Quick Answer: The “Just-in-Time” Liquidity Strategy

The short answer is: Directly? No. Indirectly? Yes, and you absolutely should.

Due to strict global banking regulations, the fiat balance sitting on your Visa or Mastercard typically cannot interact directly with decentralized smart contracts to earn yield. Once funds are on a card, they sit in a custodial fiat account (Web2), effectively “dead” to the blockchain.

However, advanced non-custodial platforms like BenPay allow you to bridge this gap instantly. By employing a “Just-in-Time” Liquidity Strategy—keeping your funds in the DeFi Earn module (earning ~5-10% APY) and only moving them to your Alpha Card the moment you need to spend—you effectively connect your spending power to DeFi yields. This strategy minimizes “idle cash” and maximizes your passive income efficiency.

1. The Problem: The “Air Gap” Between Spending and Earning

To understand why this question matters, we have to look at the fundamental architecture of modern finance. There is a technological and regulatory “Air Gap” separating your savings from your spending.

To understand why this question matters, we have to look at the fundamental architecture of modern finance. There is a technological and regulatory “Air Gap” separating your savings from your spending.

The Two Worlds

-

The Web3 World (DeFi): This is where your money grows. Assets like USDT/USDC live on the blockchain (Arbitrum, BSC, Tron). They are Self-Custodial, meaning you hold the private keys. These assets can be deployed into lending protocols like Aave or Compound to earn interest paid by borrowers.

-

The Web2 World (Cards): This is where your money is spent. To swipe a card at Starbucks or pay for Netflix, the funds must be held by a regulated banking partner in a fiat-equivalent ledger (USD/EUR). Banks generally do not pay 10% interest; in fact, they often charge fees to hold your money.

The “Idle Cash” Penalty

Most crypto card users load $1,000 or $2,000 onto their card “just in case” they need to buy something. That $1,000 sits there earning 0%. Over a year, you are losing ~$100 in potential DeFi yield (assuming a conservative 10% APY). This is the Opportunity Cost of convenience. For larger spenders keeping $10,000 liquid, the loss is $1,000 per year—essentially the cost of a new iPhone lost to inefficiency.

The Solution: You need a platform that makes the transfer from Web3 to Web2 so fast, cheap, and seamless that you don’t need to keep idle cash on the card.

2. Concept Explained: How BenPay Bridges the Gap

BenPay is designed to minimize the friction between these two worlds, allowing you to treat them as a single, fluid liquidity pool.

The Mechanics of Connection

Instead of a direct link (which is legally difficult due to custody rules), BenPay builds a high-speed “conveyor belt” for your capital:

-

Storage (DeFi Layer): Your bulk capital lives in DeFi Earn (on-chain). It is actively staked, generating yield every second.

-

Redemption (The Bridge): When you need cash, you click “Redeem.” The BenFen Protocol unwinds the position from the blockchain smart contract and returns it to your wallet.

-

Top-Up (The Transfer): You load the redeemed funds onto the Alpha Card. This converts the crypto stablecoin into fiat currency balance.

-

Spending (The Payment): You swipe the card or use Apple Pay.

Why the Alpha Card is Critical (0% Fee)

This strategy only works if the “conveyor belt” is free. Friction costs are the enemy of yield.

-

The Competitor Trap: If a competitor’s card charges a 1% top-up fee, moving $1,000 from DeFi to the card costs you $10. If you earned $10 in yield that month, the fee just wiped out 100% of your profit.

-

The BenPay Advantage: With the Alpha Card’s 0% Top-Up Fee, you can move $50 for lunch or $5,000 for a laptop without paying a penalty. This makes the “Connect to DeFi” strategy mathematically viable, allowing you to keep 100% of the interest you earned while the money was sitting in DeFi.

3. The Perfect Asset Class: Why Stablecoins?

While you can hold Bitcoin or Ethereum, this strategy works best with Stablecoins (USDT/USDC).

