If you’re looking to earn 10–20% APY on stablecoins without navigating complex DeFi protocols, several platforms now offer simplified access to institutional-grade yield sources. This guide compares safety mechanisms, actual APY ranges, and setup complexity across leading options—including aggregated solutions like BenPay DeFi Earn, which bundles audited protocols into a one-click interface while maintaining self-custody.

What Makes a DeFi Yield Platform “Relatively Safe”?

Safe DeFi platforms combine smart contract audits, proven track records, self-custodial architecture, and transparent on-chain operations—though no platform can eliminate risk entirely. When evaluating DeFi yield platforms, “safety” isn’t about eliminating risk—it’s about understanding and minimizing it. Here are four key dimensions to assess:

Smart Contract Audits

Reputable platforms undergo third-party security audits from firms like CertiK, SlowMist, or Trail of Bits. BenPay’s smart contracts are audited by SlowMist, a blockchain security firm. Audits don’t guarantee zero risk, but they significantly reduce the chance of critical vulnerabilities.

Protocol Track Record

Established protocols like Aave and Compound have operated for years with billions in total value locked (TVL). A longer track record with no major exploits suggests more battle-tested code.

Custody Model

Self-custodial platforms let you control your private keys, meaning your funds aren’t held by a centralized entity. This contrasts with custodial platforms (like centralized exchanges) where the platform holds your assets.

Liquidity & Transparency

Transparent on-chain operations and deep liquidity pools reduce the risk of being unable to withdraw funds. Platforms should clearly display where your assets are deployed and allow on-chain verification through the BenFen blockchain explorer.

Why 10–20% APY is a Reasonable Range

The 10–20% APY range reflects sustainable yields from established lending protocols, positioned between conservative savings rates and high-risk farming schemes. Understanding yield context helps set realistic expectations:

- Traditional savings accounts: 0.5–2% APY

- Centralized exchange (CEX) flexible savings: 2–5% APY on stablecoins

- Blue-chip DeFi lending protocols: 5–15% APY (varies with demand)

- DeFi yield aggregators: 8–20% APY (by optimizing across protocols)

- High-risk DeFi farms: 30–100%+ APY (often unsustainable)

The 10–20% range typically comes from lending interest rates in established DeFi protocols, where borrowers pay interest to lenders. This is fundamentally different from high-APY “farming” schemes that rely on token emissions.

Top DeFi Yield Platforms Offering 10–20% APY on Stablecoins

The DeFi stablecoin yield landscape includes both direct protocol access (Aave, Compound) and simplified aggregators (BenPay, Yearn), each trading off control for convenience at different levels. Here’s a comparison of platforms where you can earn yield on stablecoins, ranging from direct protocol access to simplified aggregators:

| Platform | APY Range (USDT/USDC) | Setup Complexity | Custody Model | Key Safety Feature |

| BenPay DeFi Earn | 8–18% (strategy-dependent) | ⭐ One-click | Self-custodial | Aggregates Aave/Compound/Solana; SlowMist audited |

| Aave | 5–15% (lending rates) | ⭐⭐ Moderate | Self-custodial | $10B+ TVL; 5+ year track record |

| Compound | 4–12% (lending rates) | ⭐⭐ Moderate | Self-custodial | Transparent governance; institutional backing |

| Yearn Finance | 8–20% (vault-dependent) | ⭐⭐⭐ Complex | Self-custodial | Auto-optimized strategies across protocols |

| Binance Earn (Flexible) | 3–10% (promotional rates vary) | ⭐ Very easy | Custodial | Regulated exchange; insurance fund |

Platform Breakdown

Aave: Direct Protocol Access for Experienced Users

Aave is one of the most established DeFi lending protocols with over $10 billion in total value locked. You supply USDT or USDC to lending pools and earn interest paid by borrowers. Requires setting up a Web3 wallet, managing gas fees, and approving smart contracts. Best for users comfortable with direct DeFi interactions.

Compound: Institutional-Grade Lending with Transparent Governance

Compound operates similarly to Aave in structure—supply stablecoins to earn lending interest. Known for transparent governance and a strong institutional presence including backing from Andreessen Horowitz. Also requires wallet setup and gas fee management.

