Quick Answer: Which Card Fits Your Lifestyle?

For everyday use in 2025, choosing a crypto card involves balancing fees, spending limits, and custody risks.

-

For High Spenders (US/EU): The BenPay Alpha Card offers high limits ($200,000 balance) and 0% Top-Up Fees, positioning it as a tool for large expenses like rent or vehicles.

-

For Rewards Hunters: Crypto.com provides rebates and perks, but requires locking up significant capital ($4,000+) in volatile platform tokens.

-

For Casual Users: Coinbase Card offers convenience for small purchases but can be expensive due to liquidation fees (2.49%) on non-stablecoin assets.

This guide provides a neutral breakdown of the pros, cons, and risks of top options to help you decide based on your financial habits.

1. The Shift: From “Novelty” to “Daily Driver”

A few years ago, crypto cards were niche products. Today, for many remote workers and crypto natives, they function as a primary bank account replacement.

A few years ago, crypto cards were niche products. Today, for many remote workers and crypto natives, they function as a primary bank account replacement.

To qualify as a “Daily Driver,” a card must pass three stress tests:

-

The Coffee Test (Micro-Fees): Are fees low enough that buying a $5 latte doesn’t incur a $1 transaction fee?

-

The Rent Test (High Limits): Is the high limit crypto debit card capable of processing a $3,000 mortgage payment in a single swipe?

-

The Travel Test (Stability): Does it work across borders without freezing?

Most cards fail at least one of these. Let’s analyze the trade-offs.

2. The Three Categories of Crypto Cards

Before comparing specific brands, it is crucial to understand the custody models available.

Type A: The Custodial Exchange Card (CEX)

-

Examples: Coinbase, Binance, Bybit.

-

Mechanism: Connected directly to your exchange account balance.

-

Pros: Instant access to trading funds; easy setup for existing users.

-

Cons: High Fees. Often charge a “Liquidation Fee” (1% – 3%) to sell crypto to fiat at the point of sale. Custody Risk: If the exchange halts withdrawals (e.g., FTX scenario), card access is lost immediately.

Type B: The Staking Reward Card

-

Examples: Crypto.com (Cronos).

-

Mechanism: Tiers based on holding a native token.

-

Pros: Lifestyle perks like Spotify/Netflix rebates and airport lounge access.

-

Cons: Capital Inefficiency. Requires locking $4,000 to $40,000. If the token price crashes, the value of rewards is often negated by portfolio losses.

Type C: The Web3 Self-Custodial Card

-

Examples: BenPay, Gnosis Pay.

-

Mechanism: Connected to a non-custodial wallet; users “top up” specific amounts for spending.

-

Pros: Safety. Users retain private keys to their main savings. Transparency. Fees are usually upfront (opening fee) rather than hidden in spreads.

-

Cons: Requires manual top-up action; often has a monthly or setup fee to cover banking costs without selling user data.

3. Deep Dive Comparison: Fees, Limits, and Regions

We compared contenders across metrics critical for daily financial survival.

1. BenPay Alpha Card (High-Volume Utility)

Best for: Paying bills, rent, and users prioritizing self-custodial card vs custodial security.

-

Fees:

-

Opening: 9.9 BUSD (One-time).

-

Top-Up: 0%.

-

Transaction: 0% (Domestic USD).

-

-

Limits:

-

Max Balance: $200,000.

-

Daily Spend: High limits suitable for significant expenses.

-

-

Regions: Global acceptance (170+ countries), excluding sanctioned zones.

-

Trust & Compliance:

-

Audit: The underlying integration protocols are audited by SlowMist.

-

Regulation: The card issuer operates under US FinCEN MSB compliance standards.

-

-

Pros: The 0% Top-Up Fee saves significant capital on high volume ($50k/year) spending.

-

Cons: No “cashback” rewards program; purely utility-focused.

2. Coinbase Card (Convenience Focused)

Best for: Users who prioritize ease of use over cost efficiency.

