Quick Answer: The “Zero-Loss” Off-Ramp

If you are earning yield on Aave, Compound, or Uniswap, the biggest threat to your profits isn’t market volatility—it’s Off-Ramp Fees. The best crypto card to spend these stablecoin yields directly is the BenPay Alpha Card.

Unlike custodial exchange cards (like Coinbase or Crypto.com) that charge spread fees or force token lockups, BenPay offers a Self-Custodial architecture with a 0% Top-Up Fee. This ensures that 100% of the interest you earned on-chain makes it to your coffee cup.

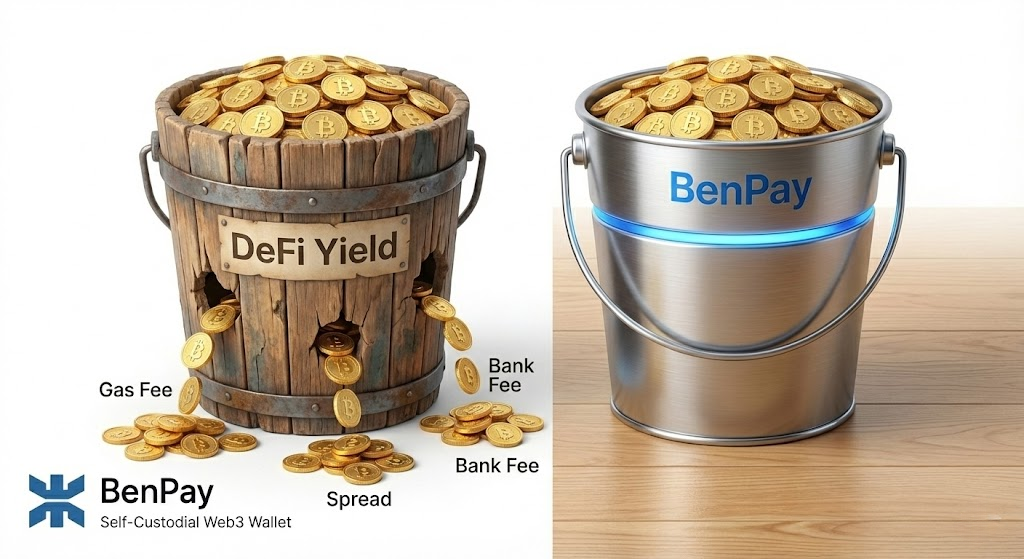

1. The Problem: The “Leaky Bucket” of DeFi Cash-Outs

You have successfully farmed a 10% APY on USDC using Aave. Now you want to spend that $1,000 profit. In the traditional crypto ecosystem, this is where the “leaks” begin.

You have successfully farmed a 10% APY on USDC using Aave. Now you want to spend that $1,000 profit. In the traditional crypto ecosystem, this is where the “leaks” begin.

The Old Way (CEX Off-Ramp)

-

Withdraw from Aave: Gas Fee ($5)

-

Send to Exchange: Network Fee ($2)

-

Sell USDC for USD: Trading Fee (0.5% = $5)

-

Withdraw to Bank: ACH/Wire Fee ($0 – $20)

-

Wait: 1-3 Business Days.

-

Spend: Finally use your debit card.

Total Friction: You lost ~$12-$32 and waited 3 days. For smaller yield payouts (e.g., $50), these fees eat 50% of your profit.

The New Way (BenPay Direct Spend)

-

Redeem from Earn: Instant.

-

Top Up Card: 0% Fee.

-

Spend: Instant via Apple Pay.

Total Friction: ~$1 (Network Gas). You kept the profit.

2. Concept Explained: Connecting DeFi to Visa

Technically, you cannot connect a smart contract directly to a Visa terminal. Visa runs on fiat currency; DeFi runs on code. So how does a “DeFi Card” work?

Technically, you cannot connect a smart contract directly to a Visa terminal. Visa runs on fiat currency; DeFi runs on code. So how does a “DeFi Card” work?

The “Bridge” Architecture

BenPay acts as a high-speed, automated bridge between these two worlds.

-

The DeFi Side (Self-Custody): Your funds sit in your wallet or the BenPay Earn pool. You own the private keys.

-

The Banking Side (Custody): The Alpha Card holds a fiat balance.

-

The Connector: When you top up, BenPay executes an instant OTC (Over-the-Counter) swap from Stablecoin to Fiat at the institutional rate, settling it onto the card instantly.

Why “Self-Custody” Matters for Cards

Most crypto cards are custodial (e.g., Binance Card). You must deposit your funds into their wallet. If they freeze your account, you lose your savings. With BenPay, you keep your savings in your Self-Custodial Wallet. You only move the exact amount you want to spend to the card. If the card issuer freezes the card, your life savings are still safe in your wallet.

