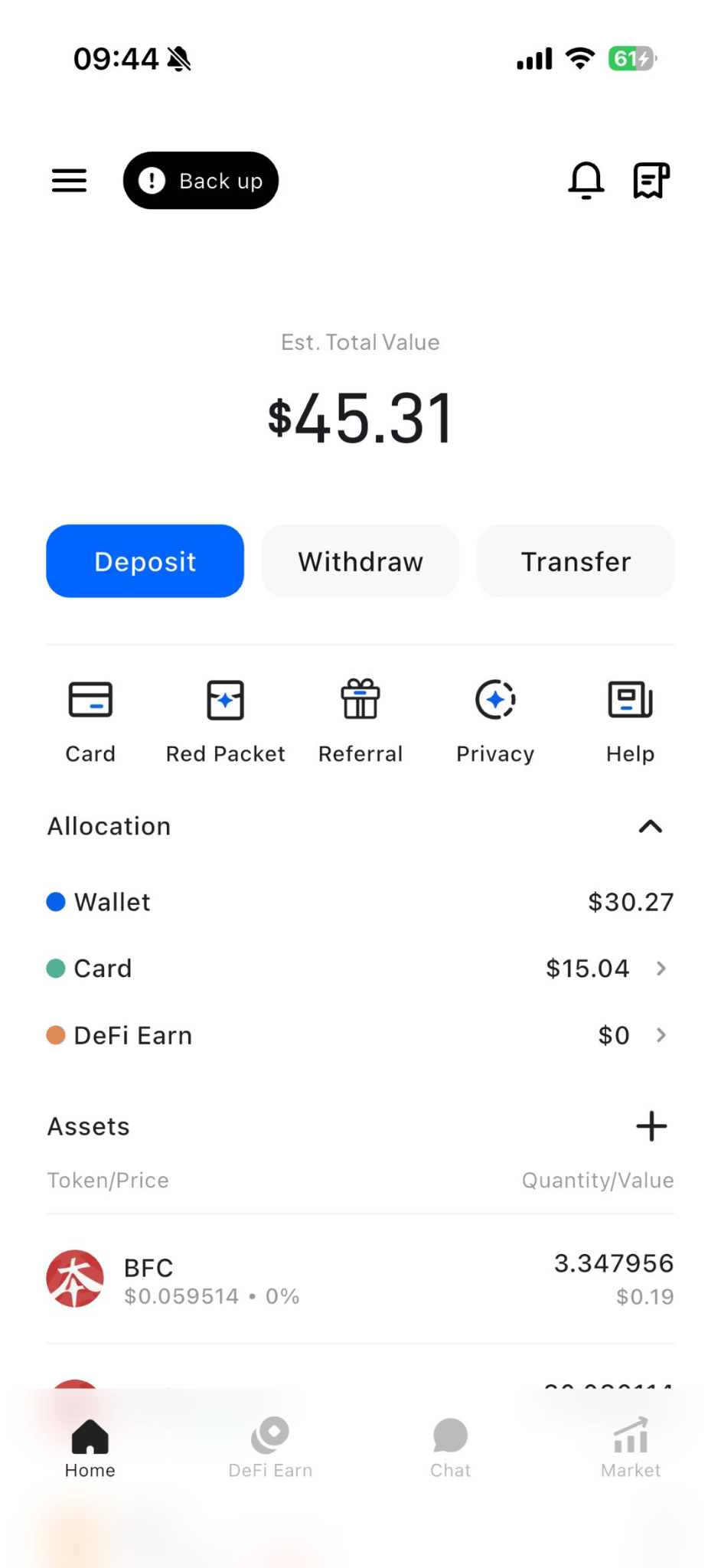

The most efficient setup in 2025 involves receiving payments into a Self-Custodial Wallet and spending via a high-limit Crypto Debit Card. The BenPay Alpha Card is a strong contender for this workflow because it offers 0% Top-Up Fees and a $200,000 balance limit, effectively functioning as a operational account for your USDT/USDC income without the custodial risks of an exchange.

1. The Problem: The “Off-Ramp” Bottleneck for Freelancers

You just closed a $5,000 web design contract. The client pays you in USDT on Tron to save fees. Now you have $5,000 on-chain, but you need to pay rent, buy groceries, and pay for software subscriptions.