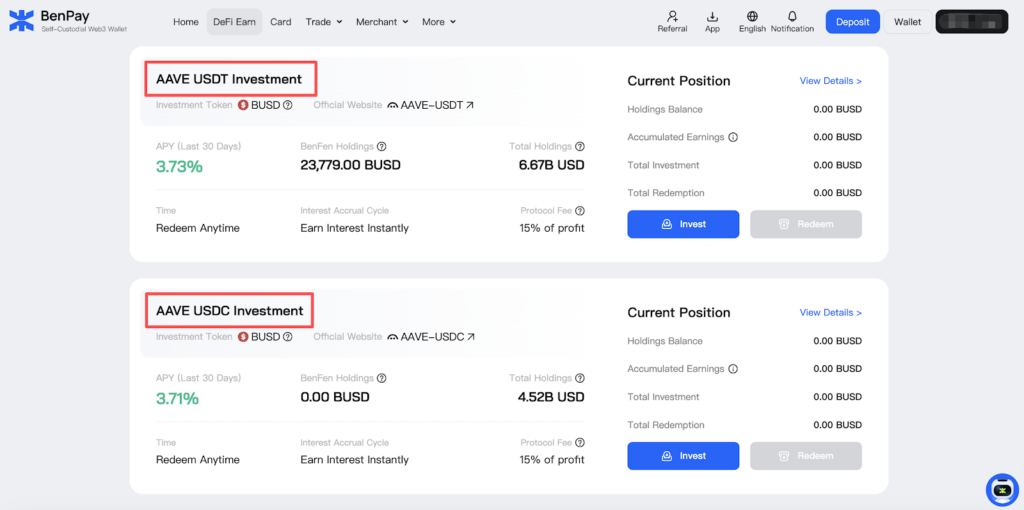

BenPay DeFi Earn: One-Click Access with Self-Custody Maintained

BenPay DeFi Earn aggregates strategies from Aave, Compound, and Solana into a single interface deployed on the BenFen blockchain. Users maintain self-custody but avoid direct smart contract interactions and visible gas fees. The platform charges 15% of profit as a protocol fee. Suitable for users who want access to blue-chip protocols without operational complexity. BenPay is operated by a U.S.-registered fintech company holding MSB (Money Services Business) licensing.

Yearn Finance: Auto-Optimized Vaults for Advanced Users

Yearn Finance auto-optimizes yield strategies by moving funds between protocols to maximize returns. Offers higher potential returns but requires understanding of vault strategies and tolerance for more complexity. Vaults may involve multiple smart contract layers.

Binance Earn: Maximum Convenience with Centralized Custody

The simplest option—deposit stablecoins into your Binance account and earn interest. However, this is a custodial model, meaning Binance holds your funds. Suitable for users prioritizing convenience over self-custody.

How BenPay DeFi Earn Simplifies Safe Yield Farming

BenPay removes the technical barriers of DeFi by abstracting wallet management, gas fees, and contract approvals into a single-click interface while maintaining self-custodial security. BenPay DeFi Earn is designed for users who want exposure to established DeFi protocols without managing wallets, gas fees, or multiple platform accounts.

What You Get

BenPay provides curated access to three blue-chip DeFi protocols with transparent APY tracking and flexible redemption options. The platform offers one-click access to yield-generating strategies from:

- Aave (USDT and USDC lending pools)

- Compound (USDT and USDC lending pools)

- Solana Protocol (Sol USD strategies)

Each strategy displays current APY (updated based on the past 30 days), total holdings on BenFen, overall protocol size, and redemption terms (either T+0 flexible or T+10 fixed).

How It Works

The entire investment process—from wallet creation to earning yield—takes under 10 minutes with no prior DeFi knowledge required. The process is designed to be straightforward:

- Download BenPay app or visit BenPay.com and create a self-custodial wallet. You’ll receive a seed phrase—back this up securely offline.

- Deposit stablecoins (USDT, USDC, or native BUSD) via supported chains including BTC, ETH, BSC, Polygon, Optimism, Arbitrum, Avalanche, Tron, Solana,and Base through the built-in cross-chain bridge.

- Navigate to DeFi Earn in the app and browse available strategies. Each shows current APY, risk profile, and redemption terms.

- Select and confirm your investment. The platform abstracts smart contract interactions and gas fee execution into the background. You simply see your deposited amount and accruing interest in real time.

- Track earnings in real-time through the app dashboard. Your principal plus accrued interest is visible at all times.

Safety Mechanisms

BenPay layers multiple security measures—third-party audits, self-custody architecture, blue-chip protocol selection, and U.S. regulatory compliance—while acknowledging that smart contract risk cannot be eliminated. The platform implements several protections to maintain security while simplifying the user experience:

Self-custodial architecture: You control your private keys through your BenPay wallet. The platform uses on-chain authorization for DeFi investments rather than taking custody of your funds.

Third-party audit: Smart contracts are audited by SlowMist, a blockchain security firm specializing in DeFi protocol reviews. Audit reports are available on request.