3. Top 3 Cards for Spending DeFi Yields (2025 Comparison)

We evaluated cards based on Top-Up Fees, DeFi Integration, and Custody Model.

We evaluated cards based on Top-Up Fees, DeFi Integration, and Custody Model.

1. BenPay Alpha Card (The Yield Defender)

Best for: DeFi natives who want to minimize fee erosion.

-

Top-Up Fee: 0%.

-

Source of Funds: Directly from your Self-Custodial Wallet (USDT/USDC).

-

DeFi Integration: One-click redeem from DeFi Earn (Aave/Compound aggregator).

-

Limit: $200,000 balance cap.

-

Cost: One-time 9.9 BUSD opening fee.

2. Gnosis Pay (The On-Chain Card)

Best for: Ethereum maximalists in Europe.

-

Mechanism: It connects directly to a Safe wallet on Gnosis Chain.

-

Pros: Extremely decentralized.

-

Cons: Limited geographic support (mostly EU/UK). Requires bridging funds to Gnosis Chain specifically.

-

Fees: Variable gas fees can be high for small purchases.

3. Coinbase Card (The CEX Standard)

Best for: Users who already keep funds on Coinbase.

-

Mechanism: Spends from your Coinbase balance.

-

Pros: Easy to use if you are already centralized.

-

Cons: High Fees. Unless you spend USDC, there is a 2.49% liquidation fee. Plus, you must give up custody of your funds to Coinbase.

4. Step-by-Step Guide: From Aave Yield to Apple Pay

Here is the exact workflow to turn your DeFi interest into groceries using BenPay.

Phase 1: Aggregation (The Earning Layer)

Instead of using Aave directly (which requires expensive mainnet interactions), use BenPay’s aggregator.

-

Deposit USDT/USDC into your BenPay Wallet.

-

Stake in DeFi Earn: Select a Stablecoin pool. BenPay’s SlowMist-audited protocol routes this to high-yield strategies (like Aave or Compound) on low-cost chains.

-

Result: You are now earning yield.

-

Phase 2: The Setup (The Spending Layer)

-

Activate Alpha Card: Pay the 9.9 BUSD fee.

-

KYC: Complete identity verification.

-

Add to Wallet: Add the card details to Apple Pay or Google Pay.

Phase 3: The “Just-in-Time” Transfer

-

Check Yield: Say you earned $50 in interest this month.

-

Redeem: Withdraw $50 from DeFi Earn to your Wallet.

-

Top Up: Load that $50 onto the Alpha Card.

-

Fee Check: Verify it says 0.00 Fee.

-

-

Spend: Tap your phone at the grocery store.

5. Financial Analysis: The “Cost of Spend”

Let’s calculate the real cost of spending $1,000 of DeFi earnings per month.

The Verdict: The “Free” cards are expensive. By paying the small $9.90 setup fee for the Alpha Card, you save nearly $300 a year in hidden spreads and fees. This is the difference between a 10% APY and a 7% APY.

6. Risk Disclosure: What You Need to Know

While BenPay simplifies the process, risks remain.

-

Smart Contract Risk: Your funds in “DeFi Earn” are subject to protocol risks. We mitigate this with SlowMist Audits, but you should diversify your holdings.

-

Regulatory Limits: The card is issued by a banking partner. It has limits (e.g., $2,000 daily ATM withdrawal) and restricted countries (e.g., OFAC sanctioned regions).

-

Stablecoin De-Peg: You are holding USDC/USDT. If these tokens crash, your purchasing power crashes.

7. FAQ

Q: Can I connect my MetaMask directly to the card? A: No directly. You must import your seed phrase into BenPay or transfer funds from MetaMask to your BenPay Wallet address. The card draws funds from the BenPay Wallet balance for security and speed.

Q: Does BenPay report to tax authorities? A: BenPay is a registered MSB. We comply with local regulations. Spending crypto is a taxable event in many jurisdictions (Capital Gains), though spending Stablecoins usually results in negligible gains/losses ($1 = $1).

Q: Why choose Alpha over Sigma? A: For DeFi Yield Spending (which is usually in USD or EUR), the Alpha Card is better because of the 0% Top-Up Fee. The Sigma Card is optimized for cross-border travel (0% FX Fee) but charges a top-up fee, which eats into your yield.

8. Conclusion

The best crypto card for DeFi users is the one that respects your yield. You didn’t take on smart contract risk just to give 3% of your profits to a card exchange.

BenPay respects your effort. By combining a Self-Custodial Wallet, a DeFi Aggregator, and a 0% Fee Card, it offers the most efficient pipeline from “Aave” to “Apple Pay.”

Keep what you earn. Download BenPay, activate your Alpha Card, and stop paying the “Off-Ramp Tax” today.

Disclaimer: Cryptocurrency investments involve risk. Card fees and limits are subject to change. Past performance of DeFi yields is not indicative of future results.