You just closed a $5,000 web design contract. The client pays you in USDT on Tron to save fees. Now you have $5,000 on-chain, but you need to pay rent, buy groceries, and pay for software subscriptions.

The Old Way (The “Bank Wire” Nightmare)

-

Receive USDT on a centralized exchange (CEX) like Binance.

-

Sell USDT for Fiat currency (0.5% fee).

-

Withdraw to Bank: Initiate a wire transfer ($15 – $30 fee).

-

Wait: 2-5 business days.

-

The Risk: Your bank sees a large transfer from a “Crypto Entity.” They flag it as suspicious. They freeze your account pending an “Source of Funds” audit. You cannot pay rent.

The New Way (The “Direct Spend” Model)

-

Receive USDT in your BenPay Wallet (Self-Custodial).

-

Top Up Alpha Card: Move $5,000 to the card instantly (0% fee).

-

Spend: Use the card to pay rent or buy groceries immediately.

-

No Banks Involved: You bypassed the SWIFT system entirely.

2. Concept Explained: What is a “Self-Custodial Salary”?

To professionalize your freelance business, you need to understand the difference between holding “Internet Money” and holding “Spendable Income.”

The Infrastructure

-

The Vault (Your Wallet): This is where you receive client payments. It is non-custodial. No one can freeze an incoming payment. It acts as your “Business Savings Account.”

-

The Conduit (The Card): This is your “Business Checking Account.” It holds fiat (USD) ready to spend.

-

The Bridge: The critical link is the ability to move funds from Vault to Conduit instantly and cheaply.

Why “Stablecoins” are Mandatory

Freelancers should invoice in USDT or USDC, not Bitcoin or Ethereum.

-

Reason: If you invoice $2,000 in ETH, and ETH drops 10% before you pay rent, you effectively took a pay cut. Stablecoins lock in the value of your labor immediately.

3. Top 3 Financial Tools for Crypto Freelancers

We evaluated platforms based on Invoicing Features, Spending Limits, and Fees.

1. BenPay Alpha Card (The Daily Driver)

Best for: Freelancers who want to keep 100% of their paycheck.

-

Inbound: Receive USDT/USDC on any major chain (TRON, BSC, ETH, Arbitrum).

-

Spending: 0% Top-Up Fee. This is the killer feature. If you earn $50,000/year, a 1% fee would cost you $500. BenPay saves this.

-

Limits: $200,000 max balance. High enough for taxes, equipment, and lifestyle.

-

Custody: You hold the keys to your salary until the moment you spend it.

2. Bitwage (The Payroll Processor)

Best for: Freelancers whose clients refuse to pay in crypto.

-

Mechanism: You give the client a Bitwage bank account number. The client wires Fiat. Bitwage converts it to Crypto and sends it to your wallet.

-

Pros: Allows you to “get paid in Bitcoin” from traditional corporate clients.

-

Cons: High Fees. Spread + Service fees can total 2-3%. It is a conversion service, not a spending card. You still need a card like BenPay to spend the crypto once you get it.

3. Wise (The Fiat Standard)

Best for: Receiving Fiat payments directly.

-

Mechanism: Multi-currency bank account.

-

Pros: Great for holding EUR, GBP, USD.

-

Cons: Anti-Crypto. Wise frequently closes accounts associated with P2P crypto transactions or exchange withdrawals. It is risky to use as an off-ramp.

4. Step-by-Step Guide: Setting Up Your Crypto Payroll

Here is the professional workflow to transition from “Gig Worker” to “Sovereign Freelancer.”

Phase 1: Client Onboarding (The Wallet)

-

Download BenPay: Create your self-custodial wallet.

-

Get Addresses: Copy your USDT (TRC20) and USDC (ERC20/Arbitrum) addresses.

-

Invoice Template: Update your invoice to include these addresses.

-

Tip: Add a note: “Payment via USDT/USDC accepted. Please use the

$$Network Name$$

network.”

-

Phase 2: The Exit Vehicle (The Card)

-

Activate Alpha Card: Pay the one-time 9.9 BUSD fee.

-

KYC: Complete identity verification. This is unavoidable for spending cards, but it protects your access to the Visa network.

Phase 3: Payday Routine

-

Receive Funds: Notification: “Received 5,000 USDT.”