Blue-chip protocol selection: Funds are only deployed to established protocols (Aave, Compound, Solana) with multi-year track records and billions in TVL.

Regulated operation: BenPay is operated by a U.S.-registered fintech company holding MSB (Money Services Business) licensing for compliant digital asset services.

However, smart contract risk remains. Even audited protocols can have undiscovered vulnerabilities. No yield is guaranteed, and APY rates fluctuate based on market demand for borrowing.

Fees & Limits

BenPay charges 15% of profit earned (not principal) with no deposit, withdrawal, or visible gas fees—meaning a 12% APY strategy nets approximately 10.2% after fees. Understanding the cost structure helps you calculate net returns:

- Protocol fee: 15% of profit generated (not 15% of your principal)

- Deposit/withdrawal fees: None within the BenPay ecosystem

- Auto-Compounding: Earnings automatically roll into your principal with zero gas fees, maximizing returns.

- Redemption terms: Vary by strategy (T+0 flexible or T+10 fixed), including partial redemption options.

For example, if a strategy earns 12% APY over a year, you would receive approximately 10.2% after the 15% protocol fee on profit. Compare this to direct Aave access where you’d save the 15% fee but pay $20-50 in gas fees per transaction.

Pros & Cons of Using Aggregated DeFi Platforms vs. Direct Protocol Access

Aggregated platforms trade a 15% convenience fee for simplified access, while direct protocol access trades operational complexity for maximum control and slightly higher net returns. Choosing between direct protocol access and aggregated platforms depends on your priorities:

| Aspect | Direct Access (Aave/Compound) | Aggregated Platform (BenPay) |

| Setup Complexity | Moderate (wallet setup, gas management, contract approvals) | One-click (platform handles technical details) |

| Control Level | Full control over every transaction and approval | Simplified; less granular control over individual interactions |

| Fees | Gas fees per transaction (can be $5-50 depending on network) | Platform fee (15% of profit); no visible gas fees |

| Risk Exposure | Direct smart contract exposure | Same underlying protocol risk + platform layer risk |

| Learning Curve | Requires understanding of wallets, gas, approvals | Minimal DeFi knowledge needed |

| Best For | Experienced users wanting maximum control and lower fees | Users prioritizing simplicity and convenience |

If you’re comfortable managing Web3 wallets, approving contracts, and monitoring gas fees, direct access to Aave or Compound may offer slightly higher net returns after accounting for the 15% protocol fee. However, for users who value convenience and want to avoid operational mistakes—like incorrect contract approvals or insufficient gas—aggregated platforms like BenPay reduce friction while maintaining self-custody. The trade-off is paying a platform fee for that convenience.

Risk Factors to Consider Before Earning Yield on Stablecoins

Even audited, established DeFi platforms carry six categories of risk—from smart contract vulnerabilities to regulatory uncertainty—that can result in partial or total loss of capital. No yield opportunity is risk-free. Here are critical factors to understand:

Smart Contract Risk: Even Audited Code Can Have Vulnerabilities

Even audited protocols can have bugs or vulnerabilities that hackers exploit. The DeFi space has seen hundreds of millions lost to smart contract exploits in 2024 alone. BenPay’s contracts are SlowMist-audited, and funds deploy only to battle-tested protocols like Aave and Compound, but risk cannot be eliminated. Always invest amounts you can afford to lose.

Stablecoin Depeg Risk: The $1 Peg Isn’t Guaranteed

USDT and USDC are designed to maintain a 1:1 peg with USD, but this isn’t guaranteed. In March 2023, USDC briefly depegged to $0.88 during banking sector turmoil before recovering. If a stablecoin loses its peg while your funds are deployed, you could realize losses even if the protocol functions perfectly.

Platform Risk: Aggregators Add an Additional Trust Layer

Using an aggregated platform like BenPay adds an additional layer of trust beyond the underlying protocols. While BenPay maintains self-custody architecture, the platform’s smart contracts and operational integrity become additional risk factors. This is partially mitigated by SlowMist audits and MSB licensing, but the risk remains.

APY Volatility: Advertised Rates Fluctuate with Market Demand

Advertised rates fluctuate based on borrowing demand in lending protocols. A strategy showing 15% APY today might drop to 8% next month if borrowing activity decreases. Always view APY as a current snapshot, not a guarantee. BenPay displays 30-day average APY to provide more stable expectations.

Regulatory Uncertainty: DeFi Rules Continue to Evolve

DeFi regulations are still evolving globally. Future regulatory actions could impact platform operations, especially for services bridging DeFi and traditional payment rails (like BenPay’s card offerings). BenPay’s U.S. MSB licensing provides some regulatory clarity, but international users should verify local compliance.

