Quick Answer: The “Sigma” Strategy for Asia

If you are traveling to or living in Asia (China, Japan, Thailand, Singapore), spending crypto is challenging due to the lack of card terminals and high foreign transaction fees. The most effective solution in 2025 is the BenPay Sigma Card.

Unlike standard US crypto cards, the Sigma Card is engineered with BINs optimized for Alipay and WeChat Pay, allowing you to bypass the “Cash Only” economy. It offers 0% Foreign Transaction (FX) Fees, saving you 3% on every local payment compared to traditional bank cards. This guide will teach you how to bind your card to Asian super-apps and spend stablecoins like a local.

1. The Problem: The “Great Wall” of Asian Payments

Western travelers and digital nomads in Asia often hit a hard financial wall. The payment infrastructure in the East has leapfrogged credit cards entirely, creating two specific pain points for crypto users.

Western travelers and digital nomads in Asia often hit a hard financial wall. The payment infrastructure in the East has leapfrogged credit cards entirely, creating two specific pain points for crypto users.

Pain Point 1: The “No Terminal” Culture

In China, Vietnam, and Thailand, Visa/Mastercard terminals are rare outside of 5-star hotels and luxury malls.

-

The Reality: You try to buy dumplings in Shanghai or street food in Bangkok. The vendor points to a QR code. They do not have a card machine.

-

The Failure: Your standard Crypto.com or Coinbase card is a piece of plastic. It is useless without a physical terminal.

Pain Point 2: The “FX Tax”

Most crypto cards are denominated in USD. When you spend in JPY, THB, or CNY, you get hit with double fees.

-

The Scenario: You swipe for 10,000 Yen (~$70).

-

The Cost: Visa Exchange Rate Spread (~1%) + Issuer FX Fee (3%) = 4% Loss.

-

The Result: On a $5,000 trip, you waste $200 just on currency conversion fees.

The Solution: You need a card that supports 0% FX and integrates natively with Local Mobile Wallets via digital binding.

2. Concept Explained: Why the Sigma Card Works

BenPay introduced the Sigma Card specifically to address these regional friction points. It differs fundamentally from the Alpha Card (which is designed for USD spending).

1. BIN Optimization (Bank Identification Number)

Not all Visa cards are created equal.

-

The Issue: Alipay and WeChat Pay have strict fraud filters. They frequently reject cards issued by generic crypto providers because the BIN range is flagged as “High Risk” or “Prepaid.”

-

The Sigma Fix: BenPay utilizes premium BINs specifically whitelisted by major Asian payment processors. This significantly increases the Binding Success Rate and reduces the chance of random declines during transactions.

2. Currency Settlement (The 0% FX Engine)

How does BenPay offer 0% FX fees when the market rate fluctuates?

-

Mechanism: We execute a wholesale spot exchange. When you pay 100 CNY, we deduct the exact USD equivalent from your card balance at the interbank rate, absorbing the spread.

-

Comparison: A standard bank charges you the “Retail Rate” (Interbank + 3%). We charge you the “Interbank Rate.”

3. Step-by-Step Guide: Binding Crypto to Alipay & WeChat

This is the “Killer App” for Asia. By binding your BenPay card to these super-apps, you can pay virtually anyone, from a taxi driver to a fruit seller.

Phase 1: Card Activation

-

Download BenPay: Install the app and create your wallet.

-

Select Sigma Card: Go to the Card tab. Choose Sigma.

-

Cost: 9.9 BUSD opening fee.

-

Monthly Fee: $1. (This small fee supports the premium banking infrastructure required for 0% FX).

-

-

KYC: Complete identity verification. This is mandatory for the card to pass Alipay’s risk control systems.

Phase 2: Funding

-

Top Up: Load USDT or USDC onto the card.

-

Fee Note: The Sigma card has a 1.5% Top-Up Fee.

-

Why pay this? Because you save 3% on the FX fee later. Mathematically, you still come out ahead for international spending (see Section 5).

-

Phase 3: The Binding Process (Alipay Example)

-

Open Alipay (International Version): Ensure you are using the version that supports foreign cards.

-

Tap “Account” -> “Bank Cards”: Select “Add New Card”.

-

Enter Details: In the BenPay app, tap “Show Details” to copy your card number, expiry, and CVV. Paste them into Alipay.

-

Verification: Alipay may charge a random small amount (e.g., $0.01) to verify. Check your BenPay transaction history for the code or amount.

-

Success: You will see the Visa/Mastercard logo in your Alipay wallet.

Phase 4: Spending

-

Scan & Pay: When you see a blue/green QR code, open Alipay, scan it, and choose your BenPay card as the payment source.

-

Limit: Alipay usually allows transactions up to 200 CNY (~$30) without a transaction fee. For single transactions >200 CNY, Alipay charges a 3% fee (this is charged by Alipay, not BenPay).

-

Troubleshooting: What if it Declines?

-

Scenario: Transaction Failed. Risk Control triggered.

-

Fix 1: Ensure your BenPay card balance is at least $20 higher than the purchase amount.

-

Fix 2: Contact Alipay Customer Service (English supported) to verify your identity. This is a one-time “unfreeze” process for new cards.