-

Allocation:

-

Savings: Leave 70% in the Self-Custodial Wallet (or put into DeFi Earn for yield).

-

Expenses: Move 30% to the Alpha Card.

-

-

Spend: Pay your Adobe subscription, WeWork rent, and Uber Eats using the card details.

5. Financial Analysis: The “$5,000 Month” Simulation

Let’s compare the net take-home pay of a freelancer using Upwork/Banks vs. Direct Crypto/BenPay.

Scenario: Client pays $5,000.

Path A: Traditional (Upwork -> Bank)

-

Upwork Freelancer Fee (10%): -$500

-

Withdrawal Fee ($30): -$30

-

Bank FX Spread (if international): -$100 (2%)

-

Take Home: $4,370

-

Time: 5-10 Days.

Path B: Crypto Direct (Wallet -> BenPay Alpha)

-

Client Network Fee (Paid by client): $0

-

BenPay Inbound Fee: $0

-

BenPay Alpha Top-Up Fee: $0

-

Take Home: $5,000

-

Time: 5 Minutes.

The Verdict: By cutting out the platform middlemen and banking rails, you effectively gave yourself a 14% raise ($630/month). Over a year, this is $7,560 in found money.

6. Risk Disclosure: The Freelancer’s Reality

Being your own bank comes with responsibilities. We prioritize transparency about potential points of failure.

1. Smart Contract & Platform Dependency

-

DeFi Risk: If you choose to put your savings into DeFi Earn, remember that funds are deployed into smart contracts (e.g., Aave/Compound). While BenPay’s integration is audited by SlowMist, protocol bugs can still happen.

-

Banking Partner Risk: The Alpha Card relies on centralized banking partners to process Visa payments. If a partner experiences downtime or regulatory issues, card spending could be paused. However, your main savings in the Self-Custodial Wallet remain safe and accessible on-chain.

2. Tax Compliance

Spending crypto is a taxable event in many countries (US, UK, Australia).

-

The Risk: If you spend Bitcoin that went up in value, you owe Capital Gains Tax on every coffee.

-

The Fix: Only accept and spend Stablecoins (USDC/USDT). Since the price doesn’t change ($1 = $1), your capital gains are effectively zero. This simplifies your tax reporting to just “Income Tax,” same as a bank transfer.

3. Regional Limitations

BenPay cards work globally but are restricted in OFAC-sanctioned countries (e.g., Russia, Iran, North Korea). Ensure you reside in a supported jurisdiction before applying for the card.

4. Client Errors

-

The Risk: The client sends USDT on the wrong network (e.g., sending ERC20 tokens to a TRC20 address).

-

The Result: Funds are lost forever.

-

Mitigation: Always provide the full string: “USDT on TRON Network (TRC20)”. Double-check with the client before the first large transfer.

7. FAQ

Q: Can I connect my BenPay card to PayPal? A: Yes. You can add the Alpha Card as a funding source in PayPal. This allows you to pay merchants who don’t accept cards directly but accept PayPal.

Q: Is there a monthly fee for holding the card? A: The Alpha Card has $0 monthly fees. This is ideal for freelancers with irregular income; you aren’t penalized during slow months.

Q: Does BenPay provide invoices/statements? A: You can export your transaction history from the app. This is crucial for your bookkeeping. However, BenPay does not generate invoices for your clients; you must do that yourself.

Q: What if my client only has Fiat? A: You can suggest they use a service like MoonPay or Coinbase to buy USDT and send it to you, or use a hybrid service like Bitwage to convert it before it reaches your BenPay wallet.

8. Conclusion

For freelancers, Crypto is not just an asset class; it is a superior payment rail. It is faster, cheaper, and borderless compared to SWIFT transfers or PayPal.

The BenPay Alpha Card completes the ecosystem. It solves the “Last Mile” problem, allowing you to live entirely on your crypto income without ever touching a traditional bank account. By eliminating the 3-5% friction of traditional off-ramps, it ensures you get paid what you are worth.

Start with a safety check. Download BenPay, complete the verification, and try a small $50 test transaction to verify the payment flow before moving your full salary.

Disclaimer: This guide is for educational purposes. Freelancers are responsible for reporting their own income and taxes in their local jurisdiction. Fees and limits subject to change.