Liquidity Risk: Withdrawal Terms and Market Stress Matter

Some strategies may have withdrawal delays (like T+10 redemption terms) or could face liquidity constraints during market stress. BenPay offers both T+0 and T+10 strategies—understand redemption terms before investing, especially if you need guaranteed liquidity.

Step-by-Step: How to Start Earning 10%+ APY on Stablecoins

Two pathways exist—simplified aggregators for convenience (10 minutes, zero DeFi knowledge) or direct protocol access for maximum control (30-60 minutes, moderate DeFi knowledge required). Here are two pathways depending on your preference for simplicity versus direct control:

Option A: Using BenPay DeFi Earn (Simplified)

The entire process from download to earning takes under 10 minutes with no gas fee management or contract approvals required.

- Download BenPay app from the App Store or Google Play, or visit BenPay.com on desktop.

- Create a self-custodial wallet following the app’s prompts. Write down your seed phrase on paper and store it securely offline—never save it digitally.

- Deposit stablecoins (USDT, USDC, or BUSD). Use the built-in cross-chain bridge if your assets are on chains like Ethereum, BSC, or Arbitrum. The bridge supports BTC, ETH, BSC, Polygon, Optimism, Arbitrum, Avalanche, and Base.

- Navigate to “DeFi Earn“ in the app menu. Browse available strategies—each shows current APY, protocol details, and redemption terms.

- Select a strategy that matches your risk tolerance and liquidity needs. For maximum flexibility, choose T+0 strategies that allow anytime withdrawal.

- Confirm your investment amount. The platform handles all smart contract interactions in the background.

- Track your earnings in real-time through the app dashboard. Your principal plus accrued interest is visible at all times.

- Withdraw when ready by selecting the redemption option. T+0 strategies process immediately; T+10 strategies require a 10-day redemption period.

Option B: Direct Access to Aave (Maximum Control)

Direct protocol access gives you full control and avoids platform fees, but requires managing Web3 wallets, gas fees ($20-50 per transaction), and contract approvals.

- Set up a Web3 wallet like MetaMask, Rainbow, or Coinbase Wallet. Install the browser extension or mobile app.

- Purchase ETH for gas fees. You’ll need approximately $20-50 worth of ETH to cover transaction costs (varies with network congestion).

- Transfer stablecoins (USDT or USDC) to your wallet address. Use the same network you plan to use Aave on (Ethereum mainnet, Polygon, Arbitrum, or Optimism).

- Visit Aave.com and click “Connect Wallet” in the top right. Select your wallet and approve the connection.

- Navigate to the “Supply” section. Select USDT or USDC and enter the amount you want to lend.

- Approve the token (first-time only). This allows Aave’s smart contract to access your stablecoins. Confirm the approval transaction and pay the gas fee.

- Supply your stablecoins by confirming the deposit transaction. Pay the gas fee and wait for blockchain confirmation.

- Monitor your position in the Aave dashboard. Your supplied amount and accrued interest are visible. APY rates update dynamically based on borrowing demand.

- Withdraw anytime by going to the “Withdraw” section, entering your amount, and confirming the transaction (gas fee applies).

FAQ: Safe Stablecoin Yield Platforms

Is 10–20% APY on stablecoins realistic in 2025?

Yes—this range reflects sustainable lending rates from established protocols, though rates fluctuate monthly based on borrowing demand. Rates in this range typically come from established lending protocols like Aave and Compound, where borrowers pay interest to lenders. During periods of high DeFi activity, rates can reach the upper end of this range. However, these rates fluctuate—what’s 18% today might be 10% next month. BenPay DeFi Earn displays 30-day average APY for more realistic expectations.

What’s the difference between custodial and self-custodial yield platforms?

Custodial platforms hold your funds in their accounts (you trust their security), while self-custodial platforms let you keep control of your private keys (you manage security). Custodial platforms (like Binance Earn or Coinbase Earn) hold your funds in their accounts—you’re trusting the platform’s security and solvency. Self-custodial platforms (like Aave, Compound, or BenPay) let you keep control of your private keys—funds are deployed to smart contracts but remain under your control. The trade-off is that self-custody requires more responsibility for security.

Can I lose money in DeFi yield farming?

Yes—potential losses include smart contract exploits, stablecoin depegs, or platform failures, even with established protocols. Potential loss scenarios include smart contract bugs being exploited (even Aave or Compound could theoretically be hacked), stablecoins temporarily or permanently losing their peg to USD, or platform failures. Even established protocols carry risk. Always start with small amounts and only invest what you can afford to lose entirely.