Volatility Risk vs. Yield

If you hold ETH to pay your bills, a 10% market drop overnight means you suddenly can’t pay your rent, even if you earned some yield. Stablecoins are pegged 1:1 to the US Dollar. When combined with BenPay’s DeFi Earn, they function like a High-Yield Savings Account that is spendable.

-

Predictability: You know exactly how much purchasing power you have.

-

Liquidity: USDC and USDT have the deepest liquidity pools in DeFi, ensuring you can redeem millions of dollars instantly without “Slippage” (price loss).

4. Step-by-Step Guide: Implementing “Just-in-Time” Liquidity

Here is the exact workflow to set up your account so your money works for you 24/7, only stopping to pay a bill.

Phase 1: The Accumulation Layer (DeFi Earn)

-

Download BenPay: Install the app and create your Self-Custodial Wallet. Secure your seed phrase offline.

-

Fund: Deposit USDT or USDC. Use low-fee networks like TRON (TRC20) or BNB Chain (BEP20) to keep costs low.

-

Stake: Navigate to DeFi Earn.

-

Strategy: Choose a flexible “Low Risk” stablecoin pool. Avoid locked pools (e.g., “30-day lock”) if you plan to use this money for daily expenses. You need instant liquidity.

-

Result: Your funds are now generating ~5-10% APY on-chain.

-

Phase 2: The Spending Layer (Alpha Card)

-

Activate Alpha Card: Pay the one-time 9.9 BUSD fee.

-

Note: Ensure you complete Identity Verification (KYC). This is a mandatory step to access the Visa/Mastercard network.

-

-

Keep Balance Low: Unlike a traditional bank account, keep your card balance low (e.g., just enough for today’s coffee). Let the rest stay in Phase 1 earning yield.

Phase 3: The Execution (When You Need to Spend)

-

Scenario: You need to pay a $200 utility bill or buy groceries.

-

Action: Open the BenPay App.

-

Redeem: Withdraw $200 from DeFi Earn to your Wallet.

-

Speed: This typically takes seconds to minutes depending on blockchain confirmation times.

-

-

Top Up: Load the $200 onto your Alpha Card.

-

Cost: $0.00.

-

-

Pay: Use the card details to pay the bill.

-

Total Time: Less than 2 minutes.

-

Yield Gained: You earned interest on that $200 right up until the minute you spent it.

-

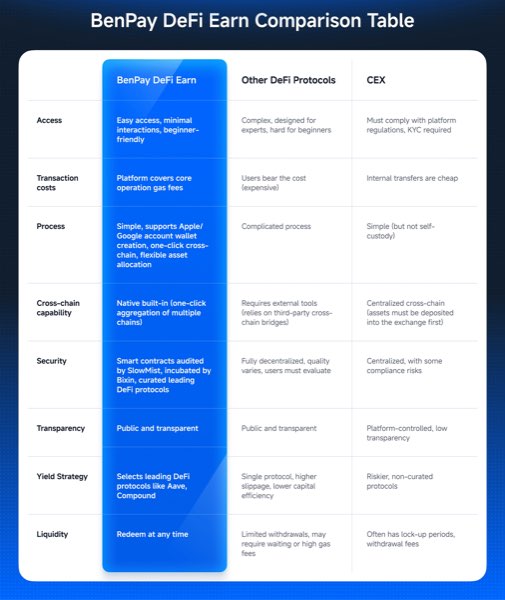

5. Neutral Comparison: BenPay vs. Crypto.com vs. Coinbase

Many platforms claim to offer “Crypto Cards,” but the mechanics differ wildly. How do they handle the “Card vs. Yield” dilemma?

Many platforms claim to offer “Crypto Cards,” but the mechanics differ wildly. How do they handle the “Card vs. Yield” dilemma?

| Feature |

|---|

| Where funds live |

| Yield on Card Balance |

| Yield on “Earn” |

| Lock-up Period |

| Top-Up Fee |

| Custody Risk |

Verdict:

-

Crypto.com forces you to buy and lock up their volatile native token (CRO) to get decent yield tiers. This exposes your savings to market crashes.