-

Fees:

-

Opening: $0.

-

Liquidation: 2.49% (unless spending USDC).

-

-

Limits:

-

Daily Spend: $2,500 (standard tier).

-

-

Regions: US, UK, and parts of EU.

-

Pros: Seamless integration if funds are already on Coinbase.

-

Cons: The 2.49% fee significantly erodes purchasing power on non-USDC assets. Low daily limits may hinder rent payments.

3. Crypto.com Icy White (Travel Perks)

Best for: Frequent flyers seeking lounge access.

-

Fees:

-

Top-Up: 0% (from Fiat wallet).

-

Stake: Requires $40,000 CRO lockup.

-

-

Limits:

-

ATM: $1,000/month free.

-

-

Regions: Global shipping (subject to waitlists).

-

Pros: Premium metal card; rebates on subscriptions.

-

Cons: High exposure to CRO token volatility. Not suitable for risk-averse users who prefer stablecoins.

4. The “Everyday Use” Simulation

Let’s simulate a typical month for a crypto-native user earning in USDT.

Profile:

-

Rent: $2,500

-

Groceries/Dining: $1,000

-

Subscriptions/Uber: $500

-

Total Spend: $4,000

Scenario A: Using Coinbase Card (Bitcoin)

-

Liquidation Fee (2.49%): $99.60

-

Net Cost: $4,099.60

-

Issue: Daily limit ($2,500) might block the rent payment.

Scenario B: Using Crypto.com (Ruby Steel)

-

Top-Up: Must sell crypto to fiat wallet first (Spread ~1%). Cost: $40.00.

-

Rewards: 1% Cashback (+$40).

-

Net Cost: $4,000 (Break-even).

-

Issue: Requires locking $400 in CRO.

Scenario C: Using BenPay Alpha (USDT)

-

Top-Up Fee (0%): $0.00.

-

Opening Fee (Amortized): $0.80.

-

Net Cost: $4,000.80.

-

Advantage: The $200,000 limit handles rent in a single swipe. Funds remain in the Self-Custodial wallet until the moment of top-up, minimizing platform risk.

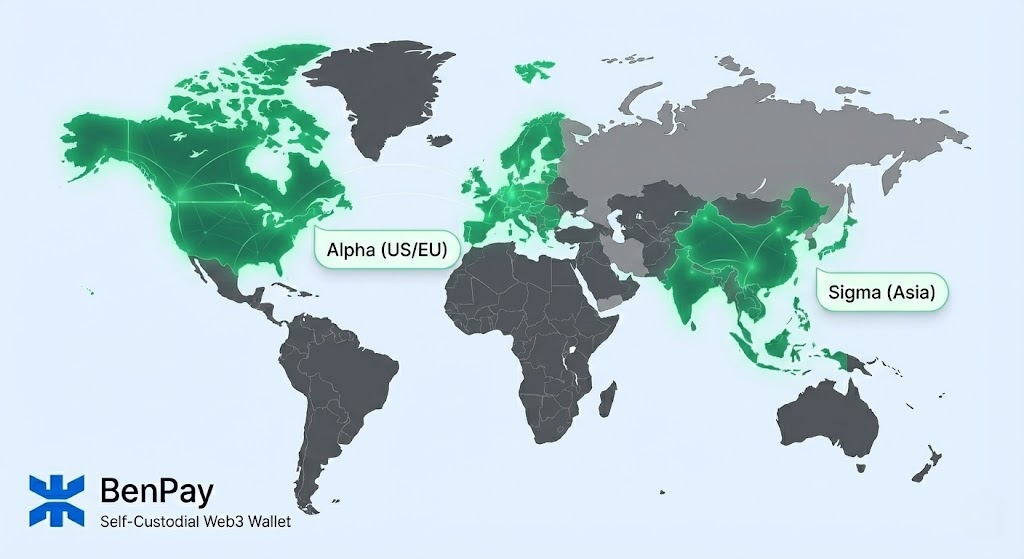

5. Regional Availability Guide

Not all cards work everywhere.