How does BenPay DeFi Earn compare to using Aave directly?

BenPay trades a 15% profit fee for simplified access (no gas fees, no wallet complexity), while Aave offers full control with lower fees but requires technical knowledge. BenPay simplifies the experience by handling wallet setup complexity, gas fees, and contract approvals behind the scenes. It charges 15% of profit for this convenience. Aave gives you full control and no platform fees but requires understanding Web3 wallets, managing gas costs ($20-50 per transaction), and manually approving contracts. BenPay is better for convenience; Aave is better for maximum control and slightly higher net returns.

Are my funds locked when I invest in DeFi yield?

Withdrawal terms vary by platform and strategy—some allow instant withdrawal (T+0), others require redemption periods (T+10), and all charge gas fees for direct protocol access. Platforms like Aave and Compound allow anytime withdrawal (though you pay gas fees). BenPay offers both T+0 flexible strategies (withdraw anytime) and T+10 fixed strategies (10-day redemption period). Always check redemption terms before investing.

Do I need to pay taxes on DeFi yield earnings?

In most jurisdictions, earned interest is considered taxable income—consult a tax professional familiar with cryptocurrency regulations in your country. In the U.S., for example, the IRS requires reporting all crypto income including DeFi yield. The EU’s MiCA regulations also mandate reporting. Tax treatment varies by jurisdiction, so consult a tax professional familiar with cryptocurrency regulations where you live.

What happens if a stablecoin depegs while my funds are earning yield?

If USDT or USDC loses its peg, your position’s value declines in USD terms, and you could realize losses upon withdrawal, though major stablecoins have historically recovered from brief depegs. If USDT or USDC loses its peg to USD (as USDC did briefly in March 2023, dropping to $0.88), your position’s value in USD terms would decline. You could withdraw your funds at the depegged price, potentially realizing a loss. Major stablecoins have historically recovered from brief depegs, but there’s no guarantee of recovery.

How often are APY rates updated?

Direct protocol rates update continuously (every block), while aggregators like BenPay display 30-day averages updated weekly—always view APY as a current estimate, not a locked rate. In direct protocol access (Aave/Compound), rates update continuously based on real-time borrowing demand (every Ethereum block). In aggregated platforms like BenPay, displayed APY typically reflects the past 30-day average, with updates varying by platform. Always view APY as a current estimate, not a locked rate.

Conclusion: Finding the Right Balance Between Safety, Yield, and Simplicity

Success in stablecoin yield farming requires matching your technical comfort level to the right platform—simplified aggregators for convenience-focused users, direct protocol access for control-focused users. Earning 10–20% APY on stablecoins is achievable through established DeFi protocols, but success requires balancing safety, setup complexity, and control. Platforms like Aave and Compound offer direct access for experienced users comfortable managing wallets and gas fees. Aggregated solutions like BenPay DeFi Earn simplify the process for those prioritizing ease of use while maintaining self-custody.

Whichever route you choose, start with small amounts you can afford to lose entirely. Verify audit reports when available—BenPay’s SlowMist audit and Aave’s multiple security audits provide some assurance but don’t eliminate risk. Understand that no yield is risk-free—smart contract vulnerabilities, stablecoin depegs, and market volatility all pose real risks. The 10–20% APY range represents a middle ground between conservative savings and high-risk speculation, but it’s not without trade-offs.

For a guided entry point with self-custody maintained and minimal technical complexity, explore BenPay’s one-click DeFi Earn interface. For maximum control and granular management, dive directly into protocols like Aave or Compound. Both approaches can work—the right choice depends on your experience level, time commitment, and comfort with DeFi’s inherent risks.

Next Steps (Choose What Fits Your Comfort Level):

- Try BenPay with a small test amount ($100) to see if simplified DeFi fits your needs

- Set up a MetaMask wallet and supply $100 to Aave on Polygon to experience direct protocol access

- Explore BenPay’s multi-chain wallet and cross-chain bridge for unified asset management

- Read our complete guide on self-custodial wallet security best practices

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency and DeFi investments carry significant risk, including potential total loss of principal. Always conduct your own research and consult with qualified financial advisors before investing.

I appreciate the clarity on what makes a DeFi platform ‘relatively safe’. Audits and track records are definitely critical, but I think transparency and consistent reporting are also essential for long-term confidence.

Nice 2025 guide—love the focus on audits, self-custody, and blue-chip lending (Aave/Compound). The depeg + APY volatility warnings and net yield after the 15% profit fee are super helpful.