-

Fix 3: Use the card for a small purchase (e.g., $5) first to build trust score.

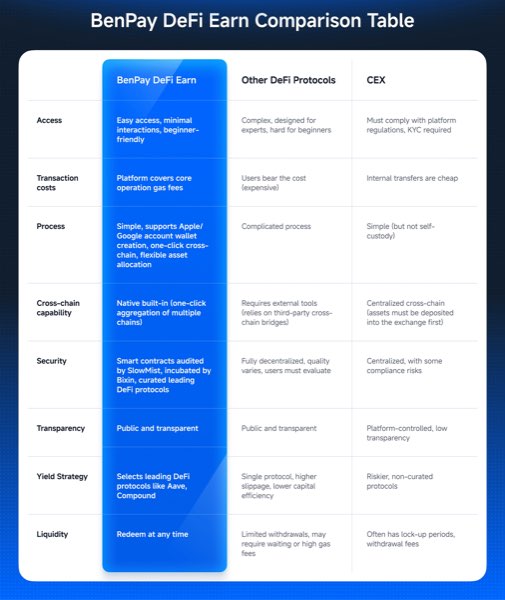

4. Platform Comparison: Sigma vs. The World

How does BenPay Sigma stack up against other options for an Asia trip?

How does BenPay Sigma stack up against other options for an Asia trip?

Verdict:

-

Use Alpha if you are in the US/Europe spending USD/EUR directly to save on top-up fees.

-

Use Sigma if you are in China, Japan, or Thailand. The 0% FX fee and Higher Acceptance Rate make it the only reliable choice for the region.

5. Financial Analysis: The “Tokyo Trip” Simulation

Let’s do the math on a $5,000 Trip to Japan. You are spending JPY.

Scenario A: The “Free” US Card (Coinbase/Alpha)

-

Top-Up Fee: $0

-

FX Fee (Visa Spread + Issuer Fee): 3%

-

Total Cost: $150 lost to currency conversion.

Scenario B: The BenPay Sigma Card

-

Top-Up Fee: 1.5% ($75)

-

FX Fee: 0%

-

Monthly Fee: $1

-

Total Cost: $76

Savings: $74. Even though the Sigma card has a top-up fee, the 0% FX benefit is so powerful for international spending that it cuts your total fees in half compared to a standard card. For digital nomads spending $30,000 a year abroad, this saves nearly $500.

6. Risk Disclosure: Navigating Asian Regulations

Using crypto in Asia requires awareness of the local landscape. We prioritize transparency.

1. Alipay/WeChat Risk Control

Chinese payment apps have strict anti-fraud algorithms.

-

The Risk: If you make a large transaction ($500+) immediately after binding a new card, Alipay might trigger a “Risk Lock.”

-

The Fix: Start small. Buy a coffee or a subway ticket first. Build a transaction history over a few days before buying electronics.

-

BenPay’s Role: Since BenPay is a regulated MSB, our cards are less likely to be flagged as “high risk” compared to anonymous virtual cards, but Alipay’s algorithm is sovereign.

2. Transaction Fee Thresholds

-

The Rule: In China, payments under 200 CNY (~$30) are usually fee-free on Alipay. Payments over 200 CNY incur a 3% fee charged by Alipay itself.

-

Strategy: Break up large payments if possible, or use the card directly at large merchants (hotels/malls) that have physical POS terminals to avoid the Alipay fee.

3. Regional Restrictions

-

Singapore/Hong Kong: Crypto friendly. High card acceptance.

-

Vietnam/Thailand: High QR adoption. Sigma works great via GrabPay or local QR apps if they accept foreign cards.

7. FAQ

Q: Can I hold JPY or CNY in my BenPay wallet? A: No. Your wallet holds USDT or USDC (Stablecoins). The conversion to local currency happens instantly at the moment of the transaction. This protects you from holding volatile local currencies.

Q: Why does the Sigma card have a monthly fee? A: The $1/month fee maintains the premium banking infrastructure required to offer 0% FX rates. It is a small price to pay for the massive savings on foreign transaction fees.

Q: Does it work for withdrawing cash at ATMs in Asia? A: Yes. You can use the Sigma card at any ATM with a Visa/Mastercard logo to withdraw local cash (Yen, Baht, etc.). Standard ATM fees apply, but you still benefit from the 0% FX rate on the currency conversion.

Q: Can I use Sigma in the US? A: You can, but it’s not efficient. You would pay the 1.5% top-up fee for no reason (since there is no FX to save on). We recommend holding both cards: Use Alpha in the US, and switch to Sigma when you board the plane.

8. Conclusion

Asia is the most exciting region for digital nomads, but its financial walls are high. The BenPay Sigma Card is your passport through those walls.

By solving the FX Fee problem and the QR Code Compatibility problem, it turns your USDT into a universally accepted local currency. Whether you are scanning a QR code for noodles in Chengdu or tapping for the subway in Tokyo, Sigma ensures you get the real exchange rate without the bank markups.

Travel freely. Download BenPay, order your Sigma Card, and make Asia your playground.

Disclaimer: This guide is for educational purposes. Acceptance of foreign cards by Alipay/WeChat is subject to their changing policies. Crypto investments involve risk.