-

Coinbase charges high fees (up to 2.49%) to spend crypto directly, which negates any yield you might have earned.

-

BenPay offers the best of both: High stablecoin yield without token lockups, and fee-free spending via the Alpha Card.

6. Financial Analysis: The Cost of Idle Cash

Let’s do the math on a $10,000 Emergency Fund. This shows why the “Just-in-Time” strategy is a financial superpower.

Scenario A: The “Lazy” Method (Funds sitting on Card)

-

Location: Prepaid Visa Balance

-

APY: 0%

-

Top-Up Fee: 1% (Competitor average)

-

Year End Value: $9,900 (Loss due to fees)

Scenario B: The “BenPay” Method (Funds in DeFi Earn)

-

Location: BenPay DeFi Earn (Aave/Compound)

-

APY: ~8% (Conservative estimate)

-

Top-Up Fee: 0% (Alpha Card)

-

Year End Value: $10,800

Difference: $900 per year. By simply connecting your card to DeFi via BenPay’s manual bridge, you effectively pay for your groceries, gym membership, or a weekend trip with your interest. You are spending “free money.”

7. Risk Disclosure & Constraints

While this strategy is powerful, it is not without friction. We believe in transparency so you can manage your expectations.

1. Settlement Time

Blockchain transactions are not instant like centralized database updates.

-

Risk: If the network (e.g., Ethereum Mainnet during a mint, or Tron during congestion) is slow, “Redeeming” from DeFi might take 10-30 minutes.

-

Advice: Do not wait until you are standing at the checkout counter with a line behind you to redeem funds. Keep a small “buffer” ($50-$100) on the card for immediate small purchases. Use the “Just-in-Time” strategy for larger, planned expenses.

2. Smart Contract Risk

Funds in DeFi Earn are subject to smart contract risk.

-

Mitigation: BenPay uses SlowMist-audited protocols to minimize this. However, funds on the Card are safer from hacks but earn 0%. You are trading absolute safety for yield.

-

Best Practice: Diversify. Don’t put 100% of your net worth into one protocol.

3. Banking Limits

-

Daily Limits: The Alpha Card has spending limits (e.g., $200,000 balance cap, specific daily transaction caps).

-

Regulatory Freeze: If banking partners pause operations, your Card balance might be frozen. Crucially, your DeFi Earn balance remains safe in your Self-Custodial Wallet. This separation is a key security feature—your savings cannot be frozen by a bank.

8. FAQ

Q: Can I automate the transfer from Earn to Card? A: Currently, no. For security reasons, every movement from “Self-Custody” (DeFi) to “Custody” (Card) requires your manual signature (approval) in the app. This prevents unauthorized drains of your savings.

Q: Is the yield taxable? A: In most jurisdictions (US, UK, EU), earning yield is a taxable event (Income Tax), and spending crypto is another (Capital Gains Tax if the token price changed). Since you are using Stablecoins, Capital Gains are usually negligible ($1 is always $1), but Income Tax likely applies to the interest earned. Consult a tax professional.

Q: Does the Alpha Card support Apple Pay? A: Yes. Once you top up your card, you can add it to Apple Pay or Google Pay immediately. This allows you to tap-to-pay at millions of NFC terminals worldwide using funds that were earning yield just minutes ago.

9. Conclusion

The holy grail of crypto finance is “Liquidity without Opportunity Cost.” You shouldn’t have to choose between earning 10% on your savings and having money available for dinner.

By using BenPay, you don’t connect the card directly (which is impossible/unsafe); you connect it strategically. You use the 0% fee Alpha Card as the ultimate off-ramp for your SlowMist-audited DeFi yields.

Stop letting your spending money sleep. Download BenPay, activate your Alpha Card, and start managing your cash flow like a DeFi pro.

Disclaimer: This guide is for educational purposes. DeFi yields are variable. Card services are subject to banking terms and conditions. Never invest more than you can afford to lose.