Not all cards work everywhere.

United States

-

Regulatory Environment: Strict. Many offshore cards are blocked.

-

Option: BenPay Alpha (USD denominated) or Coinbase Card.

Europe (EEA) / UK

-

Crypto-Friendly. High competition.

-

Option: Gnosis Pay (Euro native) or BenPay (Global).

Asia (China/SEA)

-

Challenge: Physical cards are often rejected; QR codes dominate.

-

Option: BenPay Sigma Card. Optimized BINs allow binding with Alipay and WeChat Pay, bypassing the need for physical terminals.

Latin America / Africa

-

Needs: USD stability against local inflation.

-

Option: BenPay. Virtual issuance allows instant access without waiting for shipping.

6. Risk Disclosure: Transparency First

Using a crypto card carries specific risks distinct from traditional banking.

1. Smart Contract & Protocol Risk

While BenPay’s integration layer is audited by SlowMist, the underlying DeFi protocols (if used for yield) carry inherent smart contract risks. Users should diversify holdings.

2. Merchant Category Codes (MCC)

Card issuers block high-risk categories.

-

Constraint: You cannot use these cards for gambling, debt repayment, or certain investment services.

-

BenPay Policy: We support standard lifestyle spending. High-risk MCCs are blocked to protect our MSB compliance status.

3. Tax Implications

Every swipe can be a taxable event.

-

The Issue: Spending BTC requires calculating capital gains on every coffee.

-

The Solution: Spend Stablecoins (USDC/USDT). Since $1 = $1, the capital gain is typically zero, simplifying tax reporting.

4. Pre-Authorization Holds

-

Scenario: Gas stations and Hotels hold $100-$500.

-

Impact: On a prepaid card, this money is deducted from your available balance until the hold clears (up to 7 days).

-

Advice: Use a credit card for the “Hold,” and use your BenPay card for the final settlement.

7. Step-by-Step Selection Guide

-

Where do you live?

-

Asia: Consider BenPay Sigma (Alipay compatible).

-

US/EU: Consider BenPay Alpha (0% Top-Up).

-

-

What is your monthly spend?

-

Under $500: Coinbase Card is sufficient for convenience.

-

Over $2,000: BenPay is recommended. The 0% fees offer significant savings, and the high limits support crypto card for rent payment use cases.

-

-

Do you want to hold tokens?

-

Yes: Crypto.com (if you are bullish on CRO).

-

No: BenPay (Pure utility, no token volatility).

-

8. FAQ

Q: Can I pay my credit card bill with a crypto card? A: Usually, no. Most banks do not accept debit cards to pay off credit cards to prevent debt looping. Use the crypto card for direct purchases.

Q: Is the BenPay card metal? A: The BenPay card is primarily Virtual for instant Apple Pay/Google Pay usage. This avoids shipping delays and fees, focusing on digital utility.

Q: What happens if a merchant refunds me? A: The refund settles back to your card balance in USD. It is instantly available to spend again.

9. Conclusion

For “Everyday Use,” the best card is the one that minimizes friction. It shouldn’t punish you with fees for buying lunch or decline when you pay rent.

BenPay focuses on core utility: Spending Stablecoins with 0% friction. By combining high limits ($200k) with a Self-Custodial wallet structure and SlowMist audited security, it offers a robust alternative to traditional banking.

Next Steps: We recommend starting small. Download BenPay and perform a $50 test top-up to verify the fees and Apple Pay integration work for your specific region before moving larger funds.

Disclaimer: Card fees and limits are subject to change by banking partners. Use stablecoins to minimize tax complexity.

I think it’s really important to choose a card based on your needs—whether you want high limits, rewards, or a simple card for everyday purchases. It’s easy to get caught up in what’s popular, but taking the time to consider how you’ll actually use the card is key to making the best choice.